United States Electronic Appliance Stores Market Overview

- The United States Electronic Appliance Stores Market is valued at USD 92.6 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for smart home appliances, rapid technological advancements, and a strong shift towards energy-efficient and connected products. The rise in disposable income, urbanization, and the proliferation of omnichannel retail strategies have also contributed significantly to the market's expansion, with leading retailers integrating both online and in-store experiences to meet evolving consumer preferences .

- Key cities such asNew York, Los Angeles, and Chicagocontinue to dominate the market due to their large populations, high disposable incomes, and a strong presence of major retail chains. These urban centers serve as major hubs for electronic appliance sales, benefiting from robust brick-and-mortar networks and rapidly expanding e-commerce channels, which together cater to a broad spectrum of consumer needs and preferences .

- In 2023, the U.S. government strengthened energy efficiency regulations for household appliances under theEnergy Policy and Conservation Act (EPCA), as amended by the Department of Energy (DOE) Appliance and Equipment Standards Program. This binding regulation mandates that new appliances distributed in commerce must meet specific federal minimum energy conservation standards, covering product categories such as refrigerators, dishwashers, air conditioners, and more. Compliance is required for manufacturers and importers, with periodic updates to standards and mandatory labeling to promote the adoption of eco-friendly technologies and reduce overall energy consumption .

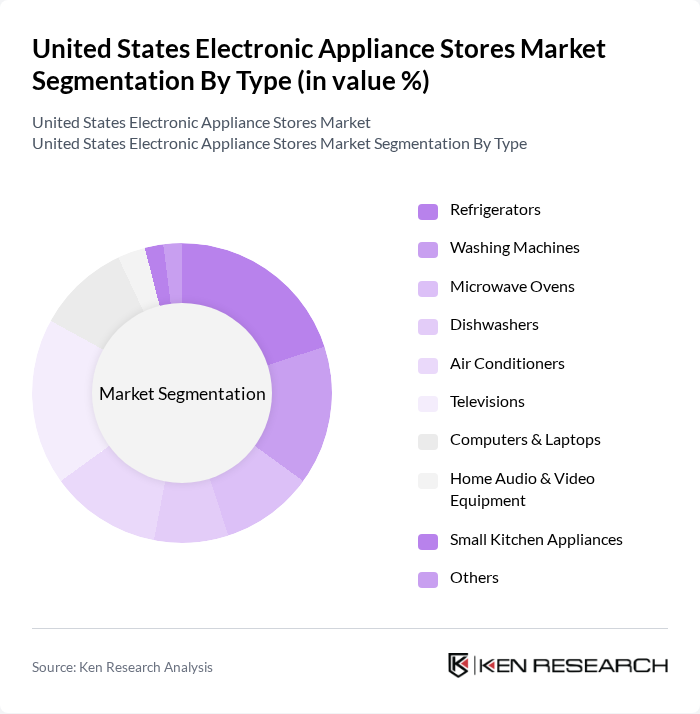

United States Electronic Appliance Stores Market Segmentation

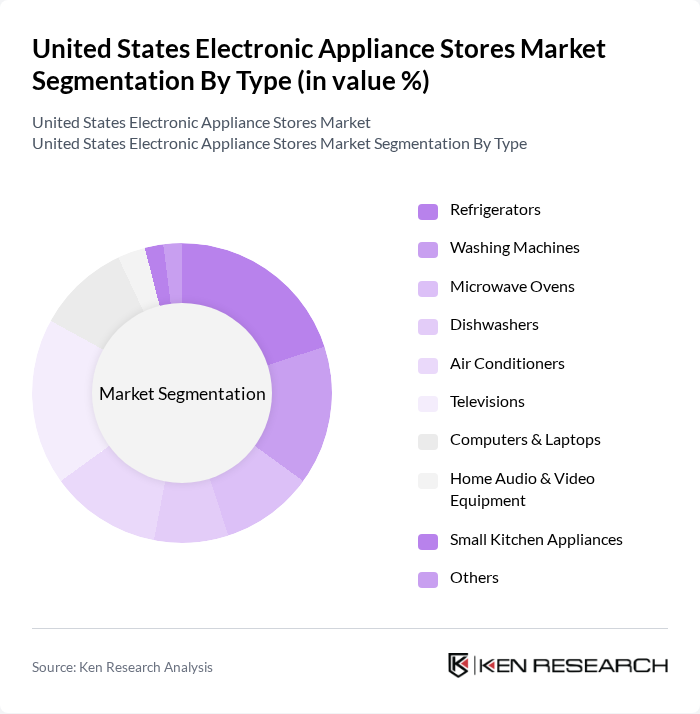

By Type:The market is segmented into various types of electronic appliances, including refrigerators, washing machines, microwave ovens, dishwashers, air conditioners, televisions, computers & laptops, home audio & video equipment, small kitchen appliances, and others. Each sub-segment addresses specific consumer needs, with demand patterns influenced by technological innovation, energy efficiency, and the growing adoption of smart and connected devices. Major appliances such as refrigerators and washing machines account for the largest share, while smart home devices and small kitchen appliances are experiencing rapid growth due to consumer interest in convenience and automation .

