Region:North America

Author(s):Dev

Product Code:KRAC0434

Pages:90

Published On:August 2025

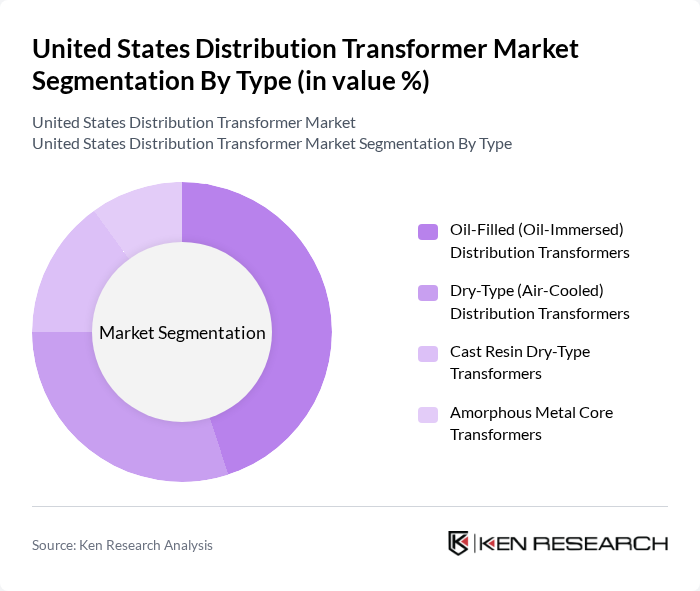

By Type:The distribution transformer market can be segmented into four main types: Oil-Filled (Oil-Immersed) Distribution Transformers, Dry-Type (Air-Cooled) Distribution Transformers, Cast Resin Dry-Type Transformers, and Amorphous Metal Core Transformers. Each type serves different applications and has unique advantages, such as efficiency, maintenance requirements, and environmental impact.

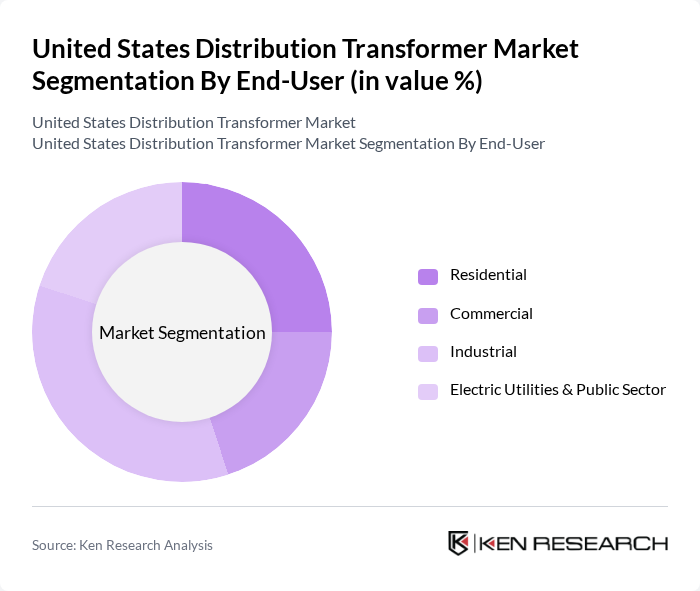

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Electric Utilities & Public Sector. Each segment has distinct requirements and influences the demand for distribution transformers based on energy consumption patterns and infrastructure development.

The United States Distribution Transformer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hitachi Energy (USA), ABB Ltd. (ABB Inc., USA), Siemens Energy, Inc. (USA), Schneider Electric USA, Inc., Eaton Corporation plc (Eaton USA), General Electric Company (GE Vernova), Mitsubishi Electric Power Products, Inc. (MEPPI), Howard Industries, Inc. (Howard Power Solutions), Prolec GE Waukesha (a Xignux company), SPX Technologies, Inc. (SPX Transformer Solutions), ERMCO, Inc. (Electric Research and Manufacturing Cooperative), S&C Electric Company, Myers Power Products, Inc., Pioneer Transformers (Pioneer Power Solutions), Southwest Electric Co. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. distribution transformer market appears promising, driven by the ongoing transition towards smart grid technologies and the increasing emphasis on energy efficiency. By future, the adoption of digital monitoring systems is expected to enhance operational efficiency, reducing maintenance costs by up to 20%. Additionally, the focus on sustainable practices will likely lead to a rise in eco-friendly transformer materials, aligning with broader environmental goals and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Oil-Filled (Oil-Immersed) Distribution Transformers Dry-Type (Air-Cooled) Distribution Transformers Cast Resin Dry-Type Transformers Amorphous Metal Core Transformers |

| By End-User | Residential Commercial Industrial Electric Utilities & Public Sector |

| By Application | Utility Power Distribution (Overhead and Underground) Renewable Interconnection (Solar, Wind, Storage) Industrial and Commercial Facilities Data Centers and Critical Infrastructure |

| By Voltage Rating | Up to 1 kV (Secondary LV) >1 kV to 36 kV (Typical MV Distribution) >36 kV (High-End Distribution) |

| By Phase | Single-Phase Three-Phase |

| By Sales Channel | Direct to Utilities/OEM Contracts Authorized Distributors/VARs EPCs and System Integrators |

| By Mounting | Pole-Mounted Pad-Mounted Substation/Platform-Mounted |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Company Transformer Usage | 100 | Utility Managers, Electrical Engineers |

| Manufacturing Sector Transformer Procurement | 80 | Procurement Managers, Operations Directors |

| Installation and Maintenance Insights | 70 | Field Technicians, Project Managers |

| Renewable Energy Integration | 60 | Renewable Energy Project Leads, Electrical Consultants |

| Market Trends and Innovations | 90 | Industry Analysts, R&D Managers |

The United States Distribution Transformer Market is valued at approximately USD 4.1 billion, driven by increasing electricity demand, renewable energy expansion, and infrastructure modernization efforts. This valuation is based on a comprehensive five-year historical analysis.