Region:North America

Author(s):Shubham

Product Code:KRAA8879

Pages:81

Published On:November 2025

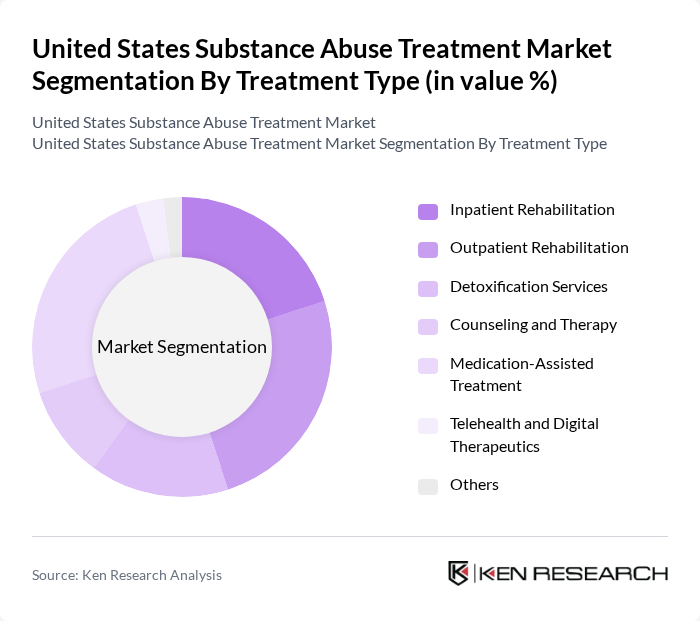

By Treatment Type:The treatment type segmentation includes various approaches to substance abuse treatment, each catering to different patient needs and preferences. The subsegments include Inpatient Rehabilitation, Outpatient Rehabilitation, Detoxification Services, Counseling and Therapy, Medication-Assisted Treatment, Telehealth and Digital Therapeutics, and Others. Among these, Medication-Assisted Treatment is currently dominating the market due to its effectiveness in treating opioid addiction, which has become a significant public health crisis. The increasing acceptance of this method by healthcare providers and patients alike is driving its growth. The adoption of telehealth and digital therapeutics is also accelerating, improving accessibility for underserved populations .

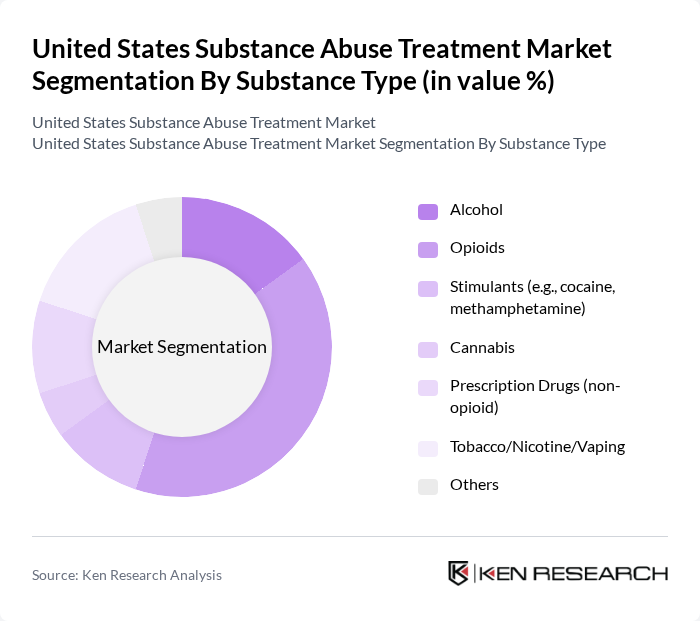

By Substance Type:The substance type segmentation encompasses various categories of substances that individuals may be addicted to, including Alcohol, Opioids, Stimulants (e.g., cocaine, methamphetamine), Cannabis, Prescription Drugs (non-opioid), Tobacco/Nicotine/Vaping, and Others. Opioids are the leading substance type in the market, largely due to the ongoing opioid epidemic in the United States. The high demand for effective treatment options for opioid addiction has led to increased investment in specialized programs and services. Alcohol and tobacco/nicotine also represent significant shares, reflecting broader substance use patterns in the country .

The United States Substance Abuse Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as American Addiction Centers, Hazelden Betty Ford Foundation, Caron Treatment Centers, Promises Behavioral Health, The Recovery Village (Advanced Recovery Systems), Serenity Lane, Phoenix House, Cumberland Heights, Gateway Foundation, The Meadows, Center for Discovery, Alta Mira Recovery Programs, The Ranch Tennessee, Clearview Treatment Programs, The Right Step (Promises Behavioral Health) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the United States substance abuse treatment market appears promising, driven by technological advancements and a growing emphasis on integrated care. As telehealth services continue to expand, more individuals will have access to treatment, particularly in underserved areas. Additionally, the integration of mental health services with substance abuse treatment is expected to enhance patient outcomes, fostering a more holistic approach to recovery. These trends indicate a shift towards more accessible and comprehensive care solutions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Treatment Type | Inpatient Rehabilitation Outpatient Rehabilitation Detoxification Services Counseling and Therapy Medication-Assisted Treatment Telehealth and Digital Therapeutics Others |

| By Substance Type | Alcohol Opioids Stimulants (e.g., cocaine, methamphetamine) Cannabis Prescription Drugs (non-opioid) Tobacco/Nicotine/Vaping Others |

| By Age Group | Adolescents (12-17) Young Adults (18-25) Adults (26-64) Seniors (65+) Others |

| By Gender | Male Female Non-binary/Other |

| By Treatment Setting | Residential Treatment Centers Outpatient Clinics Hospitals and Specialty Clinics Sober Living Homes Community Health Organizations Others |

| By Payment Source | Private Insurance Public Insurance (Medicaid, Medicare) Self-Pay Non-Profit/Grant Funding Others |

| By Geographic Distribution | Northeast Midwest South West Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Inpatient Treatment Facilities | 100 | Facility Directors, Clinical Managers |

| Outpatient Treatment Programs | 90 | Program Coordinators, Counselors |

| Medication-Assisted Treatment Providers | 60 | Pharmacists, Addiction Specialists |

| Support Groups and Community Resources | 50 | Group Leaders, Community Outreach Coordinators |

| Insurance Providers and Payers | 40 | Claims Analysts, Policy Underwriters |

The United States Substance Abuse Treatment Market is valued at approximately USD 31 billion, reflecting a significant increase driven by the rising prevalence of substance use disorders and the expansion of treatment facilities across the country.