Region:North America

Author(s):Rebecca

Product Code:KRAA1404

Pages:80

Published On:August 2025

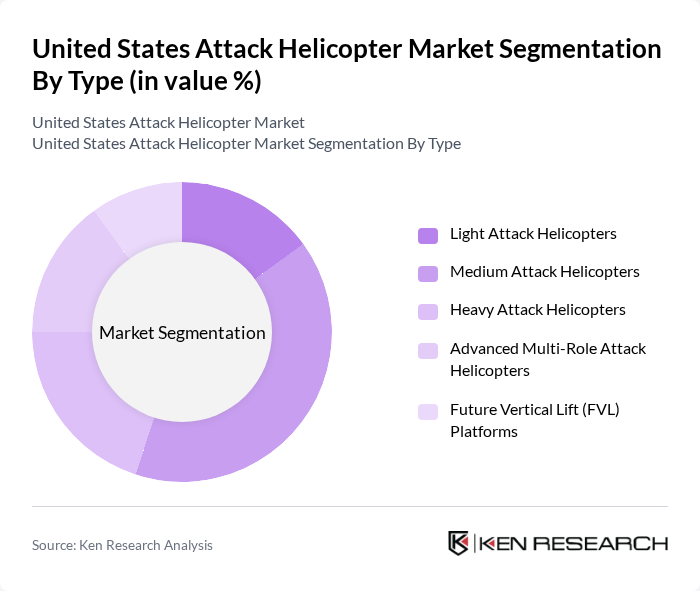

By Type:The market is segmented into various types of attack helicopters, including Light Attack Helicopters, Medium Attack Helicopters, Heavy Attack Helicopters, Advanced Multi-Role Attack Helicopters, and Future Vertical Lift (FVL) Platforms. Among these, Medium Attack Helicopters are currently leading the market due to their versatility, survivability, and effectiveness in a wide range of combat scenarios. The demand for these helicopters is driven by their ability to perform multiple roles, such as close air support, anti-armor operations, and reconnaissance, making them a preferred choice for modern military operations .

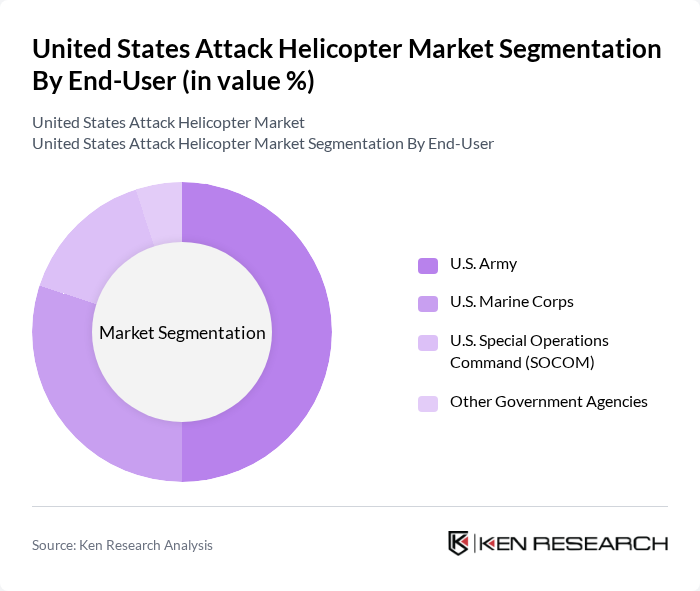

By End-User:The end-user segmentation includes the U.S. Army, U.S. Marine Corps, U.S. Special Operations Command (SOCOM), and other government agencies. The U.S. Army is the dominant end-user, primarily due to its extensive operational requirements and the largest fleet of attack helicopters. The increasing focus on ground support, anti-armor, and counter-insurgency operations has led to a surge in demand for advanced attack helicopters within the Army, reinforcing its leading position in the market .

The United States Attack Helicopter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boeing, Lockheed Martin (Sikorsky), Bell Textron Inc., Northrop Grumman Corporation, Sikorsky Aircraft (a Lockheed Martin company), Airbus Helicopters, Inc., Textron Aviation (Note: Bell Textron is the relevant attack helicopter entity), General Dynamics Corporation, RTX Corporation (formerly Raytheon Technologies), Leonardo S.p.A., Thales Group, BAE Systems plc, L3Harris Technologies, Inc., Elbit Systems Ltd., Rheinmetall AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. attack helicopter market appears promising, driven by ongoing investments in modernization and technological innovation. As defense budgets continue to rise, manufacturers are likely to focus on developing multi-role helicopters that can adapt to various mission profiles. Additionally, the integration of artificial intelligence and automation technologies is expected to enhance operational efficiency and effectiveness, ensuring that the U.S. maintains its competitive edge in aerial combat capabilities.

| Segment | Sub-Segments |

|---|---|

| By Type | Light Attack Helicopters Medium Attack Helicopters Heavy Attack Helicopters Advanced Multi-Role Attack Helicopters Future Vertical Lift (FVL) Platforms |

| By End-User | U.S. Army U.S. Marine Corps U.S. Special Operations Command (SOCOM) Other Government Agencies |

| By Application | Close Air Support (CAS) Armed Reconnaissance Anti-Armor Operations Suppression of Enemy Air Defenses (SEAD) Training and Simulation |

| By Component | Airframe Avionics and Mission Systems Weapon Systems Propulsion (Engines, Transmissions) Survivability and Countermeasure Systems |

| By Sales Channel | Direct Government Procurement Foreign Military Sales (FMS) Defense Contractors/Integrators Others |

| By Distribution Mode | Domestic Distribution International Distribution Joint Development Programs Others |

| By Price Range | Entry-Level Attack Helicopters Mid-Range Attack Helicopters Premium/Advanced Attack Helicopters Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Procurement Departments | 100 | Procurement Officers, Budget Analysts |

| Helicopter Manufacturers | 60 | Product Managers, Sales Directors |

| Defense Contractors | 50 | Program Managers, Technical Leads |

| Military Operations Units | 70 | Field Commanders, Aviation Specialists |

| Defense Analysts and Consultants | 40 | Market Analysts, Strategic Advisors |

The United States Attack Helicopter Market is valued at approximately USD 8.1 billion, reflecting a five-year historical analysis. This growth is driven by increased defense budgets and modernization of military capabilities.