Region:Europe

Author(s):Geetanshi

Product Code:KRAB0061

Pages:81

Published On:August 2025

By Type:The market is segmented into various types, including Event Promotion, Athlete Representation, Sponsorship Management, Marketing and Advertising Services, Media Rights Management, Consulting Services, eSports Promotion, Wellness and Community Sports Events, and Others. Among these, Event Promotion is the leading sub-segment, driven by the high demand for live sports events and the growing trend of experiential marketing. The increasing number of sporting events and the need for professional management services have further solidified its position in the market. Digital engagement, media rights expansion, and the rise of eSports are also contributing to diversification and growth across segments.

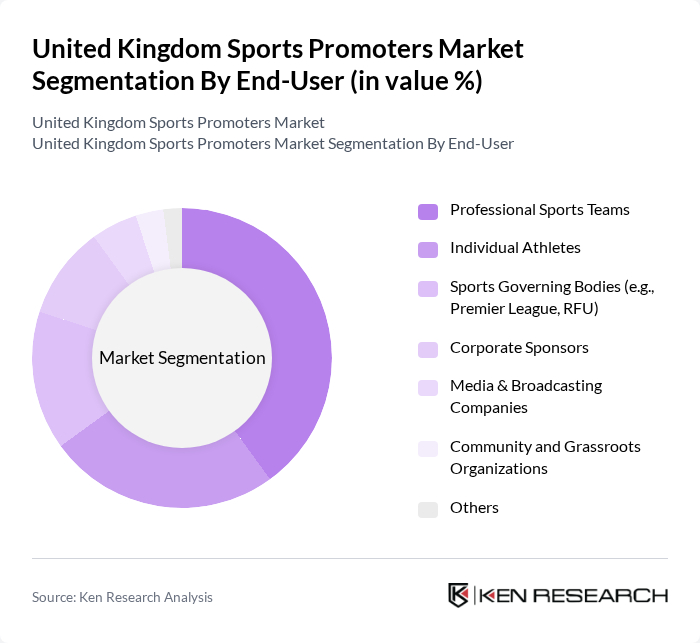

By End-User:The end-user segmentation includes Professional Sports Teams, Individual Athletes, Sports Governing Bodies (e.g., Premier League, RFU), Corporate Sponsors, Media & Broadcasting Companies, Community and Grassroots Organizations, and Others. Professional Sports Teams dominate this segment, as they require extensive promotional support to enhance their visibility and attract sponsorships. The increasing competition among teams to secure lucrative sponsorship deals has further fueled the demand for professional sports promotion services. Corporate sponsors and media companies are also expanding their roles, leveraging digital and broadcast platforms for greater reach and engagement.

The United Kingdom Sports Promoters Market is characterized by a dynamic mix of regional and international players. Leading participants such as Matchroom Sport, Queensberry Promotions, Premier League, Rugby Football Union (RFU), The Jockey Club, Pitch International, The Sports Consultancy, Synergy Sponsorship, Wasserman Media Group, CAA Sports, AEG Europe, Infront Sports & Media, Sportfive, Red Bull Media House, IMG (International Management Group) contribute to innovation, geographic expansion, and service delivery in this space. These organizations are leveraging digital platforms, strategic partnerships, and expanded event portfolios to strengthen their market positions and drive industry growth.

The future of the United Kingdom sports promoters market appears promising, driven by technological advancements and evolving consumer preferences. As digital platforms continue to grow, promoters will increasingly leverage data analytics to enhance fan engagement and tailor marketing strategies. Additionally, the integration of sustainability practices in sports events is expected to resonate with environmentally conscious consumers, further driving attendance and participation in sports activities. The market is poised for dynamic growth as it adapts to these trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Event Promotion Athlete Representation Sponsorship Management Marketing and Advertising Services Media Rights Management Consulting Services eSports Promotion Wellness and Community Sports Events Others |

| By End-User | Professional Sports Teams Individual Athletes Sports Governing Bodies (e.g., Premier League, RFU) Corporate Sponsors Media & Broadcasting Companies Community and Grassroots Organizations Others |

| By Event Type | Team Sports (e.g., Football, Rugby) Individual Sports (e.g., Tennis, Boxing) eSports Motorsport (e.g., Formula 1) Recreational and Wellness Events Others |

| By Marketing Channel | Digital Marketing Traditional Media (TV, Radio, Print) Social Media Platforms Direct Sponsorship & Partnerships Event-based Activations Others |

| By Geographic Focus | National Events International Events Local and Regional Events Others |

| By Audience Engagement Method | Live Events Virtual Engagement (Streaming, VR/AR) Community Programs Fan Loyalty Platforms Others |

| By Revenue Model | Commission-Based Fee-for-Service Subscription-Based Sponsorship & Advertising Revenue Media Rights Revenue Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Football Event Promotions | 100 | Event Managers, Marketing Directors |

| Rugby Sponsorship Deals | 60 | Sponsorship Managers, Brand Strategists |

| Athletics Event Management | 50 | Operations Managers, Venue Coordinators |

| Esports Promotions | 40 | Esports Managers, Digital Marketing Specialists |

| Community Sports Initiatives | 40 | Community Engagement Officers, Local Sports Club Managers |

The United Kingdom Sports Promoters Market is valued at approximately USD 2.2 billion, reflecting significant growth driven by the increasing popularity of sports events, rising sponsorship deals, and the expansion of digital marketing strategies.