Region:North America

Author(s):Dev

Product Code:KRAB0426

Pages:87

Published On:August 2025

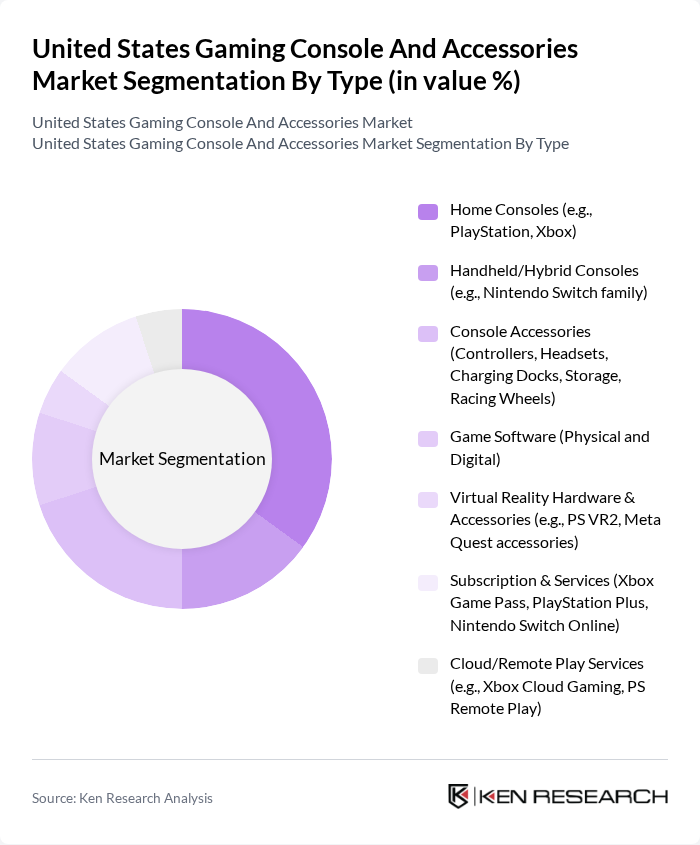

By Type:The market is segmented into various types, including home consoles, handheld/hybrid consoles, console accessories, game software, virtual reality hardware and accessories, subscription and services, and cloud/remote play services. Each sub-segment caters to different consumer preferences and technological advancements, contributing to the overall market growth.

By End-User:The end-user segmentation includes individual consumers, household/family gaming, eSports and competitive gamers, and educational/community programs and libraries. Each segment reflects different gaming habits and preferences, influencing the types of products and services offered in the market.

The United States Gaming Console And Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sony Interactive Entertainment LLC, Microsoft Corporation (Xbox), Nintendo of America Inc., Electronic Arts Inc., Activision Blizzard, Inc. (a Microsoft company), Take-Two Interactive Software, Inc., Ubisoft Entertainment S.A., Valve Corporation, Epic Games, Inc., Razer Inc., Logitech International S.A. (Logitech G), Corsair Gaming, Inc. (including Elgato), Turtle Beach Corporation, HyperX (HP Inc.), SteelSeries ApS (a GN Store Nord brand) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States gaming console and accessories market appears promising, driven by technological advancements and evolving consumer preferences. As the industry embraces cloud gaming and subscription models, companies are likely to adapt their strategies to meet changing demands. Additionally, the integration of virtual reality (VR) and augmented reality (AR) technologies is expected to enhance gaming experiences, attracting a broader audience and fostering innovation in product development.

| Segment | Sub-Segments |

|---|---|

| By Type | Home Consoles (e.g., PlayStation, Xbox) Handheld/Hybrid Consoles (e.g., Nintendo Switch family) Console Accessories (Controllers, Headsets, Charging Docks, Storage, Racing Wheels) Game Software (Physical and Digital) Virtual Reality Hardware & Accessories (e.g., PS VR2, Meta Quest accessories) Subscription & Services (Xbox Game Pass, PlayStation Plus, Nintendo Switch Online) Cloud/Remote Play Services (e.g., Xbox Cloud Gaming, PS Remote Play) |

| By End-User | Individual Consumers Household/Family Gaming eSports and Competitive Gamers Educational/Community Programs and Libraries |

| By Sales Channel | Online Retailers/Marketplaces (e.g., Amazon, Walmart.com, BestBuy.com) Specialty and Big-Box Retail (e.g., GameStop, Best Buy, Walmart, Target) First-Party Direct (PlayStation Direct, Microsoft Store, My Nintendo Store) Wholesale/Distributors |

| By Distribution Mode | Physical (In-store, packaged) Digital (Download codes, online storefronts) E-commerce Platforms/Marketplaces |

| By Price Range | Entry/Budget (e.g., Series S, Switch Lite, prior-gen models) Mid-Range Premium/Performance (e.g., PS5, Xbox Series X, OLED models) |

| By Brand Ecosystem | PlayStation Xbox Nintendo Multi-platform Accessories |

| By Game Genre | Action/Adventure Sports/Racing Role-Playing Games (RPG) Simulation/Strategy Family/Party and Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Console Gamers | 150 | Casual Gamers, Hardcore Gamers |

| Accessory Purchasers | 120 | Retail Buyers, Online Shoppers |

| Game Developers | 80 | Game Designers, Product Managers |

| Retail Store Managers | 70 | Store Managers, Sales Associates |

| Industry Analysts | 50 | Market Analysts, Research Directors |

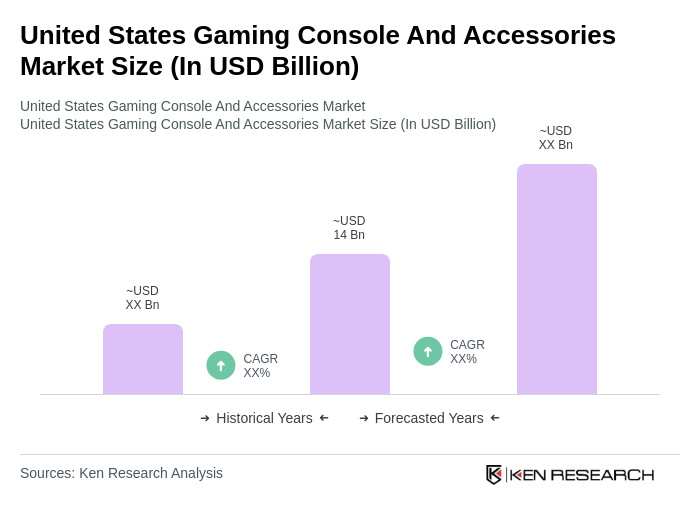

The United States Gaming Console and Accessories Market is valued at approximately USD 14 billion, reflecting significant growth driven by the increasing popularity of gaming, technological advancements, and the rise of online gaming services.