Region:North America

Author(s):Geetanshi

Product Code:KRAA1321

Pages:83

Published On:August 2025

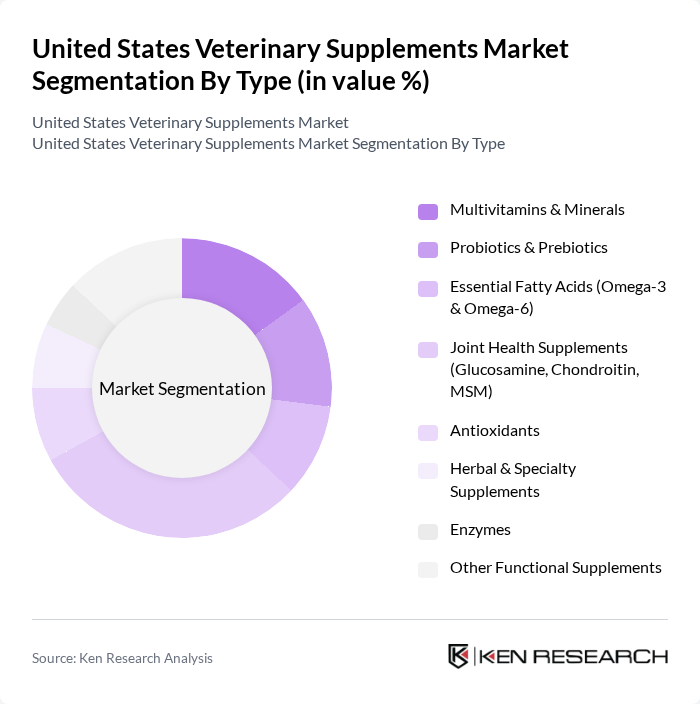

By Type:The market is segmented into various types of veterinary supplements, including Multivitamins & Minerals, Probiotics & Prebiotics, Essential Fatty Acids (Omega-3 & Omega-6), Joint Health Supplements (Glucosamine, Chondroitin, MSM), Antioxidants, Herbal & Specialty Supplements, Enzymes, and Other Functional Supplements. Among these, Joint Health Supplements and Multivitamins are leading the market, driven by the increasing prevalence of joint-related issues in aging pets and the growing focus on preventive pet health. Pet owners are seeking effective solutions to enhance their pets' mobility and overall quality of life, resulting in strong demand for these products .

By Animal Type:The market is segmented by animal type into Dogs, Cats, Horses, and Other Companion Animals. Dogs represent the largest segment due to their popularity as pets and the increasing focus on their health and wellness. Pet owners are more inclined to invest in supplements for dogs, particularly for joint health and overall vitality, which drives the demand in this segment .

The United States Veterinary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zoetis Inc., Elanco Animal Health Incorporated, Nutramax Laboratories, Inc., Bayer Animal Health (now part of Elanco), Merck Animal Health, Vetoquinol USA, Inc., PetIQ, Inc., VetriScience Laboratories (a division of FoodScience Corporation), Kemin Industries, Inc., PetHonesty, Zesty Paws, Animal Essentials, Inc., Ark Naturals, Purina Animal Nutrition (Nestlé Purina PetCare), and NaturVet contribute to innovation, geographic expansion, and service delivery in this space .

The future of the veterinary supplements market in the United States appears promising, driven by ongoing trends in pet health awareness and the increasing demand for natural products. As pet owners continue to prioritize preventive care, the market is likely to see innovations in supplement formulations. Additionally, the rise of e-commerce platforms will facilitate easier access to these products, enhancing consumer engagement and driving sales growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Multivitamins & Minerals Probiotics & Prebiotics Essential Fatty Acids (Omega-3 & Omega-6) Joint Health Supplements (Glucosamine, Chondroitin, MSM) Antioxidants Herbal & Specialty Supplements Enzymes Other Functional Supplements |

| By Animal Type | Dogs Cats Horses Other Companion Animals |

| By Distribution Channel | Veterinary Clinics Pet Specialty Stores E-commerce Mass Merchandisers |

| By Formulation | Chewables & Soft Chews Tablets & Capsules Powders Liquids & Gels Other Forms (Sprays, Pastes, etc.) |

| By Life Stage | Puppies/Kittens Adults Seniors |

| By Health Concern | Joint & Mobility Digestive Health Skin & Coat Health Immune Support Calming & Cognitive Health Renal & Urinary Health Other Specific Conditions |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Veterinary Clinics | 100 | Veterinarians, Clinic Managers |

| Pet Owners | 120 | Dog and Cat Owners, Pet Care Enthusiasts |

| Pet Supply Retailers | 80 | Store Managers, Product Buyers |

| Veterinary Supplement Manufacturers | 40 | Product Development Managers, Sales Directors |

| Industry Experts | 40 | Veterinary Researchers, Market Analysts |

The United States Veterinary Supplements Market is valued at approximately USD 2.2 billion, reflecting a significant growth trend driven by increasing pet ownership, heightened awareness of pet health, and the trend of pet humanization.