Region:North America

Author(s):Geetanshi

Product Code:KRAD3800

Pages:93

Published On:November 2025

By Product Type:The product type segmentation includes various categories such as Shade Nets, Mulch Films/Mats, Crop Covers/Protection Covers, Geotextiles, Insect Nets, Windbreaks, and Others. Each of these subsegments plays a crucial role in addressing specific agricultural needs, from protecting crops from harsh weather to enhancing soil quality. Shade nets and insect nets are increasingly used in controlled environment agriculture, while mulch films/mats and geotextiles are critical for soil management and erosion control .

The Mulch Films/Mats subsegment is currently dominating the market due to their widespread application in soil moisture retention, weed control, and temperature regulation. Farmers increasingly prefer these products as they enhance crop growth and reduce the need for chemical herbicides. The growing trend towards organic farming and sustainable practices further boosts the demand for mulch films, making them a key player in the agro textiles market. Biodegradable mulch films are gaining traction as farmers seek environmentally friendly alternatives .

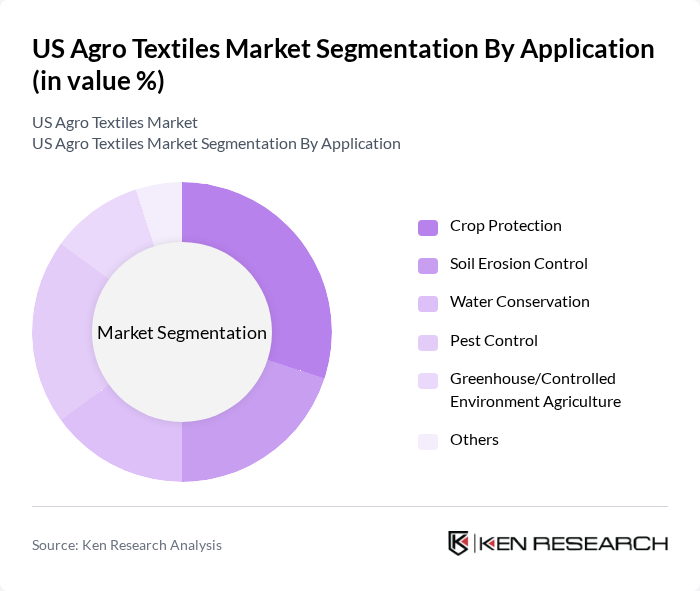

By Application:The application segmentation encompasses Crop Protection, Soil Erosion Control, Water Conservation, Pest Control, Greenhouse/Controlled Environment Agriculture, and Others. Each application serves distinct agricultural needs, contributing to the overall effectiveness and efficiency of farming practices. The use of agro textiles in greenhouse and vertical farming is expanding, supporting year-round cultivation and resource optimization .

Crop Protection is the leading application segment, driven by the increasing need to safeguard crops from adverse weather conditions and pests. The rising awareness of food security and the importance of maintaining crop health have led to a surge in the adoption of agro textiles for protective measures. This trend is further supported by advancements in material technology, enhancing the effectiveness of crop protection solutions. The integration of smart textiles and sensor-enabled fabrics is also emerging, offering real-time monitoring and adaptive protection .

The US Agro Textiles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Berry Global, Inc., DuPont de Nemours, Inc., BASF SE, TenCate Geosynthetics Americas, Lumite Inc., Ahlstrom-Munksjö, Freudenberg Performance Materials, RKW Group, Koninklijke Ten Cate, Sioen Industries, Uline, Novamont S.p.A., Tenax Corporation, Texel Technical Materials Inc., HUESKER Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The US agro textiles market is poised for significant growth as sustainability becomes a central theme in agriculture. In future, the integration of smart technologies and eco-friendly materials is expected to reshape the landscape, with a focus on multifunctional textiles that enhance crop protection. Additionally, the increasing collaboration between agro textile manufacturers and agricultural technology firms will likely drive innovation, leading to more efficient and sustainable farming practices that align with consumer demands for organic products.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Shade Nets Mulch Films/Mats Crop Covers/Protection Covers Geotextiles Insect Nets Windbreaks Others |

| By Application | Crop Protection Soil Erosion Control Water Conservation Pest Control Greenhouse/Controlled Environment Agriculture Others |

| By Material | Polypropylene Polyethylene Polyester Natural Fibers (e.g., Jute, Cotton) Others |

| By End-User | Agriculture (Row Crops, Field Crops) Horticulture Floriculture Greenhouses Landscaping Others |

| By Region | Northeast Midwest South West Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Retail Others |

| By Product Lifecycle Stage | Introduction Growth Maturity Decline Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agro Textile Manufacturers | 60 | Production Managers, R&D Heads |

| Farmers Using Agro Textiles | 100 | Crop Farmers, Agricultural Cooperatives |

| Distributors and Retailers | 50 | Supply Chain Managers, Retail Buyers |

| Research Institutions | 40 | Agricultural Researchers, Policy Analysts |

| Government Agricultural Departments | 40 | Policy Makers, Agricultural Extension Officers |

The US Agro Textiles Market is valued at approximately USD 465 million, reflecting a significant growth trend driven by sustainable agricultural practices, crop protection needs, and advancements in agro textile technologies.