Region:North America

Author(s):Rebecca

Product Code:KRAA2151

Pages:100

Published On:August 2025

By Type:The rail freight transport market is segmented into Bulk Freight, Intermodal Freight, Containerized Freight, Automotive Freight, Agricultural Products, Chemicals, Energy Commodities, Forest Products, and Others.Intermodal Freighthas emerged as the leading segment, reflecting the growing integration of rail with ports and trucking for containerized cargo. Bulk freight, including grain, coal, and chemicals, continues to represent a significant portion of rail volumes, while automotive and energy commodities remain important contributors to overall demand .

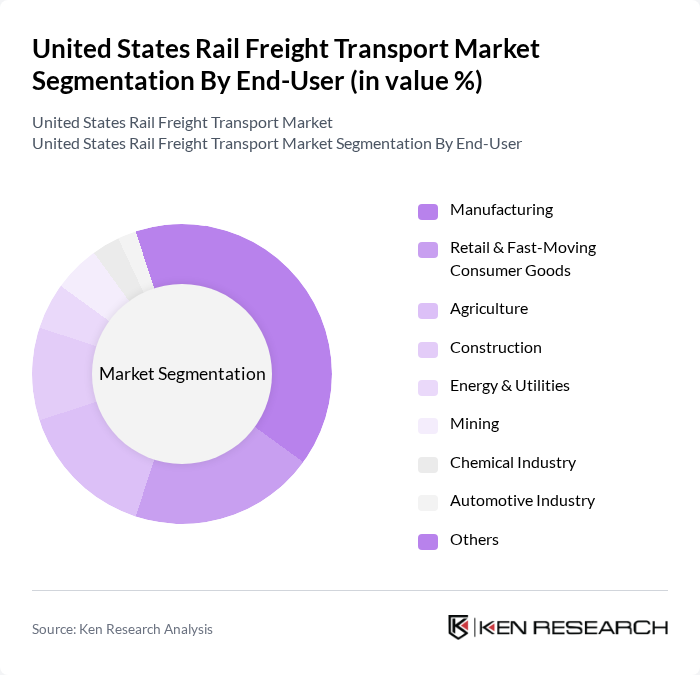

By End-User:The end-user segmentation includes Manufacturing, Retail & Fast-Moving Consumer Goods, Agriculture, Construction, Energy & Utilities, Mining, Chemical Industry, Automotive Industry, and Others.Retail & Fast-Moving Consumer Goodsis experiencing the fastest growth, driven by the expansion of e-commerce and consumer demand for rapid delivery. Manufacturing and agriculture remain core sectors, leveraging rail for cost-effective bulk and containerized shipments .

The United States Rail Freight Transport Market is characterized by a dynamic mix of regional and international players. Leading participants such as Union Pacific Railroad, BNSF Railway, CSX Transportation, Norfolk Southern Railway, Canadian Pacific Kansas City, Canadian National Railway, Genesee & Wyoming Inc., Watco Companies, LLC, Florida East Coast Railway, Patriot Rail Company, Regional Rail, LLC, TTX Company, Trinity Industries, Inc., OmniTRAX, Inc., and RailUSA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. rail freight transport market appears promising, driven by ongoing investments in infrastructure and technology. As e-commerce continues to expand, rail operators are likely to enhance intermodal services, integrating rail with trucking for seamless logistics solutions. Additionally, the focus on sustainability will push rail companies to adopt greener practices, aligning with environmental regulations and consumer preferences for eco-friendly transport options, ultimately fostering growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Bulk Freight Intermodal Freight Containerized Freight Automotive Freight Agricultural Products Chemicals Energy Commodities (e.g., Coal, Petroleum, LNG) Forest Products (e.g., Lumber, Paper) Others |

| By End-User | Manufacturing Retail & Fast-Moving Consumer Goods Agriculture Construction Energy & Utilities Mining Chemical Industry Automotive Industry Others |

| By Service Type | Freight Transportation Intermodal Logistics Services Warehousing & Transloading Railcar Leasing & Maintenance Services Others |

| By Region | Northeast Midwest South West Others |

| By Cargo Type | Hazardous Materials Non-Hazardous Materials Perishable Goods Heavy Machinery & Equipment Consumer Goods Others |

| By Delivery Mode | Direct Delivery Scheduled Delivery On-Demand Delivery Others |

| By Pricing Model | Fixed Pricing Variable Pricing Contractual Pricing Spot Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Intermodal Freight Services | 100 | Logistics Coordinators, Operations Managers |

| Agricultural Products Transport | 60 | Supply Chain Directors, Agricultural Cooperative Managers |

| Automotive Freight Solutions | 50 | Procurement Managers, Distribution Center Supervisors |

| Coal and Energy Transport | 40 | Energy Sector Analysts, Rail Operations Managers |

| Consumer Goods Logistics | 70 | Retail Supply Chain Managers, Warehouse Operations Managers |

The United States Rail Freight Transport Market is valued at approximately USD 72 billion, reflecting a five-year historical analysis. This growth is driven by increased demand for efficient transportation solutions, e-commerce expansion, and advancements in rail technology.