Region:North America

Author(s):Rebecca

Product Code:KRAD0280

Pages:97

Published On:August 2025

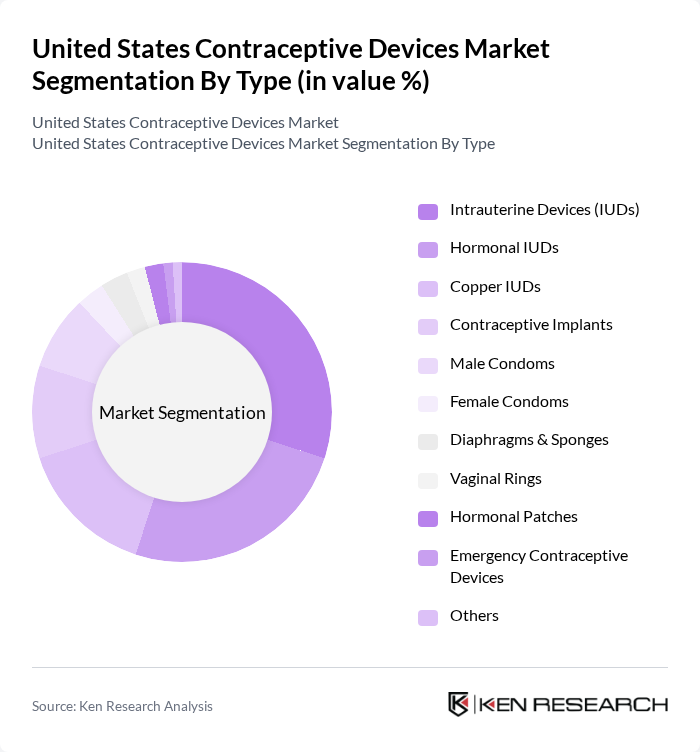

By Type:The market is segmented into various types of contraceptive devices, each catering to different consumer preferences and needs. The subsegments include Intrauterine Devices (IUDs), Hormonal IUDs, Copper IUDs, Contraceptive Implants, Male Condoms, Female Condoms, Diaphragms & Sponges, Vaginal Rings, Hormonal Patches, Emergency Contraceptive Devices, and Others. Among these, Intrauterine Devices (IUDs) and hormonal methods have gained significant traction due to their long-term effectiveness, convenience, and growing adoption among women. Male contraceptive devices, particularly condoms, also maintain substantial market share, reflecting increased attention to male reproductive responsibility and innovation in male contraceptive options .

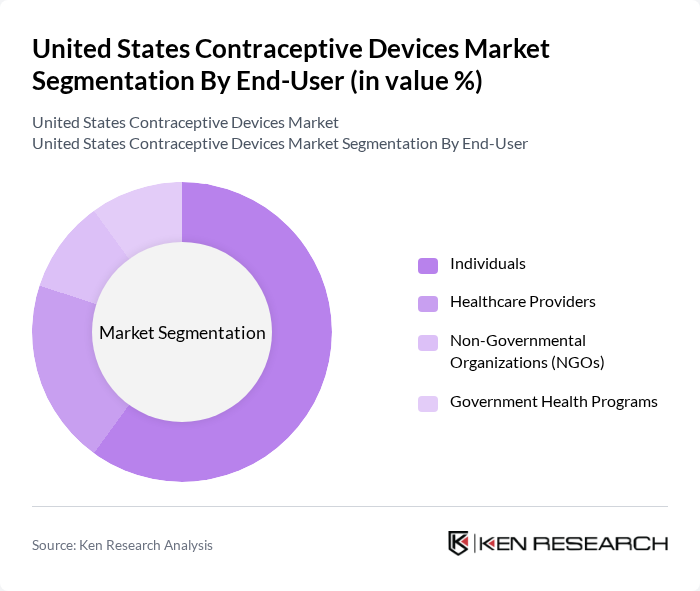

By End-User:The end-user segmentation includes Individuals, Healthcare Providers, Non-Governmental Organizations (NGOs), and Government Health Programs. Individuals represent the largest segment, driven by increasing awareness of reproductive health, the desire for family planning, and greater access to contraceptive options through retail and online channels. Healthcare providers play a crucial role in promoting contraceptive use through counseling, education, and clinical services, while NGOs and government programs contribute to accessibility and affordability, especially in underserved communities .

The United States Contraceptive Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson, Bayer AG, Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., CooperSurgical, Inc., HRA Pharma, Pfizer Inc., Organon & Co., Church & Dwight Co., Inc., Mylan N.V., Ferring Pharmaceuticals, ACON Laboratories, Inc., Durex (Reckitt Benckiser Group plc), Sandoz (Novartis AG), Hologic, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the contraceptive devices market in the United States appears promising, driven by ongoing technological advancements and increasing public health initiatives. As telehealth services expand, more individuals will gain access to contraceptive counseling, enhancing informed choices. Additionally, the growing focus on eco-friendly contraceptive options is likely to attract environmentally conscious consumers, further diversifying the market. These trends indicate a shift towards more personalized and accessible contraceptive solutions, positioning the market for sustained growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Intrauterine Devices (IUDs) Hormonal IUDs Copper IUDs Contraceptive Implants Male Condoms Female Condoms Diaphragms & Sponges Vaginal Rings Hormonal Patches Emergency Contraceptive Devices Others |

| By End-User | Individuals Healthcare Providers Non-Governmental Organizations (NGOs) Government Health Programs |

| By Distribution Channel | Pharmacies Online Retailers Hospitals and Clinics Family Planning Centers |

| By Age Group | Adolescents (15-19 years) Young Adults (20-29 years) Adults (30-39 years) Middle-aged (40-49 years) |

| By Income Level | Low Income Middle Income High Income |

| By Urban vs Rural | Urban Areas Rural Areas |

| By Policy Support | Subsidized Programs Tax Incentives Public Awareness Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Provider Insights | 150 | Gynecologists, Family Planning Specialists |

| Patient Experience Feedback | 120 | Women aged 18-45, Current Contraceptive Users |

| Market Trends Analysis | 100 | Healthcare Policy Makers, Insurance Representatives |

| Community Health Perspectives | 80 | Community Health Workers, Women's Health Advocates |

| Regulatory Insights | 50 | Regulatory Affairs Specialists, Compliance Officers |

The United States Contraceptive Devices Market is valued at approximately USD 5.4 billion, reflecting a significant growth driven by increased awareness of reproductive health, government initiatives for family planning, and advancements in contraceptive technology.