Region:North America

Author(s):Shubham

Product Code:KRAD0766

Pages:94

Published On:August 2025

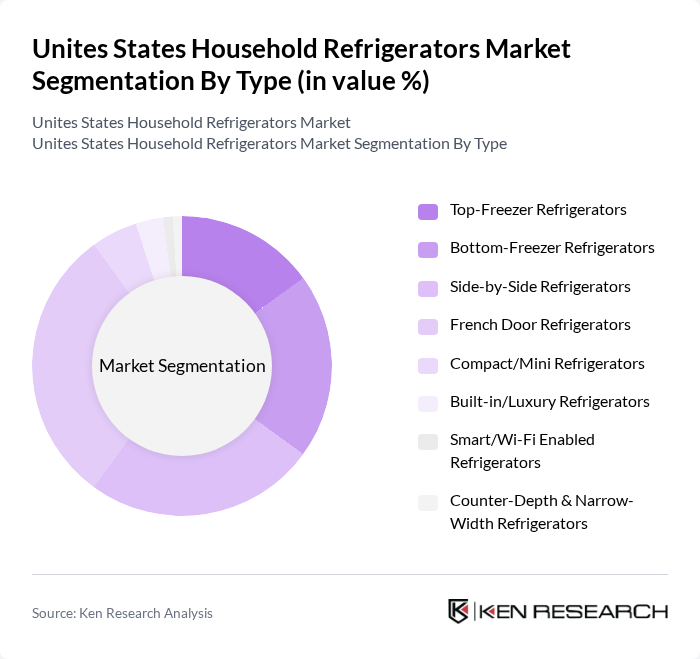

By Type:The market is segmented into various types of refrigerators, each catering to different consumer needs and preferences. The primary subsegments include Top-Freezer Refrigerators, Bottom-Freezer Refrigerators, Side-by-Side Refrigerators, French Door Refrigerators, Compact/Mini Refrigerators, Built-in/Luxury Refrigerators, Smart/Wi-Fi Enabled Refrigerators, and Counter-Depth & Narrow-Width Refrigerators. Among these, French Door and other double?door configurations have gained strong popularity due to spacious layouts and modern aesthetics, while top?freezer remains important for value?oriented buyers.

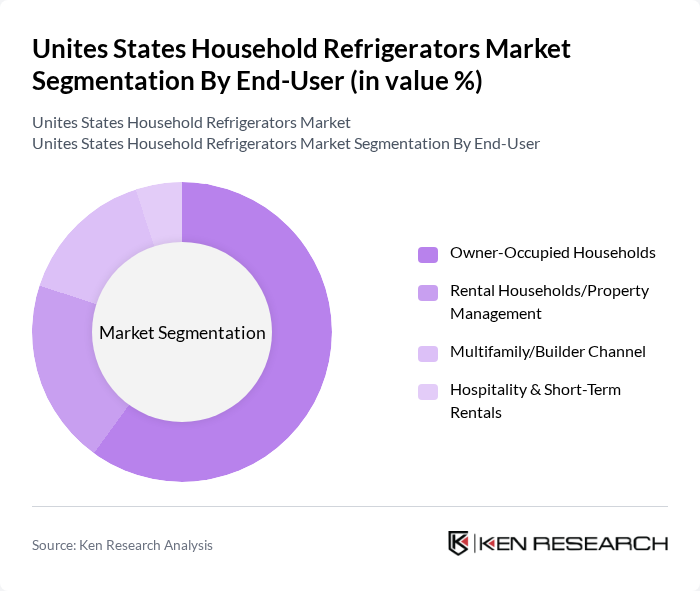

By End-User:The end-user segmentation includes Owner-Occupied Households, Rental Households/Property Management, Multifamily/Builder Channel, and Hospitality & Short-Term Rentals. Owner-Occupied Households represent the largest segment, supported by replacement cycles and kitchen upgrades, while builder/multifamily channels and rentals sustain steady unit demand.

