Region:North America

Author(s):Rebecca

Product Code:KRAD0225

Pages:90

Published On:August 2025

By Type:The market is segmented by capacity into Under 15 cu. ft., 15-20 cu. ft., 20-25 cu. ft., and Above 25 cu. ft. The 20-25 cu. ft. segment leads the market, offering an optimal balance of storage capacity and energy efficiency, which appeals to a broad consumer base including families and urban dwellers. The Under 15 cu. ft. segment, while smaller, is favored in compact urban apartments and secondary household spaces .

By Application:The market is segmented into Home and Commercial applications. The Home segment dominates, driven by the increasing number of households, the popularity of open-plan and modern kitchen designs, and the growing preference for appliances that combine convenience with advanced features. Side-by-side refrigerators are increasingly chosen for their accessibility, organization, and integration with smart home systems, making this segment the primary driver of market growth .

The United States Household Side By Side Refrigerator Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, Samsung Electronics America, Inc., LG Electronics USA, Inc., Frigidaire (Electrolux North America, Inc.), GE Appliances (a Haier company), Bosch Home Appliances (BSH Home Appliances Corporation), Maytag (Whirlpool Corporation), KitchenAid (Whirlpool Corporation), Amana (Whirlpool Corporation), Hisense USA Corporation, Miele, Inc., Sub-Zero Group, Inc., Viking Range, LLC, Danby Products Ltd., Smeg USA, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. household side-by-side refrigerator market appears promising, driven by a growing emphasis on energy efficiency and smart technology integration. As consumers increasingly prioritize sustainability, manufacturers are likely to focus on developing eco-friendly models that meet stringent energy standards. Additionally, the rise of e-commerce is expected to reshape distribution channels, making it easier for consumers to access a wider range of products and enhancing overall market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Under 15 cu. ft. 20 cu. ft. 25 cu. ft. Above 25 cu. ft. |

| By Application | Home Commercial |

| By Price Range | Budget Side By Side Refrigerators Mid-Range Side By Side Refrigerators Premium Side By Side Refrigerators |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores Online Stores Other Distribution Channels |

| By Brand | Major National Brands Regional Brands Private Label Brands |

| By Feature | Ice and Water Dispenser Adjustable Shelves Smart Technology Features |

| By Energy Efficiency Rating | Energy Star Certified Non-Energy Star Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales Insights | 100 | Store Managers, Sales Associates |

| Consumer Purchase Behavior | 120 | Homeowners, Apartment Dwellers |

| Market Trends Analysis | 80 | Industry Analysts, Market Researchers |

| Product Feature Preferences | 60 | Product Designers, Consumer Advocates |

| Post-Purchase Satisfaction | 40 | Recent Refrigerator Buyers |

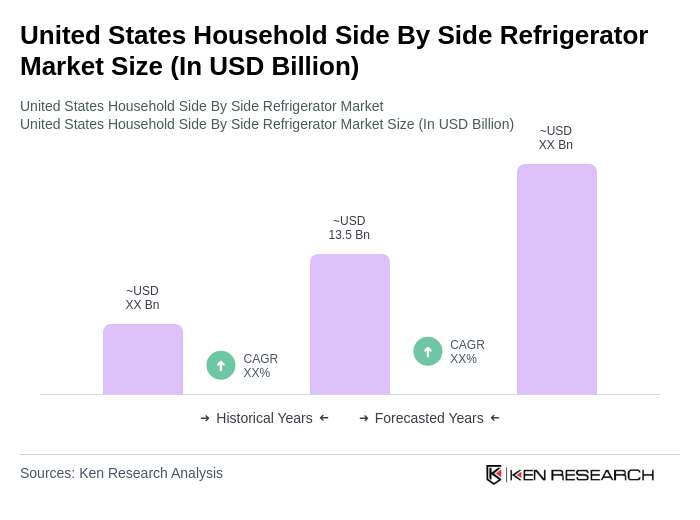

The United States Household Side By Side Refrigerator Market is valued at approximately USD 13.5 billion, reflecting a significant growth trend driven by consumer demand for energy-efficient and technologically advanced appliances.