Region:North America

Author(s):Shubham

Product Code:KRAA1719

Pages:91

Published On:August 2025

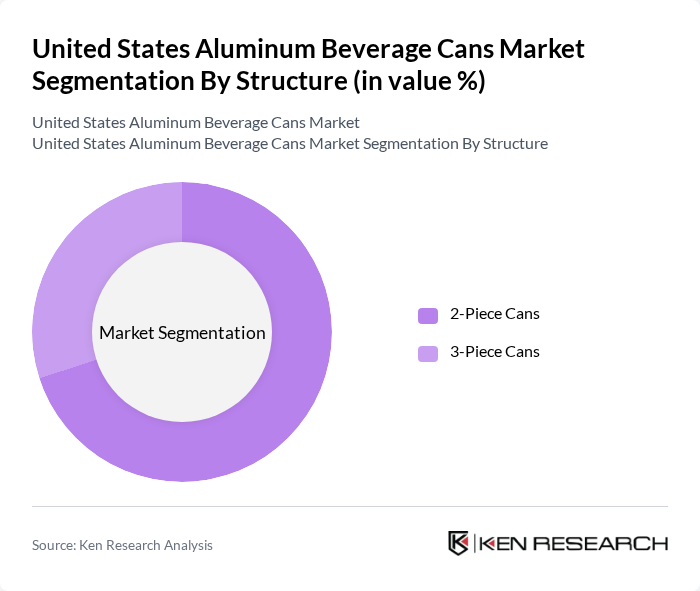

By Structure:The market is segmented into two primary structures: 2-Piece Cans and 3-Piece Cans. The 2-piece cans dominate the market due to their lightweight design and lower production costs, making them more appealing to manufacturers. The 3-piece cans, while less common, are still utilized for specific applications where durability is a priority.

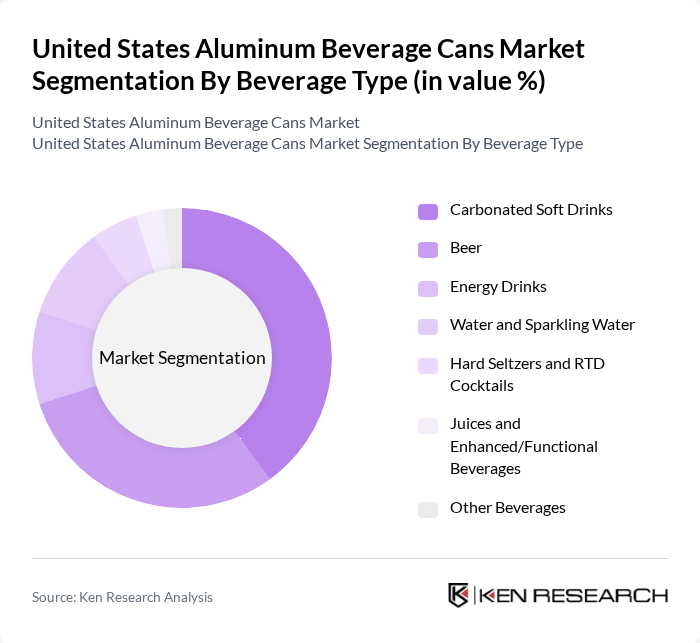

By Beverage Type:The beverage type segmentation includes Carbonated Soft Drinks, Beer, Energy Drinks, Water and Sparkling Water, Hard Seltzers and Ready-to-Drink (RTD) Cocktails, Juices and Enhanced/Functional Beverages, and Other Beverages. Carbonated Soft Drinks lead the market, driven by consumer preferences for fizzy drinks, while the growing popularity of Hard Seltzers has also significantly impacted market dynamics.

The United States Aluminum Beverage Cans Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ball Corporation, Crown Holdings, Inc., Ardagh Group S.A., CANPACK S.A., Silgan Holdings Inc., Envases Group, Trivium Packaging, Orora Limited, Novelis Inc. (can sheet supplier), Constellium SE (can sheet supplier), Golden Aluminum (can sheet supplier), Crown Beverage Packaging Mexico (U.S.-serving entity), Mauser Packaging Solutions (recycling/logistics partner), Arconic Corporation (aluminum supplier), Tri-Arrows Aluminum Inc. (U.S. can sheet supplier) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. aluminum beverage can market appears promising, driven by ongoing trends in sustainability and innovation. As consumer awareness of environmental issues grows, manufacturers are likely to invest in more eco-friendly production processes and materials. Additionally, the rise of e-commerce and direct-to-consumer sales channels will further enhance market accessibility, allowing brands to reach a broader audience. These factors will collectively shape a dynamic landscape for aluminum beverage cans, fostering growth and adaptation in the industry.

| Segment | Sub-Segments |

|---|---|

| By Structure | Piece Cans Piece Cans |

| By Beverage Type | Carbonated Soft Drinks Beer Energy Drinks Water and Sparkling Water Hard Seltzers and Ready-to-Drink (RTD) Cocktails Juices and Enhanced/Functional Beverages Other Beverages |

| By Capacity/Size | oz – 8.4 oz oz oz oz oz and Above |

| By Can Format | Standard Sleek/Slim Tall |

| By Coating/Lining Type | BPA-NI (Non-Intent) Epoxy and Next-Gen Linings Acrylic/Polyester Others |

| By Recycling Content | High-Recycled-Content Cans (e.g., ?70% recycled content) Conventional Recycled Content Non-Recycled Content |

| By Region (U.S.) | New England Mideast Great Lakes Plains Southeast Southwest Rocky Mountain Far West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Manufacturers | 120 | Production Managers, Supply Chain Directors |

| Retail Distributors | 100 | Logistics Coordinators, Sales Managers |

| Recycling Facilities | 80 | Operations Managers, Environmental Compliance Officers |

| Consumer Insights | 140 | End Consumers, Sustainability Advocates |

| Industry Experts | 50 | Market Analysts, Academic Researchers |

The United States Aluminum Beverage Cans Market is valued at approximately USD 12.5 billion, reflecting a significant growth trend driven by increasing consumer demand for sustainable packaging solutions and the recyclability of aluminum cans.