Region:North America

Author(s):Dev

Product Code:KRAB0477

Pages:84

Published On:August 2025

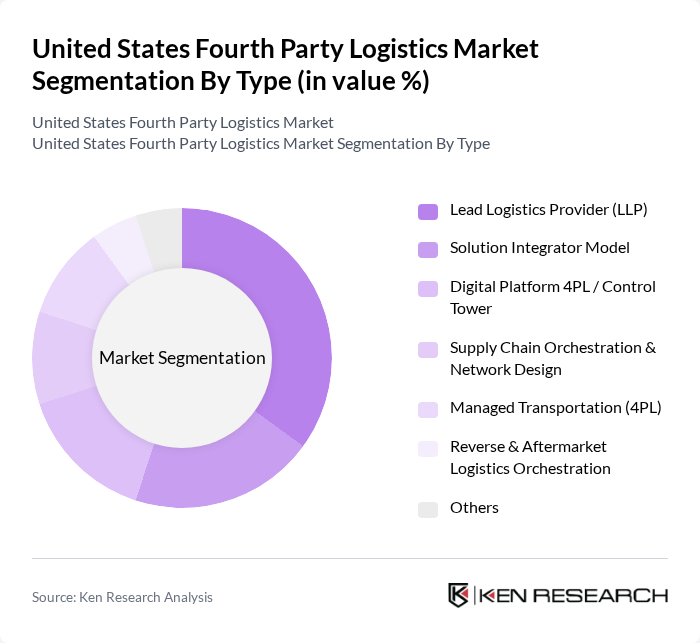

By Type:The market is segmented into various types, including Lead Logistics Provider (LLP), Solution Integrator Model, Digital Platform 4PL / Control Tower, Supply Chain Orchestration & Network Design, Managed Transportation (4PL), Reverse & Aftermarket Logistics Orchestration, and Others. Among these, the Lead Logistics Provider (LLP) segment is currently dominating the market due to its ability to offer comprehensive logistics solutions that integrate various supply chain functions, thereby enhancing operational efficiency and reducing costs for businesses.

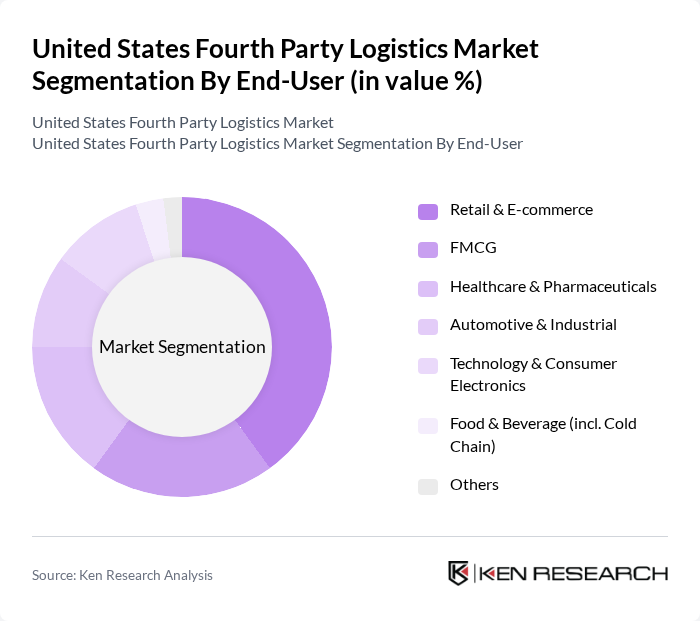

By End-User:The end-user segmentation includes Retail & E-commerce, FMCG, Healthcare & Pharmaceuticals, Automotive & Industrial, Technology & Consumer Electronics, Food & Beverage (incl. Cold Chain), and Others. The Retail & E-commerce segment is leading the market, driven by the rapid growth of online shopping and the need for efficient logistics solutions to meet consumer demand for fast delivery and order fulfillment.

The United States Fourth Party Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain & Global Forwarding, XPO, Inc., C.H. Robinson Worldwide, Inc., J.B. Hunt Transport Services, Inc. (J.B. Hunt 360/ICS), UPS Supply Chain Solutions, Ryder System, Inc., Penske Logistics, Expeditors International of Washington, Inc., DB Schenker, Kuehne+Nagel International AG, DSV A/S, GEODIS, NFI Industries, Schneider National, Inc., Hub Group, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States fourth-party logistics market appears promising, driven by ongoing technological advancements and the increasing complexity of supply chains. As businesses continue to prioritize efficiency and customer satisfaction, the demand for integrated logistics solutions is expected to rise. Additionally, the focus on sustainability and environmental responsibility will likely shape logistics strategies, pushing providers to innovate and adapt to new market realities while enhancing their service offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Lead Logistics Provider (LLP) Solution Integrator Model Digital Platform 4PL / Control Tower Supply Chain Orchestration & Network Design Managed Transportation (4PL) Reverse & Aftermarket Logistics Orchestration Others |

| By End-User | Retail & E-commerce FMCG Healthcare & Pharmaceuticals Automotive & Industrial Technology & Consumer Electronics Food & Beverage (incl. Cold Chain) Others |

| By Service Type | Integrated 4PL (End-to-End) Supply Chain Consulting & Optimization Control Tower & Visibility Platforms Managed Transportation Services Others |

| By Industry Vertical | Fashion & Lifestyle Pharmaceuticals & Life Sciences Aerospace & Defense Chemicals Others |

| By Delivery Mode | Road Rail Air Ocean Multimodal |

| By Customer Type | Large Enterprises Mid-Market SMEs Others |

| By Pricing Model | Management Fee / Retainer Gainshare / Outcome-Based Subscription (Platform + Services) Hybrid & Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Management | 120 | Logistics Directors, Supply Chain Managers |

| Healthcare Supply Chain Solutions | 90 | Operations Executives, Procurement Managers |

| Manufacturing Logistics Optimization | 70 | Production Managers, Logistics Coordinators |

| E-commerce Fulfillment Strategies | 110 | eCommerce Operations Managers, Warehouse Supervisors |

| Technology Integration in Logistics | 60 | IT Managers, Supply Chain Analysts |

The United States Fourth Party Logistics Market is valued at approximately USD 15 billion, reflecting a significant growth driven by the increasing complexity of supply chains, the rise of e-commerce, and the demand for integrated logistics solutions.