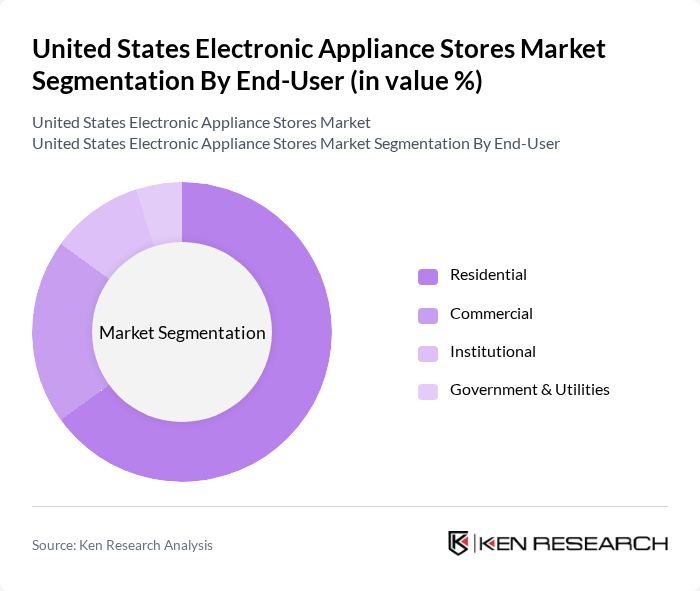

By End-User:The market is segmented based on end-users, including residential, commercial, institutional, and government & utilities. Each segment exhibits distinct purchasing behaviors and requirements, withresidential consumersdriving the majority of sales. The residential segment's dominance is attributed to the increasing adoption of smart home technologies, energy-efficient appliances, and the trend toward home automation, while commercial and institutional buyers focus on bulk procurement and product durability .

United States Electronic Appliance Stores Market Competitive Landscape

The United States Electronic Appliance Stores Market is characterized by a dynamic mix of regional and international players. Leading participants such as Best Buy Co., Inc., Walmart Inc., Amazon.com, Inc., Target Corporation, The Home Depot, Inc., Lowe's Companies, Inc., Sears Holdings Corporation, Newegg Commerce, Inc., B&H Photo Video, Micro Center, P.C. Richard & Son Inc., Abt Electronics, BrandsMart USA, Conn's, Inc., hhgregg, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

United States Electronic Appliance Stores Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Smart Appliances:The demand for smart appliances in the United States is projected to reach approximately 50 million units in future, driven by consumer interest in convenience and energy efficiency. According to the Consumer Technology Association, smart home device sales are expected to exceed $27 billion in future. This trend is fueled by the growing integration of IoT technology, which enhances user experience and promotes energy savings, making smart appliances increasingly appealing to consumers.

- Rise in E-commerce Sales:E-commerce sales in the electronic appliance sector are anticipated to surpass $45 billion in future, reflecting a significant shift in consumer purchasing behavior. The U.S. Census Bureau reported that e-commerce accounted for approximately 15% of total retail sales, a figure expected to grow as more consumers prefer the convenience of online shopping. This trend is further supported by advancements in logistics and delivery services, enhancing the overall shopping experience for consumers.

- Technological Advancements in Appliances:The electronic appliance market is witnessing rapid technological advancements, with innovations such as AI integration and energy-efficient designs. The U.S. Department of Energy estimates that energy-efficient appliances can save consumers up to $600 annually on utility bills. As manufacturers invest in R&D, the introduction of cutting-edge features is expected to drive sales, with smart refrigerators and washing machines leading the charge in consumer interest and adoption.

Market Challenges

- Intense Competition from Online Retailers:The electronic appliance market faces fierce competition from online retailers, which have captured a significant market share. Amazon accounted for approximately 42% of all online appliance sales, creating pressure on traditional brick-and-mortar stores. This competition forces retailers to innovate and enhance customer service to retain market share, often leading to reduced profit margins and increased operational costs.

- Supply Chain Disruptions:Ongoing supply chain disruptions continue to challenge the electronic appliance market, with delays affecting product availability. The Institute for Supply Management reported that 75% of manufacturers experienced supply chain issues, leading to increased lead times and costs. These disruptions can hinder retailers' ability to meet consumer demand, ultimately impacting sales and customer satisfaction in the competitive landscape.

United States Electronic Appliance Stores Market Future Outlook

The future of the United States electronic appliance market appears promising, driven by technological advancements and evolving consumer preferences. As smart home technology continues to gain traction, retailers are likely to expand their product offerings to include more innovative solutions. Additionally, the shift towards sustainable and energy-efficient appliances will likely influence purchasing decisions, prompting manufacturers to prioritize eco-friendly designs. Overall, the market is expected to adapt to these trends, fostering growth and resilience in the face of challenges.

Market Opportunities

- Growth in Eco-friendly Appliances:The demand for eco-friendly appliances is on the rise, with consumers increasingly prioritizing sustainability. The U.S. Environmental Protection Agency reported that energy-efficient appliances can reduce energy consumption by up to 35%. This trend presents a significant opportunity for manufacturers to innovate and market products that align with environmentally conscious consumer values, potentially increasing market share.

- Expansion into Emerging Markets:Emerging markets present a lucrative opportunity for U.S. electronic appliance retailers. According to the World Bank, countries in Southeast Asia are projected to experience a 7% GDP growth in future, indicating rising disposable incomes. This economic growth can lead to increased demand for electronic appliances, allowing U.S. companies to expand their reach and capitalize on new consumer bases.