Region:North America

Author(s):Dev

Product Code:KRAD0399

Pages:92

Published On:August 2025

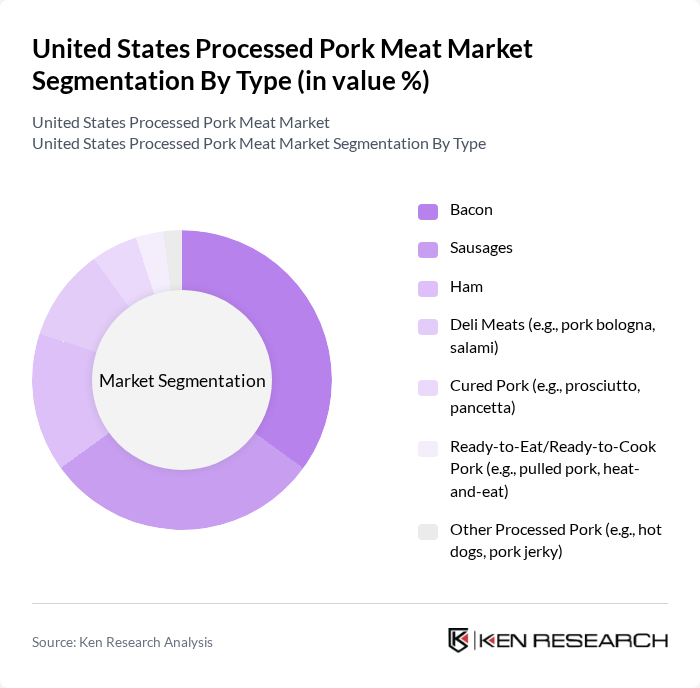

By Type:The processed pork meat market includes bacon, sausages, ham, deli meats, cured pork, ready-to-eat/ready-to-cook pork, and other processed pork products. Bacon and sausages remain the most popular due to strong consumer preferences for flavorful, convenient breakfast and snacking formats, supported by broad retail distribution and ongoing product innovation.

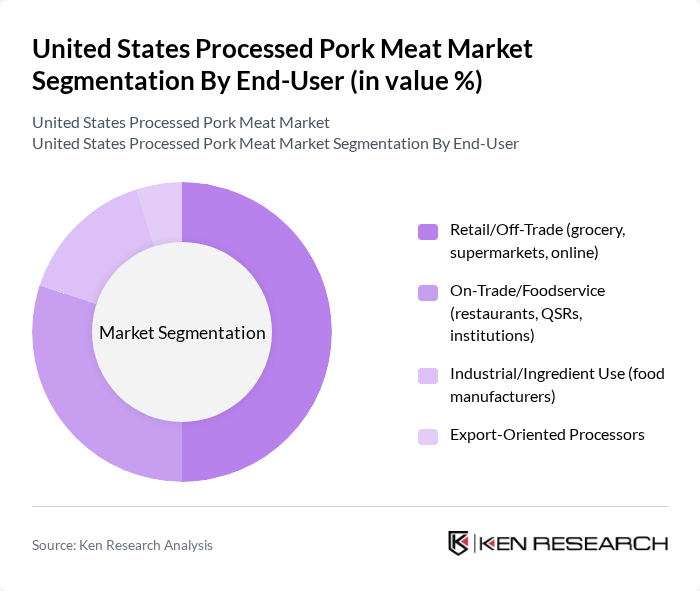

By End-User:The end-user segmentation includes retail/off-trade, on-trade/foodservice, industrial/ingredient use, and export-oriented processors. Retail/off-trade is the largest, supported by supermarket and e-commerce availability, private-label expansion, and convenience-led purchasing among busy households, while foodservice remains a significant channel for bacon and sausage formats.

The United States Processed Pork Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Smithfield Foods, Inc., Tyson Foods, Inc., Hormel Foods Corporation, JBS USA Holdings, Inc. (Swift Prepared Foods), Seaboard Foods LLC, Clemens Food Group (Hatfield), Johnsonville, LLC, OSI Group, LLC (OSI Select Ready-to-Eat), Wholestone Farms, LLC, The Kraft Heinz Company (Oscar Mayer), Conagra Brands, Inc. (Hebrew National, Armour), Maple Leaf Foods Inc. (USA operations), Danish Crown A/S (US import/distribution), American Foods Group, LLC, Cargill, Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The future of the processed pork meat market in the United States appears promising, driven by evolving consumer preferences and technological advancements. As the demand for convenience and health-oriented products continues to rise, manufacturers are likely to invest in innovative processing techniques and product development. Additionally, the expansion of e-commerce platforms will facilitate greater access to processed pork products, enhancing market reach. Overall, the industry is poised for growth, adapting to changing consumer dynamics and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Bacon Sausages Ham Deli Meats (e.g., pork bologna, salami) Cured Pork (e.g., prosciutto, pancetta) Ready-to-Eat/Ready-to-Cook Pork (e.g., pulled pork, heat-and-eat) Other Processed Pork (e.g., hot dogs, pork jerky) |

| By End-User | Retail/Off-Trade (grocery, supermarkets, online) On-Trade/Foodservice (restaurants, QSRs, institutions) Industrial/Ingredient Use (food manufacturers) Export-Oriented Processors |

| By Distribution Channel | On-Trade (HoReCa) Off-Trade: Supermarkets/Hypermarkets Off-Trade: Convenience Stores Off-Trade: Online Retail Off-Trade: Others (club stores, butchers) |

| By Packaging Type | Vacuum-Sealed/Modified Atmosphere (MAP) Canned/Shelf-Stable Tray Packs/Overwrap Bulk/Institutional Packs |

| By Price Range | Economy Mid-Range Premium/Artisanal |

| By Product Form | Chilled Frozen Shelf-Stable |

| By Quality | Conventional Organic/Natural (no antibiotics added) Premium (heritage breeds, nitrite-free) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Grocery Chains | 120 | Meat Department Managers, Category Buyers |

| Specialty Meat Shops | 90 | Owners, Head Butchers |

| Food Service Providers | 80 | Executive Chefs, Purchasing Managers |

| Consumer Households | 150 | Health-Conscious Consumers, Families |

| Processed Pork Manufacturers | 70 | Production Managers, Sales Directors |

The United States processed pork meat market is valued at approximately USD 5 billion, based on a five-year historical analysis. This valuation reflects strong consumer demand for convenient, ready-to-eat, and ready-to-cook pork products.