US Autonomous Last-Mile Delivery Robots Market Overview

- The US Autonomous Last-Mile Delivery Robots Market is valued at USD 500 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for efficient delivery solutions, particularly in urban areas, as well as advancements in robotics, artificial intelligence, and sensor technologies. The rise of e-commerce, the need for rapid and contactless delivery, and ongoing labor shortages in logistics have further accelerated the adoption of autonomous delivery robots .

- Key cities driving market adoption include San Francisco, New York, and Los Angeles, which lead due to high population density, significant e-commerce activity, and robust infrastructure for piloting and deploying autonomous delivery solutions. These urban centers offer favorable local regulatory frameworks and a tech-savvy consumer base, facilitating rapid testing and commercialization of autonomous delivery robots .

- In 2023, the US government introduced operational guidelines for autonomous delivery robots through the "National Highway Traffic Safety Administration Automated Vehicles Policy, 2023" issued by the US Department of Transportation. This regulation sets forth safety standards, operational zones, and requirements for pedestrian interaction, ensuring safe integration of autonomous robots into public spaces while supporting innovation in last-mile logistics.

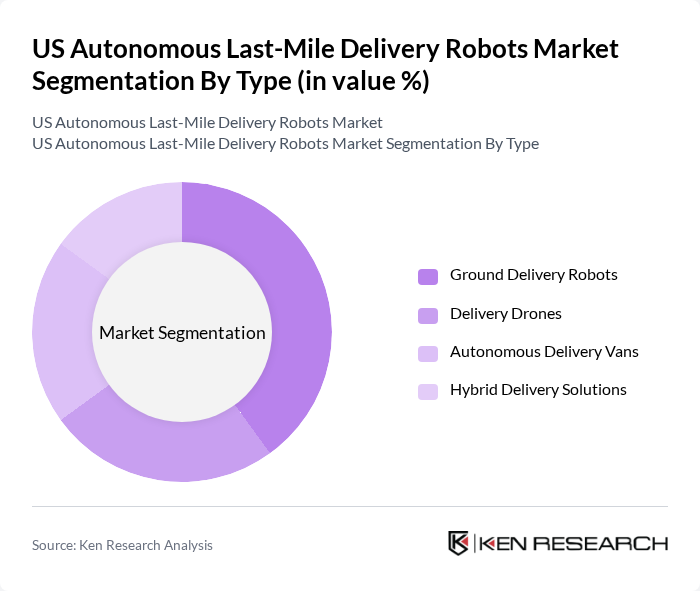

US Autonomous Last-Mile Delivery Robots Market Segmentation

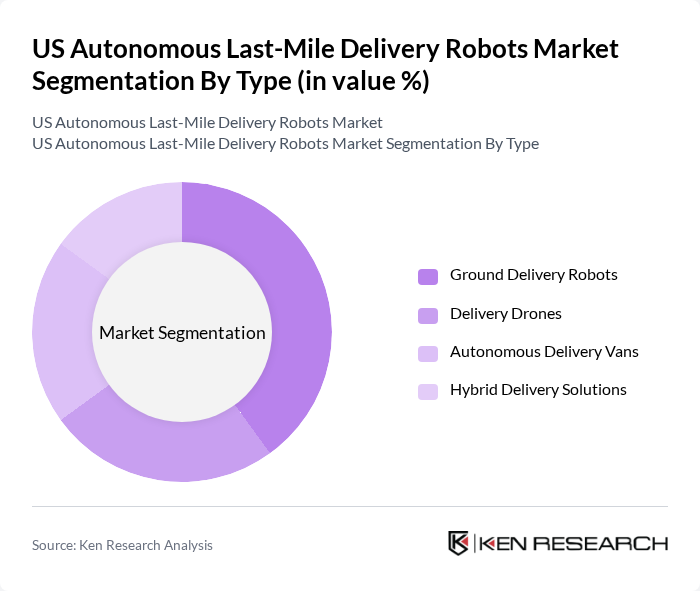

By Type:The market is segmented into Ground Delivery Robots, Delivery Drones, Autonomous Delivery Vans, and Hybrid Delivery Solutions. Ground Delivery Robots are the most widely adopted for short-distance, urban deliveries due to their ability to navigate sidewalks and congested city environments. Delivery Drones are gaining traction for urgent, lightweight deliveries, especially in areas with challenging road access. Autonomous Delivery Vans serve larger payloads and longer routes, while Hybrid Delivery Solutions combine multiple modalities to optimize efficiency and coverage .

