Region:North America

Author(s):Geetanshi

Product Code:KRAB0152

Pages:90

Published On:August 2025

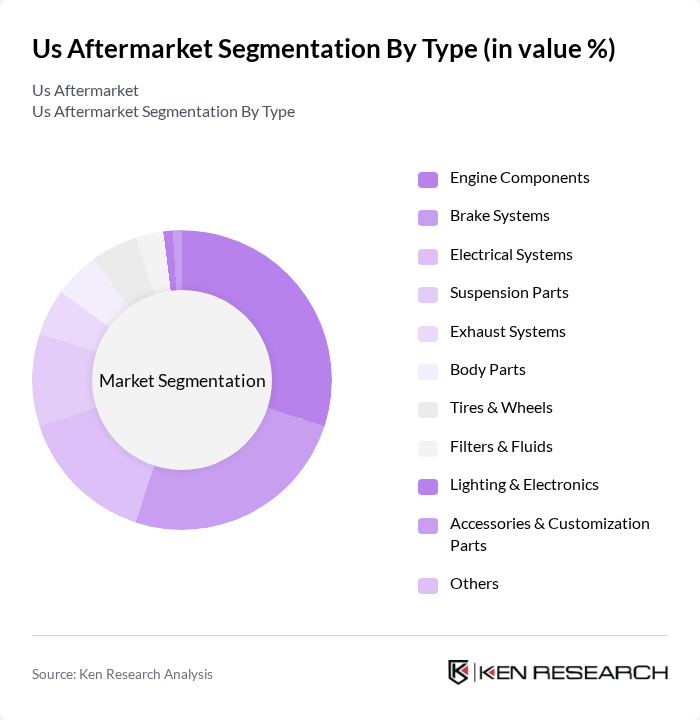

By Type:The aftermarket automotive parts and components market can be segmented into various types, including engine components, brake systems, electrical systems, suspension parts, exhaust systems, body parts, tires & wheels, filters & fluids, lighting & electronics, accessories & customization parts, and others. Among these, engine components and brake systems are particularly significant due to their critical role in vehicle safety and performance. The increasing focus on vehicle maintenance and repair, along with a growing preference for high-performance and replacement parts, has led to a surge in demand for these components, making them dominant segments in the market .

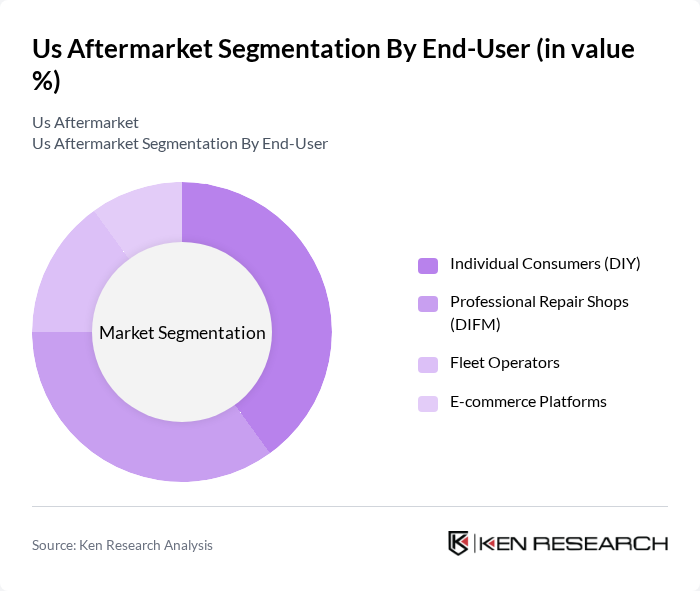

By End-User:The aftermarket automotive parts market is segmented by end-user into individual consumers (DIY), professional repair shops (DIFM), fleet operators, and e-commerce platforms. The DIY segment is particularly prominent as more consumers are opting to perform their own vehicle maintenance and repairs, driven by the availability of online resources and parts. Professional repair shops also play a crucial role, as they require a steady supply of high-quality parts to meet customer demands. E-commerce platforms are experiencing rapid growth, driven by the convenience of online ordering and direct-to-consumer delivery models .

