Region:North America

Author(s):Rebecca

Product Code:KRAB2978

Pages:88

Published On:October 2025

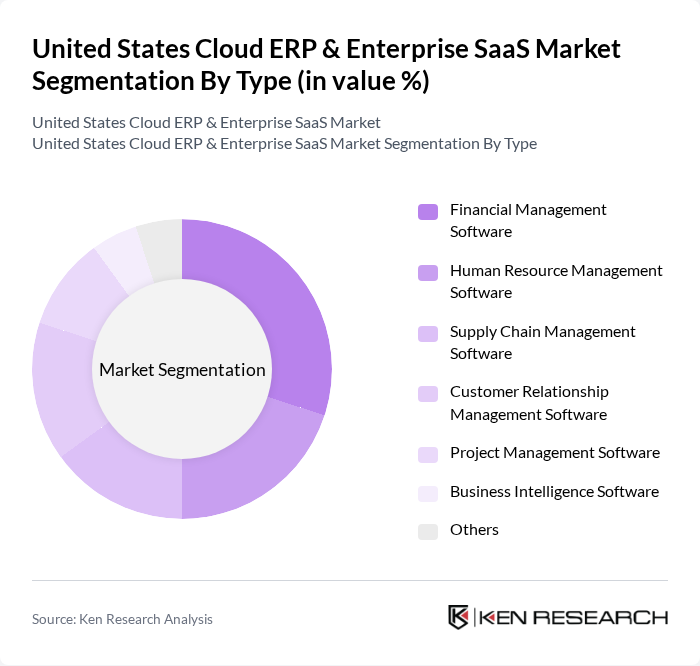

By Type:The market is segmented into various types of software solutions that cater to different business needs. The primary subsegments include Financial Management Software, Human Resource Management Software, Supply Chain Management Software, Customer Relationship Management Software, Project Management Software, Business Intelligence Software, and Others. Among these, Financial Management Software is currently leading the market due to its critical role in managing company finances, budgeting, and compliance, which are essential for businesses of all sizes.

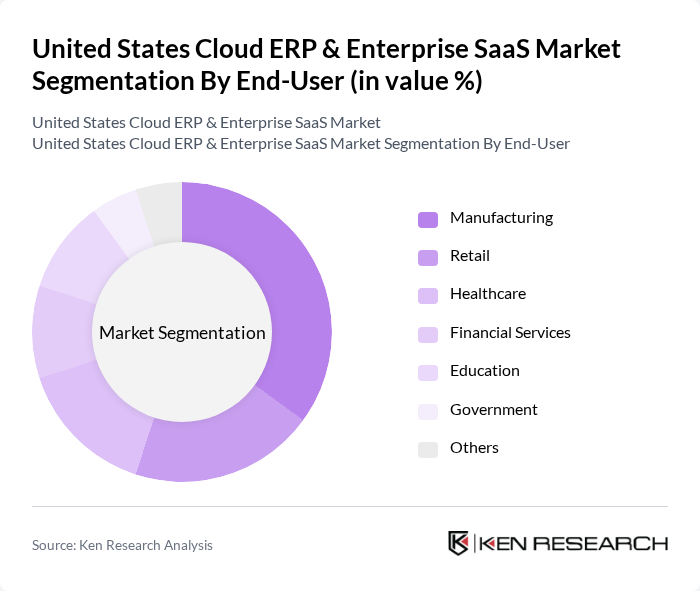

By End-User:The market is segmented based on various end-user industries, including Manufacturing, Retail, Healthcare, Financial Services, Education, Government, and Others. The Manufacturing sector is currently the dominant end-user, driven by the need for efficient resource management, production planning, and supply chain optimization. The increasing complexity of manufacturing processes and the push for digital transformation are propelling the adoption of cloud ERP solutions in this sector.

The United States Cloud ERP & Enterprise SaaS Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oracle Corporation, SAP SE, Microsoft Corporation, Salesforce.com, Inc., Workday, Inc., Infor, Inc., NetSuite Inc., Sage Group plc, Epicor Software Corporation, Acumatica, Inc., Zoho Corporation, Freshworks Inc., Odoo S.A., Unit4 N.V., Deltek, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. Cloud ERP and Enterprise SaaS market appears promising, driven by ongoing technological advancements and evolving business needs. As organizations increasingly prioritize agility and scalability, the demand for cloud-native applications is expected to rise. Additionally, the integration of artificial intelligence and machine learning into ERP systems will enhance data analytics capabilities, enabling businesses to make informed decisions. This dynamic landscape will foster innovation and create new opportunities for growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Financial Management Software Human Resource Management Software Supply Chain Management Software Customer Relationship Management Software Project Management Software Business Intelligence Software Others |

| By End-User | Manufacturing Retail Healthcare Financial Services Education Government Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud |

| By Industry Vertical | IT and Telecommunications Manufacturing Healthcare Retail Financial Services Others |

| By Company Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee |

| By Geographic Presence | East Coast West Coast Midwest South Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud ERP Adoption in Manufacturing | 150 | IT Managers, Operations Directors |

| SaaS Utilization in Retail | 120 | Product Managers, E-commerce Directors |

| Healthcare SaaS Solutions | 100 | Healthcare IT Specialists, Compliance Officers |

| Financial Services Cloud ERP | 80 | CFOs, Financial Analysts |

| SMB Cloud ERP Implementation | 90 | Small Business Owners, IT Consultants |

The United States Cloud ERP & Enterprise SaaS Market is valued at approximately USD 150 billion, reflecting significant growth driven by the adoption of cloud technologies and the demand for operational efficiency and real-time data analytics.