Region:North America

Author(s):Dev

Product Code:KRAB3017

Pages:87

Published On:October 2025

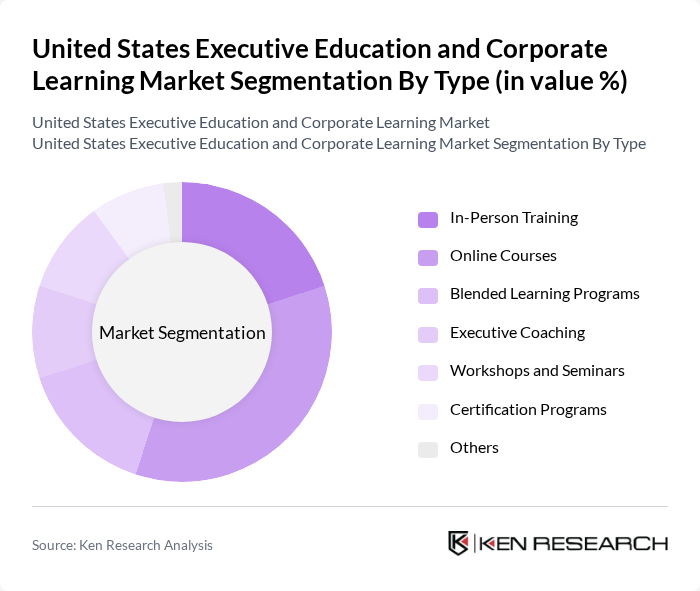

By Type:The market is segmented into various types of educational offerings, including In-Person Training, Online Courses, Blended Learning Programs, Executive Coaching, Workshops and Seminars, Certification Programs, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, catering to a diverse audience seeking professional development. The shift towards digital learning platforms has been accelerated by the COVID-19 pandemic, leading to a surge in demand for online educational resources.

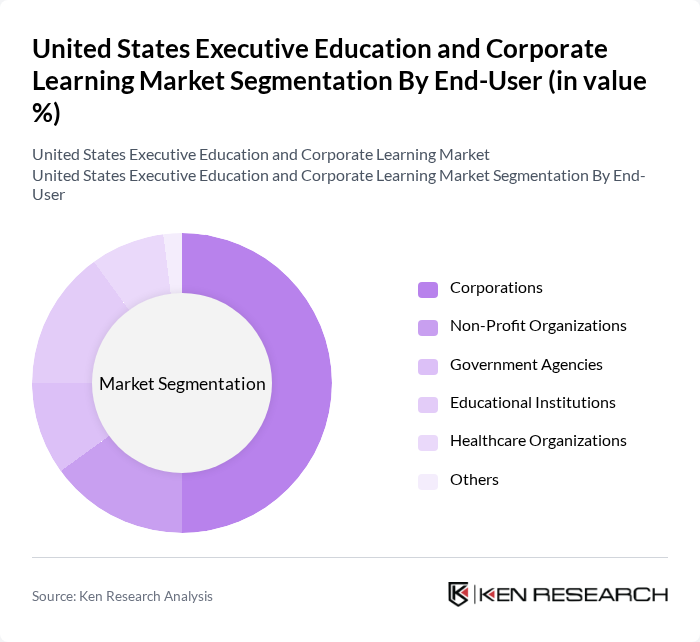

By End-User:The end-user segmentation includes Corporations, Non-Profit Organizations, Government Agencies, Educational Institutions, Healthcare Organizations, and Others. Corporations are the leading end-users, as they invest heavily in employee training and development to maintain competitiveness in the market. The increasing focus on leadership development and skill enhancement within corporate structures drives the demand for tailored educational programs.

The United States Executive Education and Corporate Learning Market is characterized by a dynamic mix of regional and international players. Leading participants such as Harvard Business School, Wharton Executive Education, Stanford Graduate School of Business, MIT Sloan School of Management, Columbia Business School, INSEAD, Duke Corporate Education, University of Chicago Booth School of Business, Northwestern University Kellogg School of Management, Cornell University ILR School, UCLA Anderson School of Management, University of Michigan Ross School of Business, University of Virginia Darden School of Business, University of Pennsylvania LPS, Thunderbird School of Global Management contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States Executive Education and Corporate Learning Market appears promising, driven by technological advancements and evolving workforce needs. As organizations increasingly prioritize employee development, the integration of artificial intelligence and personalized learning experiences will become essential. Furthermore, the emphasis on soft skills and diversity training will shape program offerings, ensuring that companies remain competitive in a rapidly changing business landscape. The market is poised for innovation, with a focus on creating adaptable and inclusive learning environments.

| Segment | Sub-Segments |

|---|---|

| By Type | In-Person Training Online Courses Blended Learning Programs Executive Coaching Workshops and Seminars Certification Programs Others |

| By End-User | Corporations Non-Profit Organizations Government Agencies Educational Institutions Healthcare Organizations Others |

| By Delivery Mode | Virtual Learning On-Site Training Hybrid Learning Mobile Learning Others |

| By Duration | Short-Term Courses (Less than 1 month) Medium-Term Courses (1-3 months) Long-Term Courses (More than 3 months) Others |

| By Industry Focus | Technology Finance Healthcare Manufacturing Retail Others |

| By Learning Objective | Leadership Development Skill Enhancement Compliance Training Team Building Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Learning Programs | 150 | HR Directors, Learning & Development Managers |

| Executive Education Participants | 100 | Mid to Senior-Level Executives, Program Alumni |

| Online Learning Platforms | 80 | Product Managers, Digital Learning Specialists |

| Industry-Specific Training Initiatives | 70 | Training Coordinators, Compliance Officers |

| Corporate Partnerships with Educational Institutions | 90 | Strategic Partnership Managers, Academic Liaisons |

The United States Executive Education and Corporate Learning Market is valued at approximately USD 40 billion, reflecting a significant growth driven by the increasing demand for upskilling and reskilling in a rapidly evolving job market.