Region:North America

Author(s):Shubham

Product Code:KRAA1702

Pages:80

Published On:August 2025

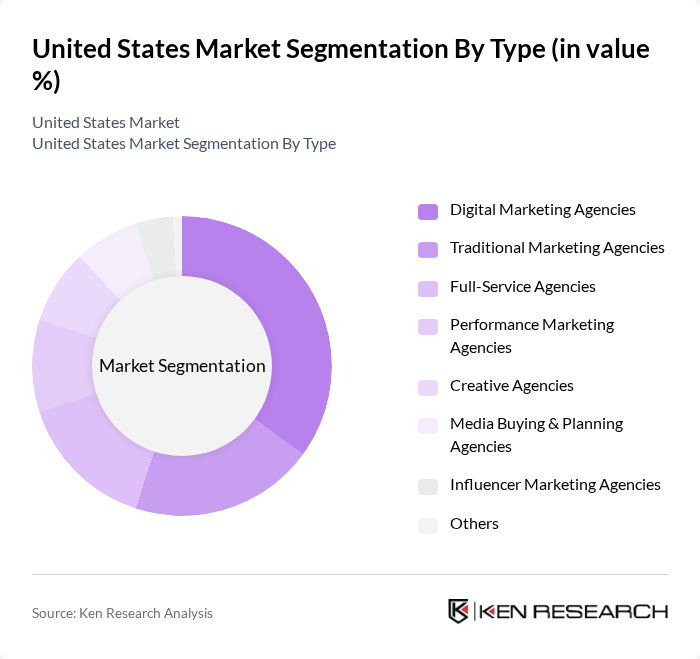

By Type:The marketing agencies industry can be segmented into various types, including Full-Service Integrated Agencies, Digital-Only Agencies, Creative & Branding Agencies, Media Buying & Planning Agencies, Performance Marketing & Paid Media, SEO/Content & Inbound Marketing, PR & Communications Agencies, Social & Influencer Marketing Agencies, Experiential & Event Marketing Agencies, and Marketing Technology & Consulting. Among these, Full-Service Integrated Agencies dominate the market due to their ability to offer comprehensive solutions that cater to diverse client needs, combining traditional and digital marketing strategies effectively.

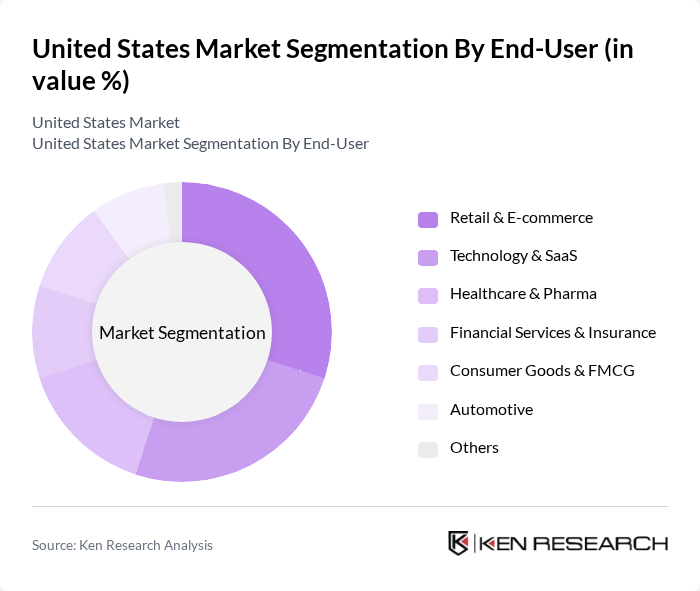

By End-User:The marketing agencies industry serves a diverse range of end-users, including Retail & E-commerce, Technology & SaaS, Healthcare & Pharma, Financial Services & Insurance, Education, Government & Public Sector, Industrial & Manufacturing, Media & Entertainment, and Others. The Retail & E-commerce segment is the largest end-user, supported by sustained digital ad spending growth and the increasing share of online retail that prioritizes performance-driven campaigns and digital channels .