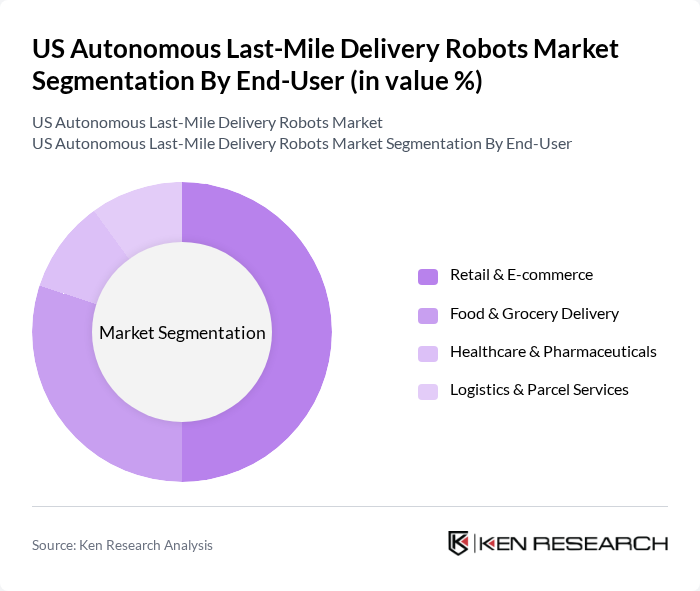

By End-User:The end-user segmentation includes Retail & E-commerce, Food & Grocery Delivery, Healthcare & Pharmaceuticals, and Logistics & Parcel Services. Retail & E-commerce dominates due to the surge in online shopping and consumer expectations for fast, reliable delivery. Food & Grocery Delivery is a major segment, leveraging autonomous robots for rapid, contactless fulfillment. Healthcare & Pharmaceuticals utilize robots for secure, timely medication and sample transport, while Logistics & Parcel Services focus on optimizing last-mile efficiency for a variety of goods .

US Autonomous Last-Mile Delivery Robots Market Competitive Landscape

The US Autonomous Last-Mile Delivery Robots Market is characterized by a dynamic mix of regional and international players. Leading participants such as Starship Technologies, Nuro, Amazon Robotics, Robby Technologies, Kiwibot, Postmates (Uber Eats), FedEx SameDay Bot, Zipline, Waymo, Boxbot, Marble, TeleRetail, Yandex.Rover, A2Z Drone Delivery, Gatik, Refraction AI, Udelv, Serve Robotics, Coco, Wing (Alphabet) contribute to innovation, geographic expansion, and service delivery in this space.

US Autonomous Last-Mile Delivery Robots Market Industry Analysis

Growth Drivers

- Increasing Demand for Contactless Delivery:The COVID-19 pandemic has accelerated the demand for contactless delivery solutions, with a reported 40% increase in online orders in future. According to the U.S. Census Bureau, e-commerce sales reached $1.1 trillion in future, reflecting a significant shift in consumer behavior. This trend is expected to continue, as 70% of consumers express a preference for contactless delivery options, driving the adoption of autonomous last-mile delivery robots in urban areas.

- Advancements in Robotics Technology:The robotics sector is witnessing rapid technological advancements, with investments in AI and machine learning projected to reach $150 billion in future, according to the International Federation of Robotics. These innovations enhance the capabilities of autonomous delivery robots, enabling them to navigate complex urban environments more efficiently. As a result, companies are increasingly integrating these technologies to improve delivery speed and reliability, further propelling market growth.

- Rising E-commerce Activities:The U.S. e-commerce market is projected to grow to $1.5 trillion in future, according to Statista. This growth is driven by changing consumer preferences and the convenience of online shopping. As e-commerce expands, the demand for efficient last-mile delivery solutions increases, creating a favorable environment for autonomous delivery robots. Companies are investing in these technologies to meet consumer expectations for faster and more reliable delivery services.

Market Challenges

- Regulatory Hurdles:The deployment of autonomous delivery robots faces significant regulatory challenges. As of future, only 20 states have enacted laws specifically addressing the operation of delivery robots, creating a fragmented regulatory landscape. This inconsistency can hinder the expansion of services, as companies must navigate varying state regulations, which can delay deployment and increase operational costs, ultimately impacting market growth.

- Public Acceptance and Trust Issues:Public perception plays a crucial role in the adoption of autonomous delivery robots. A survey by the Pew Research Center found that only 50% of Americans are comfortable with the idea of robots delivering goods. Concerns about safety, privacy, and reliability contribute to this skepticism. Building public trust is essential for widespread acceptance, and companies must invest in education and outreach to address these concerns effectively.

US Autonomous Last-Mile Delivery Robots Market Future Outlook

The future of the US autonomous last-mile delivery robots market appears promising, driven by technological advancements and evolving consumer preferences. As urbanization continues, cities are increasingly adopting smart city initiatives, which will integrate autonomous delivery solutions into urban infrastructure. Additionally, partnerships between delivery companies and retailers are expected to enhance service offerings, making delivery more efficient. The focus on sustainability will also drive innovation, as companies seek eco-friendly delivery options to meet consumer demand for greener solutions.

Market Opportunities

- Expansion into Suburban Areas:As urban areas become saturated, there is a significant opportunity for autonomous delivery robots to expand into suburban regions. With a growing population in these areas, the demand for efficient delivery solutions is increasing. Companies can tap into this market by offering tailored services that cater to the unique needs of suburban consumers, potentially increasing their market share.

- Partnerships with Retailers:Collaborating with retailers presents a lucrative opportunity for autonomous delivery companies. By forming strategic partnerships, companies can enhance their service offerings and streamline operations. Retailers are increasingly looking for innovative delivery solutions to meet consumer expectations, and these partnerships can lead to improved customer satisfaction and increased sales, benefiting both parties involved.