Region:North America

Author(s):Rebecca

Product Code:KRAA2129

Pages:85

Published On:August 2025

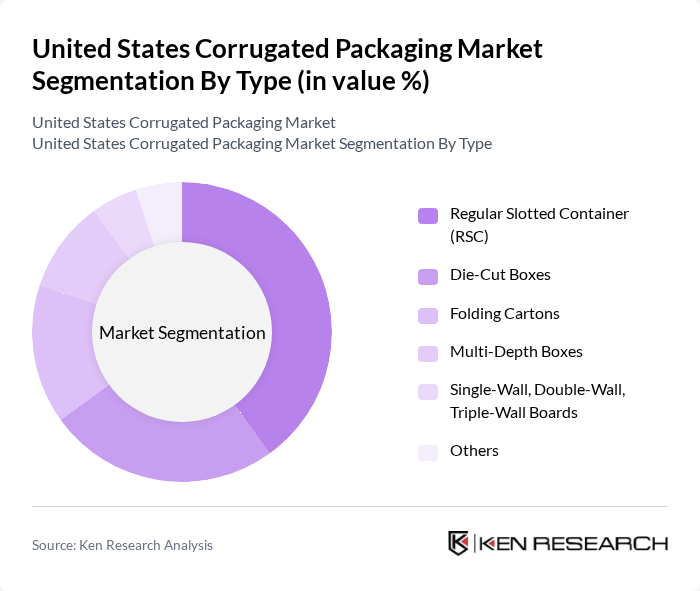

By Type:The corrugated packaging market is segmented into various types, including Regular Slotted Containers (RSC), Die-Cut Boxes, Folding Cartons, Multi-Depth Boxes, Single-Wall, Double-Wall, Triple-Wall Boards, and Others. Among these, Regular Slotted Containers (RSC) hold the largest share due to their versatility, cost-effectiveness, and ease of assembly. RSCs are widely adopted across multiple industries for their adaptability in shipping and storage, making them the preferred choice for a range of packaging applications .

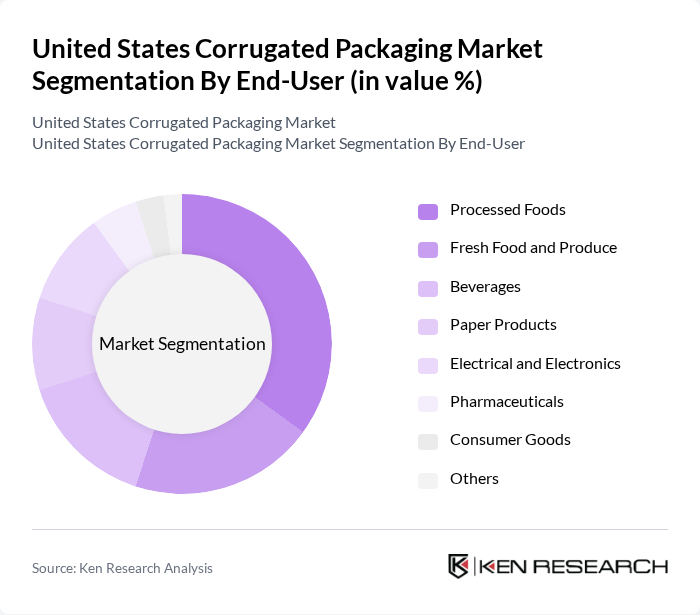

By End-User:The end-user segmentation includes Processed Foods, Fresh Food and Produce, Beverages, Paper Products, Electrical and Electronics, Pharmaceuticals, Consumer Goods, and Others. The processed foods segment is the leading end-user, supported by the growing demand for packaged and ready-to-eat food products and the need for efficient, compliant distribution methods. This segment’s dominance is reinforced by stringent FDA regulations and the critical role of corrugated packaging in maintaining product safety and minimizing damage during transport .

The United States Corrugated Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as International Paper Company, WestRock Company, Smurfit Kappa Group, Packaging Corporation of America, Georgia-Pacific LLC, Mondi Group, DS Smith Plc, Sonoco Products Company, Pratt Industries, Stora Enso Oyj, Ranpak Holdings Corp., Ahlstrom-Munksjö Oyj, Novolex Holdings, Inc., UFP Industries, Inc., Veritiv Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. corrugated packaging market appears promising, driven by ongoing trends in e-commerce and sustainability. As companies increasingly adopt eco-friendly practices, the demand for recyclable materials is expected to rise significantly. Additionally, advancements in automation and smart packaging technologies will enhance production efficiency and product tracking. These developments will likely position the corrugated packaging sector as a key player in meeting the evolving needs of consumers and businesses alike, fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Regular Slotted Container (RSC) Die-Cut Boxes Folding Cartons Multi-Depth Boxes Single-Wall, Double-Wall, Triple-Wall Boards Others |

| By End-User | Processed Foods Fresh Food and Produce Beverages Paper Products Electrical and Electronics Pharmaceuticals Consumer Goods Others |

| By Application | Retail Packaging Industrial Packaging E-commerce Packaging Export Packaging Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Material Type | Recycled Paperboard Virgin Paperboard Kraft Paper Others |

| By Size | Small Medium Large Others |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 120 | Packaging Managers, Supply Chain Coordinators |

| E-commerce Packaging Solutions | 90 | E-commerce Operations Managers, Logistics Directors |

| Consumer Goods Packaging | 70 | Product Development Managers, Marketing Executives |

| Industrial Packaging Applications | 60 | Procurement Managers, Operations Supervisors |

| Sustainability Initiatives in Packaging | 50 | Sustainability Officers, R&D Managers |

The United States Corrugated Packaging Market is valued at approximately USD 211 billion, driven by factors such as the demand for sustainable packaging solutions, the growth of e-commerce, and efficient logistics management across various industries.