Region:North America

Author(s):Shubham

Product Code:KRAB0551

Pages:80

Published On:August 2025

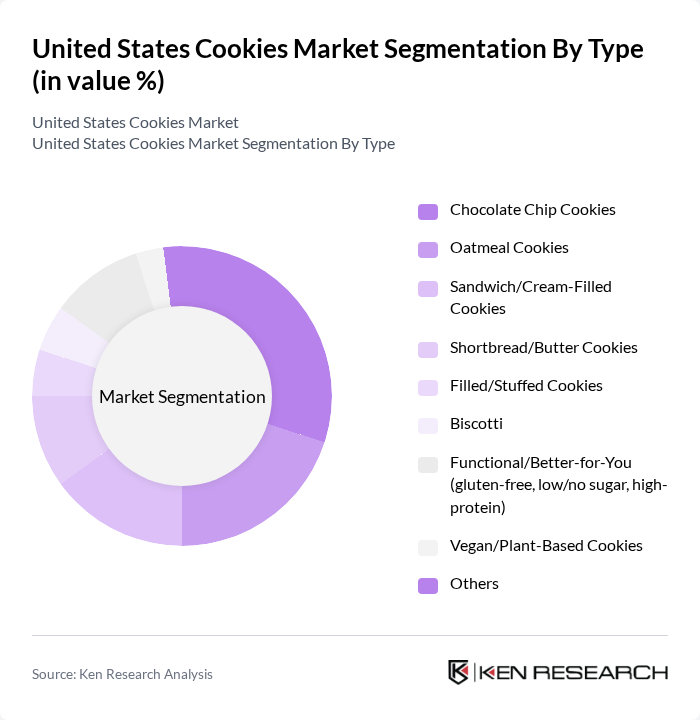

By Type:The cookies market can be segmented into various types, including chocolate chip cookies, oatmeal cookies, sandwich/cream-filled cookies, shortbread/butter cookies, filled/stuffed cookies, biscotti, functional/better-for-you cookies, vegan/plant-based cookies, and others. Among these, chocolate chip cookies are the most popular, driven by their classic appeal and widespread recognition. Oatmeal cookies also hold a significant share due to their perception as a healthier option. The demand for functional/better-for-you and plant-based cookies continues to rise, reflecting consumer interest in gluten-free, low/no sugar, high-protein, and vegan offerings promoted by major brands and challenger bakeries .

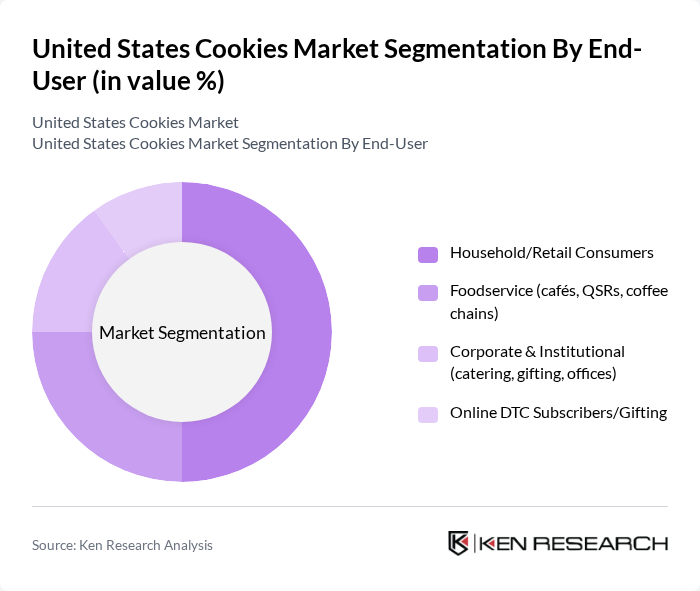

By End-User:The cookies market is segmented by end-user into household/retail consumers, foodservice (cafés, QSRs, coffee chains), corporate & institutional (catering, gifting, offices), and online DTC subscribers/gifting. The household/retail consumer segment dominates the market, supported by strong grocery channels and at-home snacking. Foodservice and bakery cafés are expanding cookie offerings, while e-commerce and subscription boxes have grown as complementary channels for premium and fresh-baked cookies .

The United States Cookies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mondel?z International, Inc. (OREO, Chips Ahoy!, belVita, Tate’s Bake Shop), Ferrero North America (Keebler, Mother’s Cookies), Campbell Soup Company — Pepperidge Farm, Kellogg Company (Kellanova) — (Famous Amos), General Mills, Inc. (Annie’s, Pillsbury refrigerated/baked), McKee Foods Corporation (Little Debbie), Nestlé USA, Inc. (Nestlé Toll House refrigerated dough), Bimbo Bakeries USA (Barcel, Marinela cookies), Utz Brands, Inc. (Zapp’s/On The Border cookies and licensed/partnered items), Hostess Brands (Voortman Cookies), Lotus Bakeries (Lotus Biscoff), Mondelez-owned Tate’s Bake Shop, Insomnia Cookies, Crumbl Cookies, Levain Bakery contribute to innovation, geographic expansion, and service delivery in this space .

The future of the United States cookies market appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends continue to shape the market, brands are likely to invest in healthier cookie alternatives, including low-sugar and high-protein options. Additionally, the integration of technology in production and marketing strategies will enhance consumer engagement and streamline operations. Companies that adapt to these trends will be well-positioned to thrive in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Chocolate Chip Cookies Oatmeal Cookies Sandwich/Cream-Filled Cookies Shortbread/Butter Cookies Filled/Stuffed Cookies Biscotti Functional/Better-for-You (gluten-free, low/no sugar, high-protein) Vegan/Plant-Based Cookies Others |

| By End-User | Household/Retail Consumers Foodservice (cafés, QSRs, coffee chains) Corporate & Institutional (catering, gifting, offices) Online DTC Subscribers/Gifting |

| By Sales Channel | Supermarkets & Hypermarkets Convenience & Drug Stores E-commerce & DTC Platforms Specialty & Gourmet Stores/Bakeries |

| By Packaging Type | Pouches/Resealable Bags Boxes/Cartons Tins/Gift Packs Bulk/Foodservice Packaging |

| By Price Range | Premium Cookies Mid-Range Cookies Budget Cookies |

| By Flavor | Classic (chocolate chip, peanut butter, sugar) Innovative/Exotic (matcha, chai, ube, international) Seasonal/Limited-Time |

| By Distribution Mode | Direct Store Delivery (DSD) Warehouse/Wholesaler Supply Online/DTC Fulfillment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Cookie Sales | 150 | Category Managers, Grocery Store Buyers |

| Consumer Preferences | 140 | Cookie Consumers, Snack Enthusiasts |

| Health-Conscious Cookie Options | 100 | Nutritionists, Health Food Store Managers |

| Online Cookie Sales Trends | 120 | E-commerce Managers, Digital Marketing Specialists |

| Cookie Product Development Insights | 80 | Product Development Managers, R&D Specialists |

The United States Cookies Market is valued at approximately USD 7.6 billion, reflecting a significant growth trend driven by consumer demand for convenient snack options and the rise of e-commerce and premium cookie offerings.