Region:North America

Author(s):Rebecca

Product Code:KRAD0181

Pages:88

Published On:August 2025

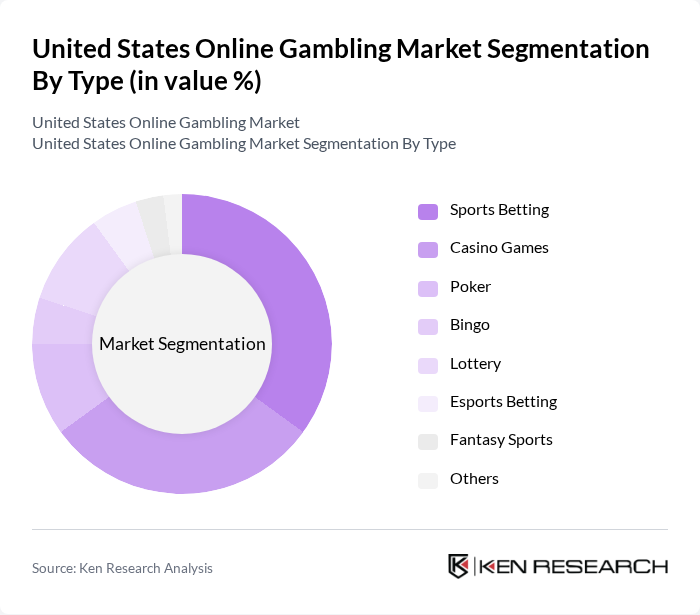

By Type:The online gambling market can be segmented into various types, including Sports Betting, Casino Games, Poker, Bingo, Lottery, Esports Betting, Fantasy Sports, and Others. Each of these segments caters to different consumer preferences and behaviors. Sports betting and casino games are the leading segments, driven by increased legalization and the popularity of mobile platforms. Esports betting and fantasy sports are experiencing rapid growth due to rising interest among younger demographics and the integration of innovative technologies .

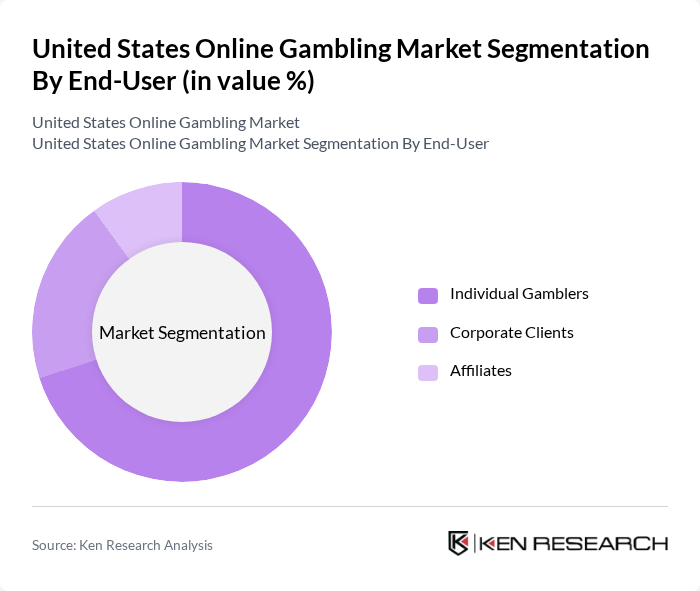

By End-User:The end-user segmentation includes Individual Gamblers, Corporate Clients, and Affiliates. Each of these user types has distinct motivations and engagement levels within the online gambling ecosystem. Individual gamblers form the largest segment, driven by accessibility and the proliferation of mobile devices. Corporate clients and affiliates play a crucial role in market expansion through partnerships, marketing, and technology integration .

The United States Online Gambling Market is characterized by a dynamic mix of regional and international players. Leading participants such as DraftKings Inc., FanDuel Group, BetMGM (MGM Resorts International), Caesars Entertainment, Inc., William Hill US (now part of Caesars Entertainment), PointsBet Holdings Limited, BetRivers (Rush Street Interactive), 888 Holdings plc, Golden Nugget Online Gaming, Inc. (now part of DraftKings), Rush Street Interactive, Barstool Sportsbook (PENN Entertainment), Unibet (Kindred Group), Betfair US (Flutter Entertainment), Pala Interactive (now part of Boyd Gaming), Scientific Games Corporation (Light & Wonder, Inc.), Fanatics Betting & Gaming, bet365, Bally Interactive contribute to innovation, geographic expansion, and service delivery in this space .

The future of the online gambling market in the United States appears promising, driven by ongoing technological innovations and expanding legalization efforts. As more states consider legalizing online gambling, the market is expected to attract new players and increase overall participation. Additionally, advancements in mobile technology and user experience will likely enhance engagement, while responsible gambling initiatives will foster a safer environment. The integration of emerging technologies will further shape the landscape, creating new opportunities for growth and development.

| Segment | Sub-Segments |

|---|---|

| By Type | Sports Betting Casino Games Poker Bingo Lottery Esports Betting Fantasy Sports Others |

| By End-User | Individual Gamblers Corporate Clients Affiliates |

| By Payment Method | Credit/Debit Cards E-Wallets (PayPal, Skrill, Neteller) Bank Transfers Prepaid Cards Cryptocurrency |

| By Device Type | Desktop Mobile Tablet |

| By Game Format | Instant Play Downloadable Games |

| By User Demographics | Age Group Gender Income Level |

| By Marketing Channel | Online Advertising Affiliate Marketing Social Media Sponsorships & Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Sports Betting Users | 150 | Active Bettors, Sports Enthusiasts |

| Online Casino Game Players | 100 | Casino Game Players, High Rollers |

| Regulatory Stakeholders | 50 | State Regulators, Compliance Officers |

| Industry Experts and Analysts | 40 | Market Analysts, Gambling Consultants |

| Technology Providers in Online Gambling | 40 | Software Developers, IT Managers |

The United States Online Gambling Market is valued at approximately USD 13 billion, driven by increasing legalization, mobile gaming adoption, and heightened consumer interest in digital entertainment options, particularly following the COVID-19 pandemic.