The US aftermarket automotive parts and components market is characterized by a dynamic mix of regional and international players. Leading participants such as AutoZone, Inc., Advance Auto Parts, Inc., O'Reilly Automotive, Inc., NAPA Auto Parts (Genuine Parts Company), RockAuto LLC, Genuine Parts Company, Duralast (AutoZone Brand), CARQUEST Auto Parts (Advance Auto Parts Brand), Pep Boys, LKQ Corporation, Tenneco Inc., Federal-Mogul Motorparts (a Tenneco brand), Bosch Automotive Aftermarket, Continental AG, ACDelco (General Motors) contribute to innovation, geographic expansion, and service delivery in this space.

The U.S. aftermarket industry is expected to evolve significantly, driven by technological advancements and changing consumer preferences. The increasing integration of digital platforms for sales and customer engagement will enhance market accessibility. Additionally, the growing trend towards vehicle electrification will create new opportunities for specialized aftermarket services and parts. As consumers become more aware of the benefits of aftermarket services, the industry is likely to see sustained growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Engine Components Brake Systems Electrical Systems Suspension Parts Exhaust Systems Body Parts Tires & Wheels Filters & Fluids Lighting & Electronics Accessories & Customization Parts Others |

| By End-User | Individual Consumers (DIY) Professional Repair Shops (DIFM) Fleet Operators E-commerce Platforms |

| By Sales Channel | Online Retailers Brick-and-Mortar Stores Distributors/Wholesalers Direct-to-Consumer Sales |

| By Component | Mechanical Parts Electrical/Electronic Parts Accessories & Appearance Products Tools & Equipment |

| By Price Range | Budget Mid-Range Premium |

| By Distribution Mode | Direct Distribution Indirect Distribution Online Distribution |

| By Application | Passenger Vehicles Commercial Vehicles Heavy-Duty Vehicles Electric & Hybrid Vehicles Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Repair Shops | 100 | Shop Owners, Service Managers |

| Parts Distributors | 80 | Distribution Managers, Sales Representatives |

| Consumer Preferences | 120 | Vehicle Owners, Fleet Managers |

| Aftermarket Service Providers | 60 | Service Advisors, Technicians |

| Automotive Retailers | 90 | Store Managers, Product Buyers |

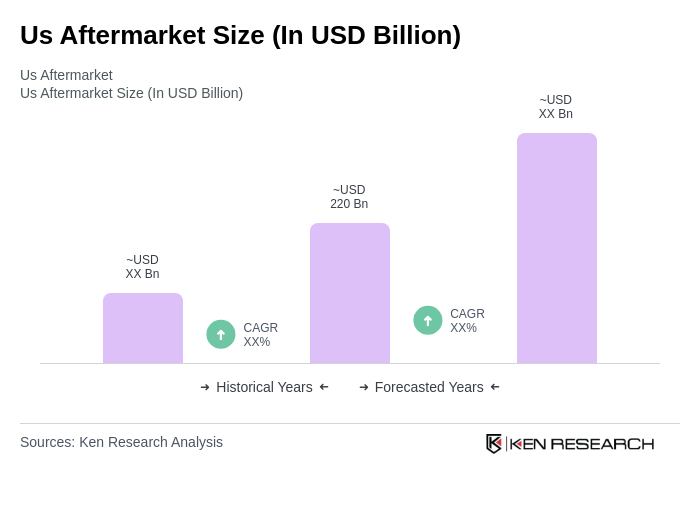

The US aftermarket automotive parts and components market is valued at approximately USD 220 billion, driven by factors such as the increasing age of vehicles, consumer preferences for customization, and the trend of DIY repairs among car owners.