Region:Europe

Author(s):Shubham

Product Code:KRAC0679

Pages:96

Published On:August 2025

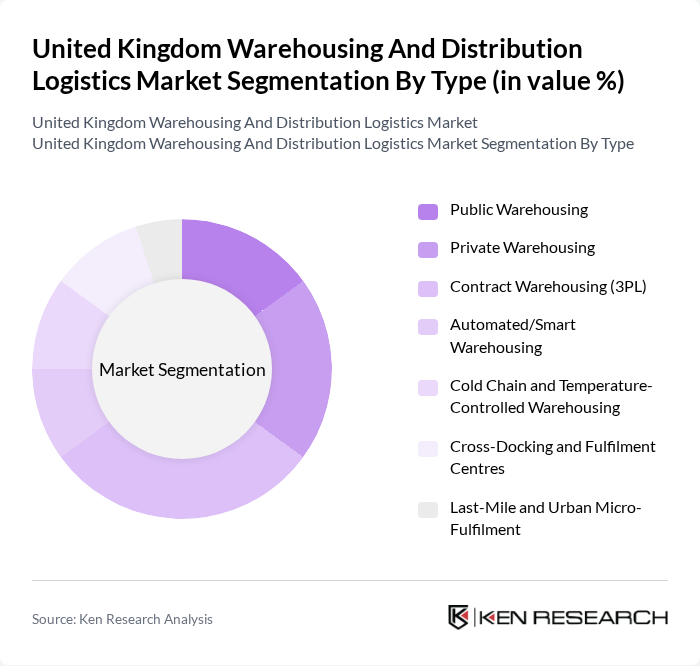

By Type:The market is segmented into various types of warehousing solutions, including Public Warehousing, Private Warehousing, Contract Warehousing (3PL), Automated/Smart Warehousing, Cold Chain and Temperature-Controlled Warehousing, Cross-Docking and Fulfilment Centres, and Last-Mile and Urban Micro-Fulfilment. Among these, Contract Warehousing (3PL) is currently the leading sub-segment due to the increasing reliance of businesses on third-party logistics providers for efficient supply chain management. The trend towards outsourcing logistics functions has been driven by the need for flexibility and cost-effectiveness in operations.

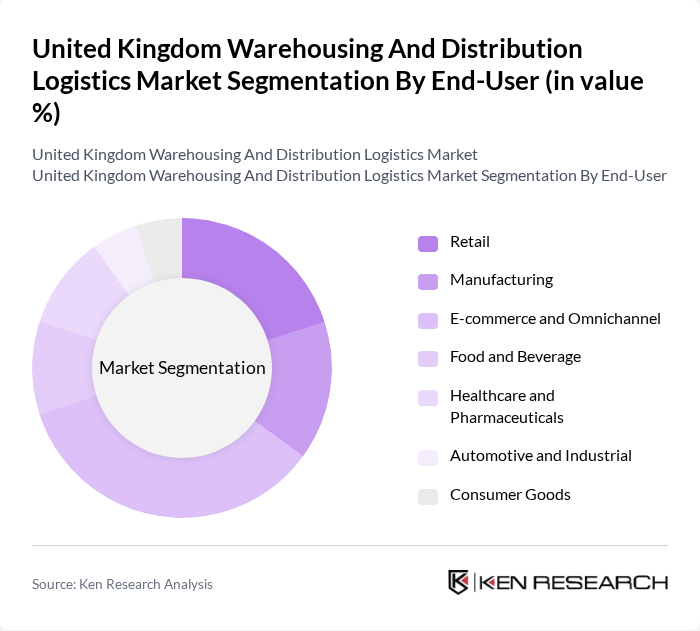

By End-User:The end-user segmentation includes Retail, Manufacturing, E-commerce and Omnichannel, Food and Beverage, Healthcare and Pharmaceuticals, Automotive and Industrial, and Consumer Goods. The E-commerce and Omnichannel segment is leading the market, driven by the rapid growth of online shopping and the need for efficient logistics solutions for fast, reliable delivery and returns management. Retailers and 3PLs continue to expand fulfilment capacity, automation, and inventory visibility to support next?day and same?day delivery standards.

The United Kingdom Warehousing And Distribution Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain (UK), XPO Logistics (UK), Wincanton plc, Kuehne+Nagel (UK), CEVA Logistics (UK), DB Schenker (UK), UPS Supply Chain Solutions (UK), FedEx Express/ FedEx Supply Chain (UK), GEODIS (UK), Palletways Group, GXO Logistics (incl. Clipper Logistics), Agility Logistics (Menzies/Agility Logistics Parks UK operations), DSV A/S (DSV UK), Rhenus Logistics (UK), Kintetsu World Express (UK) Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK warehousing and distribution logistics market appears promising, driven by ongoing technological advancements and evolving consumer preferences. As companies increasingly adopt automation and AI, operational efficiencies are expected to improve significantly. Furthermore, the focus on sustainability will likely shape logistics strategies, with businesses seeking eco-friendly solutions. The integration of smart technologies will enhance supply chain visibility, enabling firms to respond swiftly to market changes and consumer demands, ensuring competitiveness in a dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Warehousing Private Warehousing Contract Warehousing (3PL) Automated/Smart Warehousing Cold Chain and Temperature-Controlled Warehousing Cross-Docking and Fulfilment Centres Last-Mile and Urban Micro-Fulfilment |

| By End-User | Retail Manufacturing E-commerce and Omnichannel Food and Beverage Healthcare and Pharmaceuticals Automotive and Industrial Consumer Goods |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea/Port-Centric Logistics Intermodal (Road–Rail/Sea–Rail) Courier, Express and Parcel (CEP) |

| By Service Type | Storage and Handling Value-Added Services (VAS: kitting, labelling, returns, assembly) Inventory and Demand Management Order Fulfilment and Pick-Pack-Ship Transportation and Distribution Reverse Logistics |

| By Technology | Warehouse Management Systems (WMS) Automated Guided Vehicles (AGVs) and AMRs Internet of Things (IoT) and RTLS Artificial Intelligence (AI) and Analytics Robotics and AS/RS Temperature and Condition Monitoring |

| By Pricing Model | Fixed Pricing Variable/Volume-Based Pricing Subscription/Retainer-Based Pricing Pay-Per-Use/On-Demand Pricing Performance-Based/Outcome Pricing |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups and D2C Brands Public Sector and NHS PL/4PL Clients |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 120 | Warehouse Managers, Logistics Coordinators |

| E-commerce Fulfillment Strategies | 100 | eCommerce Operations Managers, Supply Chain Analysts |

| Third-Party Logistics Providers | 80 | Business Development Managers, Operations Directors |

| Cold Chain Logistics | 70 | Quality Assurance Managers, Supply Chain Executives |

| Automated Warehousing Solutions | 60 | IT Managers, Automation Specialists |

The United Kingdom Warehousing and Distribution Logistics Market is valued between USD 190 billion and USD 235 billion, reflecting a robust growth driven by e-commerce demand, rapid delivery expectations, and advancements in warehouse management technologies.