United States Compound Feed Market Overview

- The United States Compound Feed Market is valued at USD 104 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for animal protein, advancements in feed formulations (including the incorporation of prebiotics and probiotics), and a growing focus on sustainable and precision feeding practices. The market has seen a significant rise in the production of high-quality feed formulations that cater to the specific dietary needs of various livestock species, with a notable emphasis on animal health, welfare, and traceability .

- Key players in this market include states like Iowa, Texas, and North Carolina, which dominate due to their extensive agricultural infrastructure, high livestock populations, and favorable climatic conditions for feed production. These regions benefit from a well-established supply chain and access to raw materials, making them pivotal in the compound feed industry .

- The Animal Feed Regulatory Program Standards (AFRPS) have been implemented to enhance the safety and quality of animal feed. These standards require all feed manufacturers to adhere to strict guidelines regarding ingredient sourcing, production processes, and labeling, ensuring that feed is safe for animal consumption and meets nutritional standards .

United States Compound Feed Market Segmentation

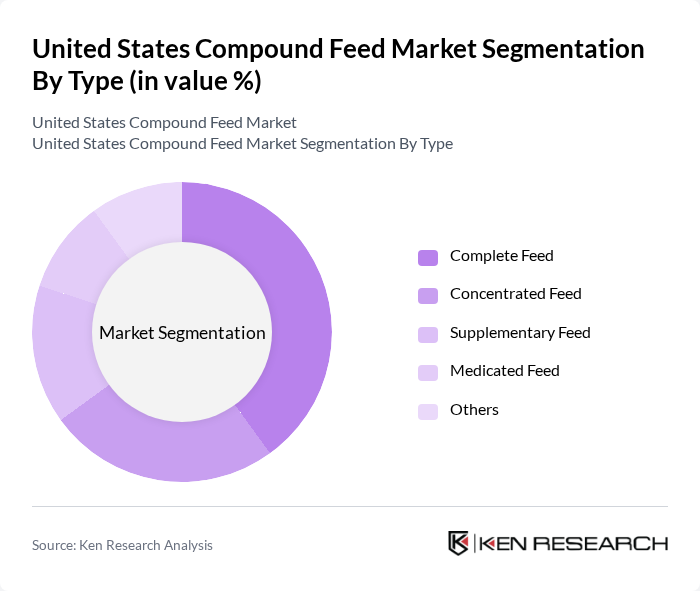

By Type:The compound feed market can be segmented into various types, including Complete Feed, Concentrated Feed, Supplementary Feed, Medicated Feed, and Others. Each of these subsegments serves distinct purposes in animal nutrition, catering to the specific dietary requirements of different livestock .

The Complete Feed subsegment is currently dominating the market due to its convenience and comprehensive nutritional profile, which meets the dietary needs of various livestock species. This segment is particularly favored by farmers and livestock producers as it simplifies feeding practices and ensures that animals receive all necessary nutrients in a single product. The trend towards holistic animal nutrition and the increasing awareness of the benefits of complete feed formulations are driving its popularity .

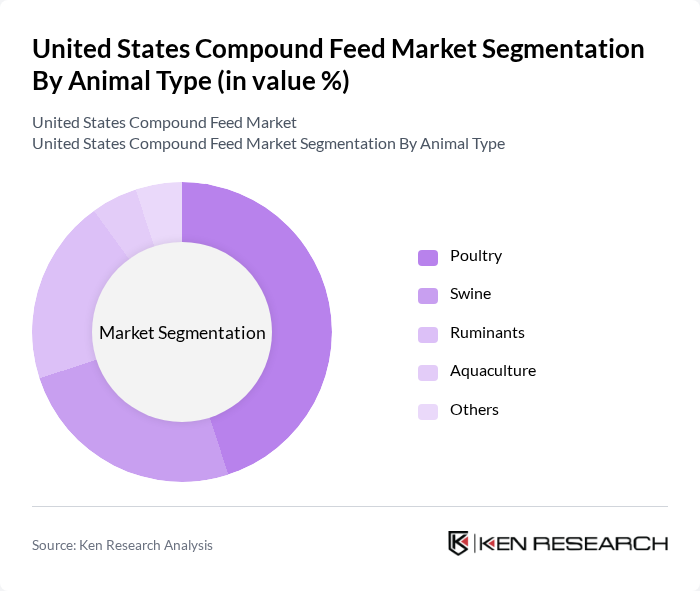

By Animal Type:The market can also be segmented based on animal types, including Poultry, Swine, Ruminants, Aquaculture, and Others. Each category reflects the specific nutritional needs and feeding practices associated with different livestock species .

