Region:Europe

Author(s):Shubham

Product Code:KRAC0714

Pages:98

Published On:August 2025

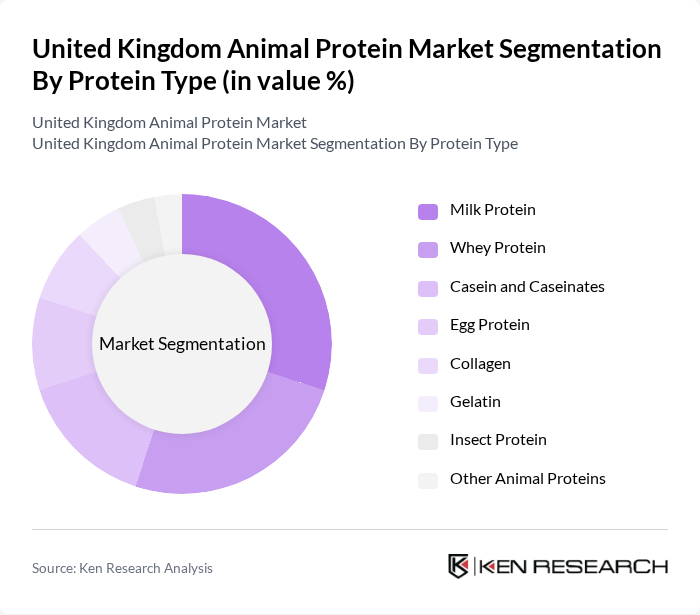

By Protein Type:The market is segmented into various protein types, including Milk Protein, Whey Protein, Casein and Caseinates, Egg Protein, Collagen, Gelatin, Insect Protein, and Other Animal Proteins. Among these, Milk Protein and Whey Protein are leading segments due to their widespread use in food and beverage applications and nutritional supplements; whey protein holds a significant share in the UK due to its high nutrition content and use in functional foods and sports nutrition.

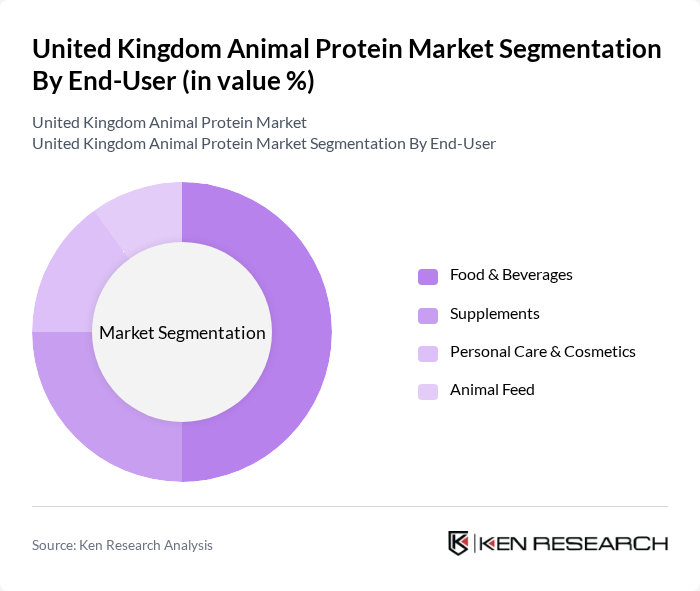

By End-User:The end-user segmentation includes Food & Beverages, Supplements, Personal Care & Cosmetics, and Animal Feed. The Food & Beverages segment is the largest, driven by the increasing incorporation of animal proteins in various food products, including dairy, meat, and ready-to-eat or functional foods; sports nutrition and supplement demand also materially support whey and collagen usage.

The United Kingdom Animal Protein Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arla Foods amba (UK), Saputo Dairy UK (Cathedral City, Davidstow), Glanbia Performance Nutrition (Optimum Nutrition), Fonterra Co-operative Group (UK presence), Volac International Ltd, Lactalis UK & Ireland, Kerry Group plc, ABP Food Group, Cranswick plc, Avara Foods, Moy Park Ltd, Hilton Food Group plc, Cargill PLC (Cargill UK), Collagen Solutions plc (Inspirit Capital-owned), Nitta Gelatin Inc. (UK/EU operations) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK animal protein market appears promising, driven by evolving consumer preferences and technological advancements. As the population continues to grow, the demand for sustainable and ethically sourced animal protein is expected to rise. Innovations in livestock management and production efficiency will likely enhance supply chain resilience. Additionally, the increasing integration of e-commerce platforms for meat distribution will facilitate broader market access, catering to the changing shopping habits of consumers seeking convenience and quality.

| Segment | Sub-Segments |

|---|---|

| By Protein Type | Milk Protein Whey Protein Casein and Caseinates Egg Protein Collagen Gelatin Insect Protein Other Animal Proteins |

| By End-User | Food & Beverages Supplements Personal Care & Cosmetics Animal Feed |

| By Distribution Channel | Business-to-Business (B2B) Channels Direct Supply/Contracts Distributors/Wholesalers Online (e-tailing/marketplaces) |

| By Product Form | Concentrates Isolates Hydrolysates Other Forms (powders, liquids, flakes) |

| By Packaging Type | Bags/Sacks (multiwall, FIBCs) Drums/IBC Totes Retail Pouches/Tubs Aseptic and Specialty Packaging |

| By Price Range | Economy Mid-Range Premium |

| By Certification/Standard | Organic Grass-Fed/Pasture-Raised (applicable to dairy/beef-derived proteins) Free-Range (applicable to egg-derived proteins) Halal/Kosher Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Animal Protein Sales | 120 | Retail Managers, Category Buyers |

| Food Service Sector Insights | 100 | Restaurant Owners, Menu Planners |

| Consumer Preferences in Animal Protein | 150 | General Consumers, Health-Conscious Shoppers |

| Production Insights from Farmers | 80 | Livestock Farmers, Agricultural Consultants |

| Market Trends from Distributors | 70 | Supply Chain Managers, Distribution Executives |

The United Kingdom Animal Protein Market is valued between USD 2.3 billion and USD 2.5 billion, reflecting a significant growth driven by increasing consumer demand for high-protein diets and the expansion of the food and beverage sector.