Region:Europe

Author(s):Geetanshi

Product Code:KRAD0012

Pages:89

Published On:August 2025

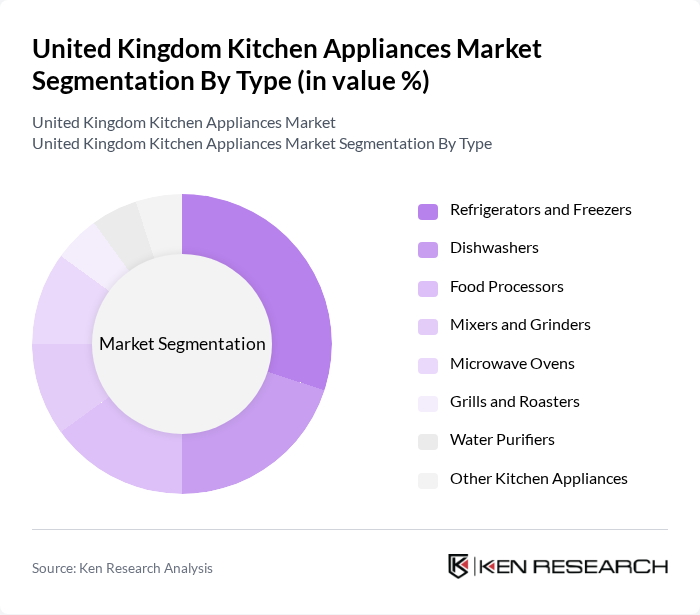

By Type:The kitchen appliances market can be segmented into various types, including Refrigerators and Freezers, Dishwashers, Food Processors, Mixers and Grinders, Microwave Ovens, Grills and Roasters, Water Purifiers, and Other Kitchen Appliances. Among these, Refrigerators and Freezers are the most dominant segment due to their essential role in food preservation and storage. The increasing focus on energy efficiency, integration of smart technology, and demand for multi-functional appliances has further propelled the adoption of advanced refrigeration and food preparation solutions.

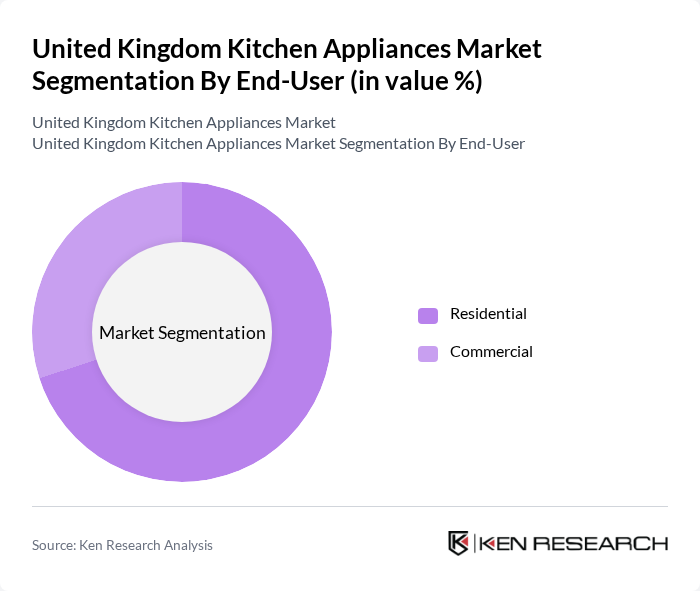

By End-User:The kitchen appliances market is segmented into Residential and Commercial end-users. The Residential segment holds a significant share due to the increasing number of households, a strong trend towards home cooking, and consumer investment in modern kitchen appliances to enhance convenience and efficiency. The Commercial segment, while smaller, is also growing as restaurants, catering services, and hospitality businesses seek advanced appliances to meet operational and sustainability requirements.

The United Kingdom Kitchen Appliances Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, BSH Hausgeräte GmbH (Bosch, Siemens, Neff), Electrolux AB, Samsung Electronics Co., Ltd., LG Electronics Inc., Panasonic Corporation, Beko plc, Miele & Cie. KG, SMEG S.p.A., Frigidaire (Electrolux Group), Kenwood Limited, KitchenAid (Whirlpool Corporation), AEG (Electrolux Group), Gorenje d.d., Haier Group Corporation, Rangemaster (AGA Rangemaster Group), Hotpoint (Whirlpool Corporation), CDA Group Ltd., Hoover (Candy Group), Zanussi (Electrolux Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK kitchen appliances market appears promising, driven by technological advancements and evolving consumer preferences. As smart home technologies gain traction, manufacturers are likely to invest in innovative features that enhance user experience. Additionally, the growing emphasis on sustainability will push brands to develop eco-friendly products, aligning with consumer demand for greener solutions. The market is expected to adapt to these trends, fostering a competitive environment that encourages continuous improvement and diversification in product offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerators and Freezers Dishwashers Food Processors Mixers and Grinders Microwave Ovens Grills and Roasters Water Purifiers Other Kitchen Appliances |

| By End-User | Residential Commercial |

| By Sales Channel | Mass Merchandisers Specialty Stores Online Other Distribution Channels |

| By Price Range | Budget Mid-Range Premium |

| By Brand | National Brands Private Labels International Brands |

| By Functionality | Basic Appliances Smart Appliances Multi-Functional Appliances |

| By Material | Stainless Steel Plastic Glass Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Kitchen Appliances | 100 | Store Managers, Sales Executives |

| Consumer Preferences in Kitchen Appliances | 120 | Homeowners, Renters |

| Market Trends in Energy-Efficient Appliances | 100 | Product Development Managers, Sustainability Officers |

| Impact of E-commerce on Kitchen Appliance Sales | 100 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Feedback on New Kitchen Technologies | 80 | Early Adopters, Tech Enthusiasts |

The United Kingdom Kitchen Appliances Market is valued at approximately USD 5.1 billion, reflecting a significant growth trend driven by consumer demand for energy-efficient and smart appliances, as well as an increase in home cooking and meal preparation.