Region:Europe

Author(s):Shubham

Product Code:KRAA1898

Pages:89

Published On:August 2025

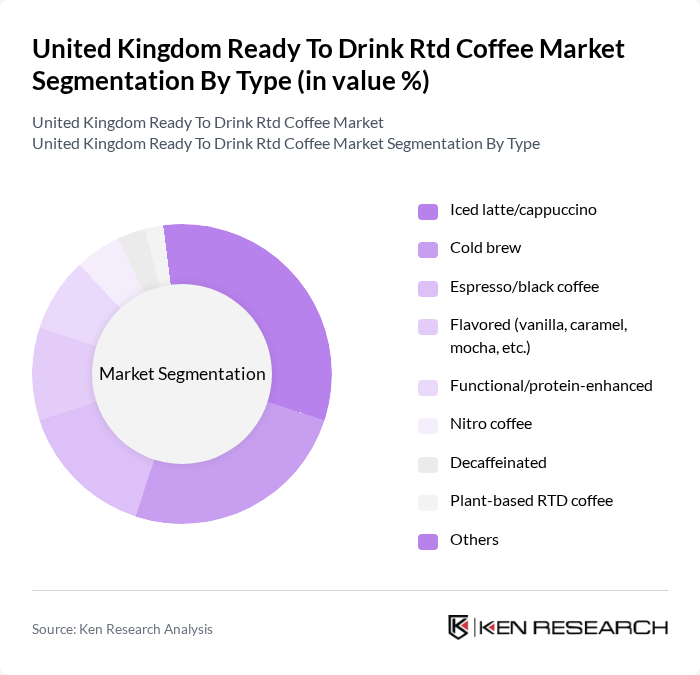

By Type:The market is segmented into various types of ready-to-drink coffee, including iced latte/cappuccino, cold brew, espresso/black coffee, flavored options, functional/protein-enhanced varieties, nitro coffee, decaffeinated options, plant-based RTD coffee, and others. Among these, iced latte/cappuccino and cold brew are particularly popular due to their refreshing taste and convenience, appealing to a wide range of consumers. The trend towards healthier options has also led to a rise in demand for functional and plant-based varieties, reflecting changing consumer preferences.

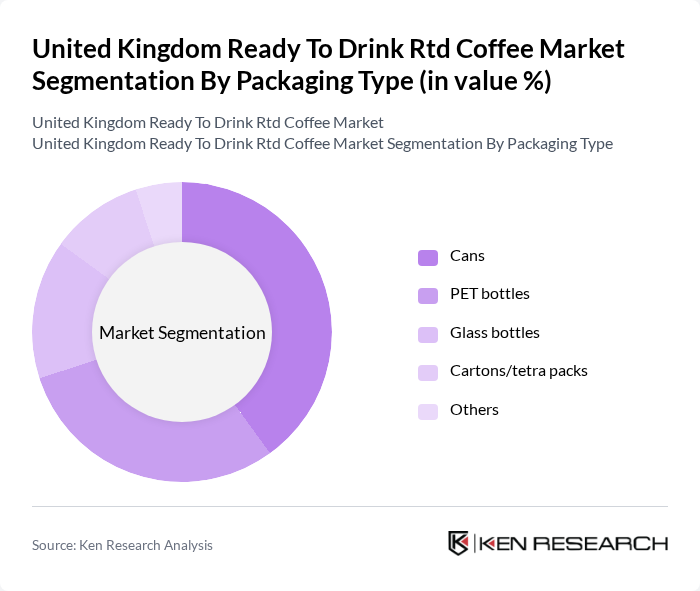

By Packaging Type:The packaging of ready-to-drink coffee products plays a crucial role in consumer choice. The market is segmented into cans, PET bottles, glass bottles, cartons/tetra packs, and others. Cans and PET bottles are the most popular due to their convenience and portability, making them ideal for on-the-go consumption. Glass bottles are also gaining traction among premium brands, while cartons are favored for their sustainability attributes.

The United Kingdom Ready To Drink Rtd Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Costa Coffee (The Coca-Cola Company), Starbucks RTD (Nestlé S.A.), Jimmy’s Iced Coffee (Britvic plc), Pret A Manger RTD, Emmi CAFFÈ LATTE (Emmi AG), UCC Coffee UK & Ireland (Caffé Latte/Black brands), Caffè Nero RTD, Tchibo GmbH (RTD/iced coffee), Illycaffè S.p.A., JDE Peet’s (including L’OR and Douwe Egberts RTD), Monster Beverage Corporation (Java Monster), Lavazza Group, Califia Farms, Minor Figures, High Brew Coffee contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ready-to-drink coffee market in the UK appears promising, driven by evolving consumer preferences and innovative product developments. As the market adapts to the increasing demand for health-conscious options, brands are likely to invest in premium and organic offerings. Additionally, the growth of e-commerce will facilitate broader market access, allowing brands to reach untapped demographics. With sustainability becoming a priority, companies will also focus on eco-friendly packaging solutions to attract environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Iced latte/cappuccino Cold brew Espresso/black coffee Flavored (vanilla, caramel, mocha, etc.) Functional/protein-enhanced Nitro coffee Decaffeinated Plant-based RTD coffee Others |

| By Packaging Type | Cans PET bottles Glass bottles Cartons/tetra packs Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Specialist retailers (coffee shops, delis) On-trade/foodservice Others |

| By Consumer Demographics | Age Group (16-24, 25-34, 35-44, 45+) Gender Income Level Lifestyle Preferences |

| By Flavor Profile | Plain/classic Sweet Creamy Chocolate/cocoa-forward Others |

| By Price Range | Budget Mid-range Premium Luxury |

| By Brand Loyalty | Brand-loyal consumers Price-sensitive consumers Occasional buyers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for RTD Coffee | 150 | Regular RTD Coffee Consumers, Occasional Buyers |

| Retail Distribution Insights | 120 | Retail Managers, Category Buyers |

| Market Trends and Innovations | 90 | Product Developers, Marketing Strategists |

| Health and Wellness Impact on Consumption | 80 | Health-Conscious Consumers, Nutritionists |

| Brand Loyalty and Switching Behavior | 100 | Brand Loyalists, Switchers |

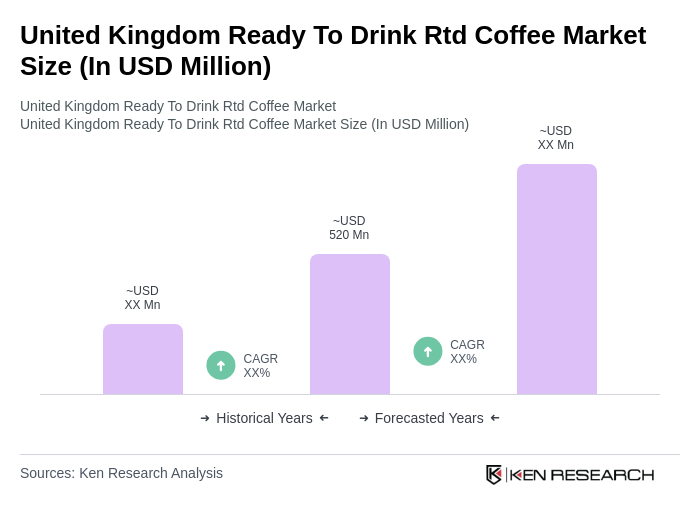

The United Kingdom Ready To Drink Coffee Market is valued at approximately USD 520 million, reflecting a significant growth trend driven by consumer demand for convenience and premium coffee experiences.