Region:North America

Author(s):Rebecca

Product Code:KRAB0270

Pages:89

Published On:August 2025

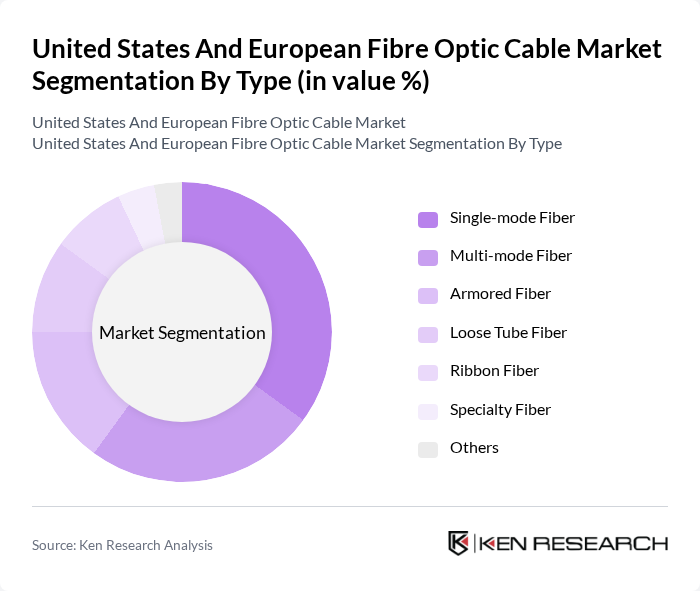

By Type:The market is segmented into various types of fibre optic cables, including Single-mode Fiber, Multi-mode Fiber, Armored Fiber, Loose Tube Fiber, Ribbon Fiber, Specialty Fiber, and Others. Each type serves specific applications and industries, catering to the diverse needs of consumers and businesses .

The Single-mode Fiber segment dominates the market due to its ability to transmit data over long distances with minimal loss, making it ideal for telecommunications and high-speed internet applications. The increasing demand for high-capacity networks and the expansion of long-haul communication systems have further propelled its growth. Multi-mode Fiber also holds a significant share, particularly in data centers and enterprise networks, where shorter distances are common. The trend towards higher bandwidth requirements and the need for efficient data transmission continue to drive the adoption of these fibre types .

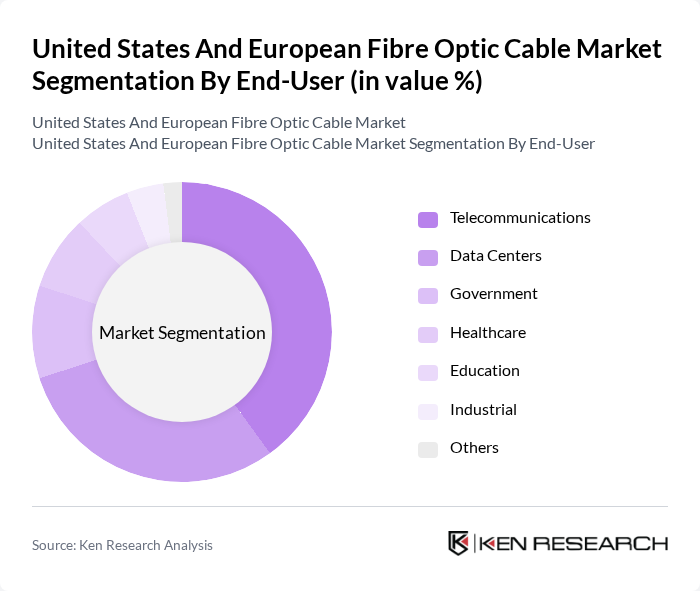

By End-User:The market is segmented by end-users, including Telecommunications, Data Centers, Government, Healthcare, Education, Industrial, and Others. Each end-user category has unique requirements and applications for fibre optic cables, influencing market dynamics .

The Telecommunications sector is the largest end-user of fibre optic cables, driven by the need for high-speed internet and mobile data services. The rapid expansion of 5G networks and the increasing demand for bandwidth-intensive applications have significantly boosted the adoption of fibre optics in this sector. Data Centers also represent a substantial market segment, as they require high-capacity and reliable data transmission solutions to support cloud computing and big data analytics. The growing emphasis on digital transformation across various industries further enhances the demand for fibre optic cables .

The United States And European Fibre Optic Cable Market is characterized by a dynamic mix of regional and international players. Leading participants such as Corning Incorporated, Prysmian Group, OFS Fitel, LLC, CommScope Holding Company, Inc., Nexans S.A., Sumitomo Electric Industries, Ltd., Fujikura Ltd., Sterlite Technologies Limited, Leviton Manufacturing Co., Inc., Belden Inc., TE Connectivity Ltd., 3M Company, ZTT International Limited, Yangtze Optical Fibre and Cable Joint Stock Limited Company (YOFC), Hitachi Cable, Ltd., Hexatronic Group AB, HUBER+SUHNER AG, Draka Communications (a Prysmian Group company), AFL (a subsidiary of Fujikura Ltd.), Ericsson AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fibre optic cable market in the U.S. and Europe appears promising, driven by technological advancements and increasing investments in digital infrastructure. As smart city initiatives gain momentum, the demand for reliable and high-speed connectivity will intensify. Furthermore, the ongoing rollout of 5G networks will create additional opportunities for fibre optic integration, enhancing overall network performance and reliability. This evolving landscape will likely lead to increased collaboration between telecom providers and technology firms.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-mode Fiber Multi-mode Fiber Armored Fiber Loose Tube Fiber Ribbon Fiber Specialty Fiber Others |

| By End-User | Telecommunications Data Centers Government Healthcare Education Industrial Others |

| By Application | Telecommunications Networks Enterprise Networks Cable Television Military and Aerospace Smart Grids Others |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing Discount Pricing Others |

| By Component | Fiber Optic Cables Connectors Splice Closures Patch Panels Others |

| By Installation Type | Indoor Installation Outdoor Installation Aerial Installation Buried Installation Others |

| By Geography | United States United Kingdom Germany France Italy Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators | 100 | Network Infrastructure Managers, CTOs |

| Data Center Operators | 60 | Facility Managers, IT Directors |

| Construction and Installation Firms | 50 | Project Managers, Installation Technicians |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Analysts |

| Research and Development Departments | 40 | R&D Managers, Product Development Engineers |

The United States and European Fibre Optic Cable Market is valued at approximately USD 3.1 billion, driven by the increasing demand for high-speed internet, data center expansion, and the adoption of cloud computing services.