The United States Household Refrigerators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Whirlpool Corporation, GE Appliances, a Haier company, Samsung Electronics America, LG Electronics USA, Electrolux North America (Frigidaire), BSH Home Appliances (Bosch, Thermador), Sub-Zero Group, Inc. (Sub-Zero, Wolf, Cove), Haier America, Miele, Inc. (USA), Hisense USA, Danby Products Inc. (USA), Viking Range, LLC (Middleby), Fisher & Paykel Appliances USA, KitchenAid (Whirlpool), and Amana (Whirlpool) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. household refrigerators market appears promising, driven by technological advancements and a growing emphasis on sustainability. As consumers increasingly prioritize energy efficiency and smart home integration, manufacturers are likely to innovate continuously. The market is expected to see a rise in demand for customizable and multifunctional refrigerators, catering to diverse consumer preferences. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products, enhancing consumer choice and convenience in purchasing decisions.

| Segment | Sub-Segments |

|---|---|

| By Type | Top-Freezer Refrigerators Bottom-Freezer Refrigerators Side-by-Side Refrigerators French Door Refrigerators Compact/Mini Refrigerators Built-in/Luxury Refrigerators Smart/Wi?Fi Enabled Refrigerators Counter-Depth & Narrow-Width Refrigerators |

| By End-User | Owner-Occupied Households Rental Households/Property Management Multifamily/Builder Channel Hospitality & Short?Term Rentals |

| By Price Range | Under $700 (Entry/Budget) $700–$1,299 (Lower Mid?Range) $1,300–$2,499 (Upper Mid?Range) $2,500–$4,999 (Premium) $5,000+ (Luxury/Professional) |

| By Distribution Channel | Online (Brand.com, Retailers’ E?commerce, Marketplaces) Big-Box & Home Improvement Retail (e.g., Home Depot, Lowe’s) National Appliance Chains (e.g., Best Buy) Independent Appliance Dealers Builder/Contractor & Wholesale Channels |

| By Brand Ownership | Global/National Brands Private Labels (Retail & OEM) European & Niche Luxury Brands |

| By Energy Efficiency | ENERGY STAR Certified Not ENERGY STAR Certified |

| By Features | Ice Makers & Craft Ice Water Dispensers & Filtration Smart Features (Voice, App Control, Cameras) Flexible Storage (Adjustable Shelves, Drawers, Door?in?Door) Convertible Compartments & Dual Evaporators Finish & Aesthetics (Stainless, Panel?Ready, Matte) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Refrigerator Purchases | 150 | Homeowners, Renters |

| Retail Sales Insights | 120 | Store Managers, Sales Associates |

| Energy Efficiency Preferences | 80 | Environmentally Conscious Consumers |

| Brand Loyalty and Awareness | 120 | Frequent Appliance Buyers, Brand Advocates |

| Market Trends and Innovations | 90 | Industry Analysts, Appliance Designers |

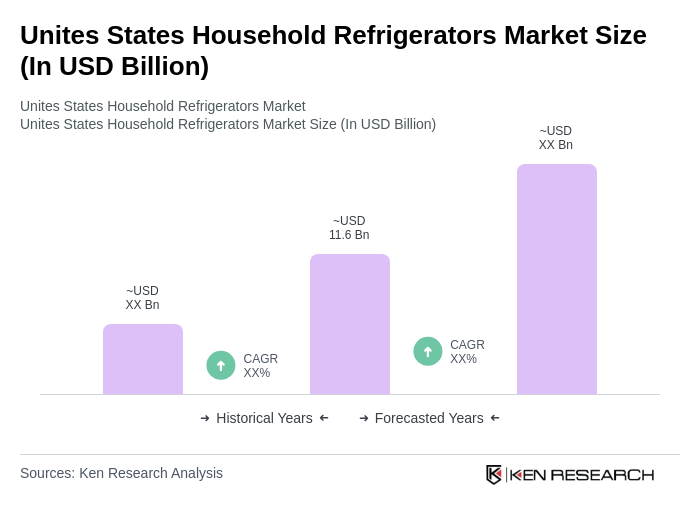

The United States Household Refrigerators Market is valued at approximately USD 11.6 billion, reflecting a five-year historical analysis. This valuation is influenced by factors such as rising demand for energy-efficient appliances and the adoption of smart features.