Region:North America

Author(s):Shubham

Product Code:KRAC0672

Pages:87

Published On:August 2025

By Shipment Type:The shipment type segmentation includes various methods of transporting goods, each catering to specific needs and industries. The subsegments are Dry Van FTL, Refrigerated/Temp-Controlled FTL, Flatbed/Step-Deck FTL, Heavy Haul/Oversize FTL, Dedicated/Contracted FTL, and Cross-Border FTL (USMCA). Among these,Dry Van FTLis the most dominant given its versatility for consumer goods, retail replenishment, and general merchandise and its broad trailer availability across carrier networks. Rising food, pharma, and healthcare demand continues to supportRefrigerated FTL, while construction and industrial activity underpinFlatbed/Step-Deckneeds.

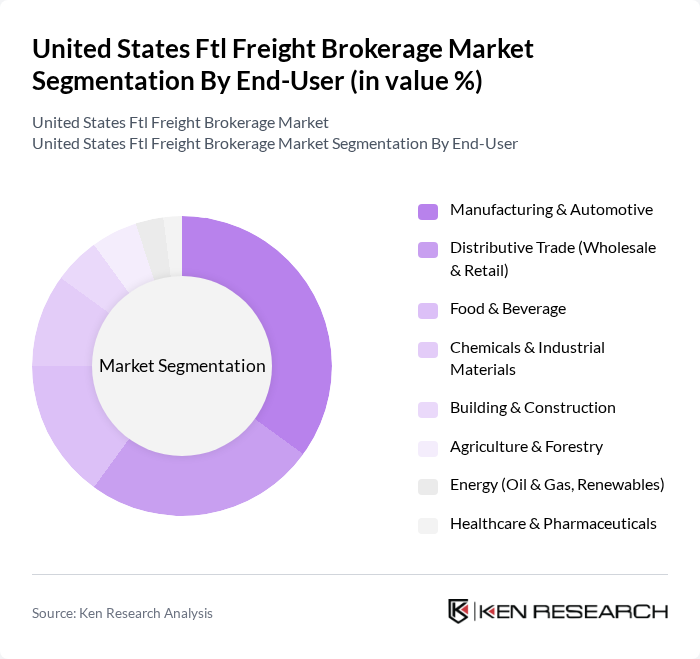

By End-User:The end-user segmentation encompasses various industries that utilize freight brokerage services, including Manufacturing & Automotive, Distributive Trade (Wholesale & Retail), Food & Beverage, Chemicals & Industrial Materials, Building & Construction, Agriculture & Forestry, Energy (Oil & Gas, Renewables), and Healthcare & Pharmaceuticals.Manufacturing & Automotiveremains a leading user due to just-in-time practices and steady parts and finished-goods flows, whileDistributive Trade(retail and wholesale) is a major brokerage user aligned with e-commerce and omnichannel distribution. Refrigerated demand inFood & Beverageand time- and condition-sensitive moves inHealthcare & Pharmaceuticalssustain brokerage reliance for service assurance and coverage.

The United States Ftl Freight Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as C.H. Robinson Worldwide, Inc., XPO, Inc. (formerly XPO Logistics), Echo Global Logistics, LLC, Schneider National, Inc. (Schneider Logistics), J.B. Hunt Transport Services, Inc. (J.B. Hunt 360), Landstar System, Inc., Total Quality Logistics (TQL), Coyote Logistics, LLC (a UPS company), Hub Group, Inc., RXO, Inc., Transplace (now Uber Freight), Uber Freight LLC, Freightquote by C.H. Robinson, Nolan Transportation Group (NTG), Arrive Logistics, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. freight brokerage market appears promising, driven by ongoing technological advancements and the increasing demand for efficient logistics solutions. As e-commerce continues to grow, brokers will need to adapt to changing consumer expectations, focusing on real-time tracking and enhanced service offerings. Additionally, the integration of AI and automation will streamline operations, allowing brokers to optimize their services and improve customer satisfaction, positioning them favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Shipment Type (FTL focus) | Dry Van FTL Refrigerated/Temp-Controlled FTL Flatbed/Step-Deck FTL Heavy Haul/Oversize FTL Dedicated/Contracted FTL Cross-Border FTL (USMCA) |

| By End-User | Manufacturing & Automotive Distributive Trade (Wholesale & Retail) Food & Beverage Chemicals & Industrial Materials Building & Construction Agriculture & Forestry Energy (Oil & Gas, Renewables) Healthcare & Pharmaceuticals |

| By Service Scope (Brokerage Offering) | Spot Brokerage Contract Brokerage Managed Transportation (3PL) Digital Freight Matching Value-Added Services (Tracking, Claims, Insurance) |

| By Pricing Model | Commission/Markup Cost-Plus Contracted Rate Indexation Dynamic/Algorithmic Pricing |

| By Geographic Coverage | National Regional/Multi-State Intra-State/Local Cross-Border (US–Canada/Mexico) |

| By Service Level | Standard FTL Expedited/Time-Definite FTL Drop Trailer/Power-Only High-Value/Secured FTL |

| By Customer Type | Enterprise (Large Shippers) Mid-Market SMB Government & Public Sector |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Full Truckload Freight Brokerage | 120 | Freight Brokers, Operations Managers |

| Logistics Technology Adoption | 100 | IT Managers, Technology Officers |

| Regulatory Compliance in Freight | 80 | Compliance Officers, Legal Advisors |

| Market Trends in Freight Brokerage | 110 | Market Analysts, Business Development Managers |

| Customer Satisfaction in Freight Services | 90 | Customer Service Managers, Account Executives |

The United States FTL Freight Brokerage Market is valued at approximately USD 16.9 billion, reflecting a five-year historical analysis. This growth is primarily driven by increasing e-commerce shipping demands and the adoption of digital brokerage platforms.