Poultry is the leading subsegment in the animal type category, driven by the high demand for chicken and eggs in the U.S. market. The increasing consumer preference for poultry products, coupled with advancements in poultry farming techniques and a growing trend toward organic and antibiotic-free poultry products, has led to a significant rise in the consumption of specialized poultry feed formulations .

United States Compound Feed Market Competitive Landscape

The United States Compound Feed Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Archer Daniels Midland Company, Land O'Lakes, Inc. (Purina Animal Nutrition), Alltech, Inc., CHS Inc., The Andersons, Inc., Kent Nutrition Group, Perdue Farms Inc., Tyson Foods, Inc., Nutreco N.V., De Heus Animal Nutrition, Hubbard Feeds, West Feeds, Inc., United Animal Health, Provimi (Cargill) contribute to innovation, geographic expansion, and service delivery in this space .

United States Compound Feed Market Industry Analysis

Growth Drivers

- Increasing Demand for Livestock Products:The United States livestock sector is projected to produce approximately 27 billion pounds of beef and 27 billion pounds of pork in future, reflecting a robust demand for animal protein. This surge in livestock production directly correlates with the rising consumption of compound feed, which is essential for optimal animal growth and health. The USDA anticipates a 2% increase in livestock feed consumption, driven by both domestic and export markets, further propelling the compound feed industry.

- Advancements in Feed Formulation Technology:The compound feed industry is experiencing significant technological advancements, with investments exceeding $1 billion in research and development in future. Innovations in feed formulation, such as precision nutrition and the use of additives, enhance feed efficiency and animal health. These advancements are expected to improve feed conversion ratios, leading to a projected increase in overall feed demand by 3% annually, as producers seek to optimize production costs and animal performance.

- Expansion of the Poultry and Aquaculture Industries:The poultry sector in the U.S. is expected to produce over 45 billion pounds of chicken in future, while aquaculture is projected to grow by 5% annually, reaching 1.1 billion pounds. This growth in poultry and aquaculture directly drives the demand for specialized compound feeds tailored to these industries. The National Chicken Council reports that the poultry industry alone will require an additional 9 million tons of feed, significantly boosting the compound feed market.

Market Challenges

- Fluctuating Raw Material Prices:The compound feed industry faces significant challenges due to the volatility of raw material prices, particularly corn and soybean meal, which account for over 65% of feed formulations. In future, corn prices are projected to average $4.80 per bushel, while soybean meal may reach $375 per ton. These fluctuations can severely impact profit margins for feed manufacturers, forcing them to adjust pricing strategies and potentially pass costs onto livestock producers.

- Stringent Regulatory Compliance:The compound feed market is subject to rigorous regulatory frameworks, including FDA regulations that govern feed safety and quality. In future, compliance costs are expected to rise due to increased inspections and the implementation of new safety standards. This regulatory burden can strain smaller feed manufacturers, limiting their ability to compete effectively in a market dominated by larger players with more resources to manage compliance.

United States Compound Feed Market Future Outlook

The future of the United States compound feed market appears promising, driven by increasing consumer demand for sustainable and high-quality livestock products. As the industry adapts to technological advancements and regulatory changes, manufacturers are likely to focus on developing innovative feed solutions that enhance animal health and productivity. Additionally, the integration of digital technologies in feed management will streamline operations, improve traceability, and foster greater efficiency, positioning the market for sustained growth in the coming years.

Market Opportunities

- Growth in Organic and Non-GMO Feed Products:The demand for organic and non-GMO feed products is on the rise, with sales projected to reach $800 million in future. This trend is driven by consumer preferences for healthier and more sustainable food options, presenting a lucrative opportunity for feed manufacturers to diversify their product offerings and capture a growing market segment.

- Technological Innovations in Feed Production:The adoption of advanced technologies, such as artificial intelligence and blockchain, in feed production is expected to enhance operational efficiency and transparency. By future, investments in these technologies could exceed $300 million, enabling manufacturers to optimize feed formulations and improve supply chain management, ultimately leading to increased profitability and market competitiveness.