Region:North America

Author(s):Dev

Product Code:KRAB0473

Pages:84

Published On:August 2025

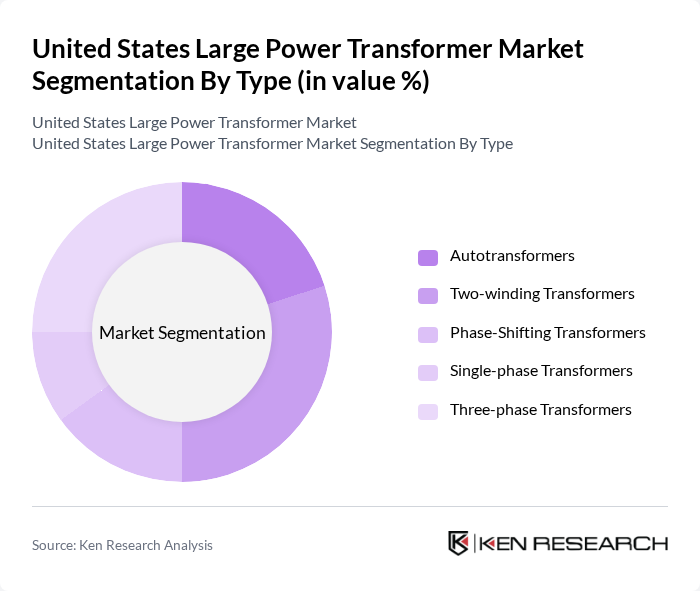

By Type:The market is segmented into various types of transformers, including autotransformers, two-winding transformers, phase-shifting transformers, single-phase transformers, and three-phase transformers. Each type serves specific applications and industries, with varying demand based on efficiency, cost, and operational requirements .

The two-winding transformers segment dominates the market due to their versatility and efficiency in power transmission, and they are widely used across utility, industrial, and commercial applications requiring high-voltage transformation . The increasing focus on renewable integration and grid modernization, including transmission expansion to accommodate wind and solar, has further supported demand for high-capacity two-winding units .

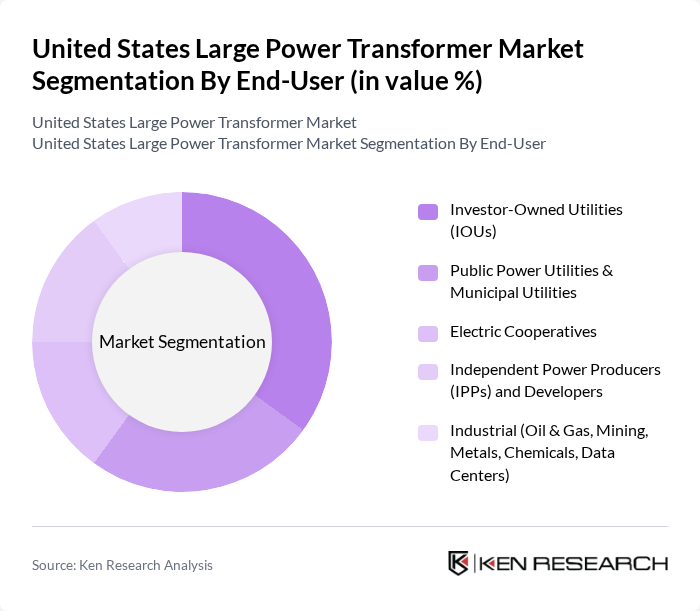

By End-User:The market is segmented based on end-users, including investor-owned utilities (IOUs), public power utilities & municipal utilities, electric cooperatives, independent power producers (IPPs) and developers, and industrial sectors such as oil & gas, mining, metals, chemicals, and data centers .

Investor-Owned Utilities (IOUs) are the leading end-users due to their extensive transmission and substation footprints and large-scale grid modernization programs, which drive sustained procurement of large power transformers to enhance reliability and integrate variable renewables . The combination of aging fleet replacement and the need to connect utility-scale wind, solar, and data center loads reinforces the IOU share .

The United States Large Power Transformer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Energy, Inc. (U.S.), GE Vernova (General Electric) – Grid Solutions, Hitachi Energy USA Inc., Mitsubishi Electric Power Products, Inc. (MEPPI), ABB Ltd. (ABB Power Grids legacy; U.S. operations via Hitachi Energy), SPX Transformer Solutions, Inc. (Waukesha), Hyundai Electric & Energy Systems Co., Ltd. (including Hyundai Power Transformers USA), Toshiba International Corporation, SGB-SMIT Group (including SGB-SMIT Transformer Solutions US), Pennsylvania Transformer Technology, Inc. (PTTI), Prolec GE Waukesha, Inc. (Prolec GE), Virginia Transformer Corp. (including Georgia Transformer), Howard Industries, Inc. – Power Transformer Division, Niagara Transformer Corp., Eaton (Cooper Power Systems – Power/Auto/HV substation transformers) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. large power transformer market appears promising, driven by technological advancements and increasing investments in renewable energy. As utilities prioritize grid modernization, the adoption of smart grid technologies and energy storage solutions will become more prevalent. Additionally, the integration of digital twin technology will enhance operational efficiency and predictive maintenance, allowing for better management of transformer assets. These trends indicate a robust market evolution, aligning with national energy goals and sustainability initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Autotransformers Two-winding Transformers Phase-Shifting Transformers Single-phase Transformers Three-phase Transformers |

| By End-User | Investor-Owned Utilities (IOUs) Public Power Utilities & Municipal Utilities Electric Cooperatives Independent Power Producers (IPPs) and Developers Industrial (Oil & Gas, Mining, Metals, Chemicals, Data Centers) |

| By Application | Power Generation Interconnection (Thermal, Nuclear, Hydro) Transmission Distribution Substations Renewable Integration (Wind, Solar, Storage) |

| By Component | Core Windings Tap Changers (On-load/Off-load) Insulation & Bushings Cooling System (Radiators, Pumps, Fans) |

| By Sales Channel | Direct to Utilities/Developers EPC Contractors/System Integrators Distributors |

| By Logistics Mode | Rail Transport Road Transport Sea Transport |

| By Power Rating (MVA) | –300 MVA –600 MVA Above 600 MVA |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies | 120 | Operations Managers, Grid Engineers |

| Transformer Manufacturers | 90 | Product Development Managers, Sales Directors |

| Renewable Energy Projects | 70 | Project Managers, Technical Leads |

| Government Regulatory Bodies | 50 | Policy Analysts, Energy Regulators |

| Consulting Firms in Energy Sector | 60 | Market Analysts, Energy Consultants |

The United States Large Power Transformer Market is valued at approximately USD 3.5 billion, driven by increasing electricity demand, renewable energy integration, and grid modernization initiatives, including substantial funding from the Infrastructure Investment and Jobs Act.