The United States Marketing Agencies Industry is characterized by a dynamic mix of regional and international players. Leading participants such as WPP (Ogilvy, VML, Grey), Omnicom Group (BBDO, DDB Worldwide, TBWA\Worldwide), Interpublic Group (McCann Worldgroup, FCB, MullenLowe), Publicis Groupe (Leo Burnett, Saatchi & Saatchi, Publicis Sapient), Havas (Havas Creative, Arnold Worldwide), Accenture Song, Deloitte Digital, S4Capital (Media.Monks), Stagwell (360i, Anomaly, Assembly), IPG Mediabrands (Initiative, UM), Horizon Media, Merkle (Dentsu), Wieden+Kennedy, R/GA, BARKLEYOKRP, VaynerMedia, Weber Shandwick, Edelman, Deutsch LA, Droga5 (part of Accenture Song) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. marketing industry appears promising, driven by technological advancements and evolving consumer behaviors. Agencies are increasingly adopting artificial intelligence and automation tools to enhance efficiency and deliver personalized experiences. Additionally, the focus on sustainability in marketing practices is expected to grow, as consumers demand more ethical and environmentally friendly options. These trends will likely shape the strategies of marketing agencies, positioning them for success in a dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Integrated Agencies Digital-Only Agencies Creative & Branding Agencies Media Buying & Planning Agencies Performance Marketing & Paid Media SEO/Content & Inbound Marketing PR & Communications Agencies Social & Influencer Marketing Agencies Experiential & Event Marketing Agencies Marketing Technology & Consulting |

| By End-User | Retail & E-commerce Technology & SaaS Healthcare & Pharma Financial Services & Insurance Education Government & Public Sector Industrial & Manufacturing Media & Entertainment Others |

| By Sales Channel | Direct (In-house Sales) Online/Marketplace Platforms Agency Networks & Partnerships Referrals & Affiliate Partners Others |

| By Industry Vertical | Consumer Packaged Goods (CPG) Automotive Telecommunications Travel & Hospitality Real Estate Food & Beverage Nonprofit Others |

| By Geographic Region | Northeast Midwest South West Others |

| By Client Size | Small Enterprises Medium Enterprises Large Enterprises Startups & VC-backed Others |

| By Marketing Strategy | Inbound & Lifecycle Marketing Outbound & Demand Generation Account-Based Marketing (ABM) Influencer & Creator-Led Marketing Omnichannel & Retail Media Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Market | 140 | Product Managers, Retail Buyers |

| Health & Wellness Products | 100 | Health Product Developers, Marketing Executives |

| Food & Beverage Sector | 120 | Supply Chain Managers, Quality Assurance Officers |

| Fashion & Apparel Industry | 80 | Brand Managers, Merchandising Directors |

| Home Improvement Products | 90 | Retail Operations Managers, Category Managers |

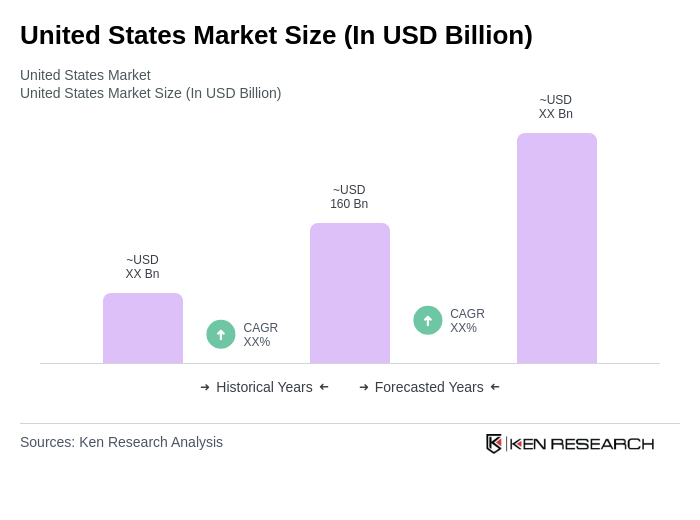

The United States marketing agencies industry is valued at approximately USD 160 billion, reflecting significant growth driven by the demand for digital marketing services, programmatic media, and data-driven marketing strategies.