Region:North America

Author(s):Dev

Product Code:KRAD3439

Pages:96

Published On:November 2025

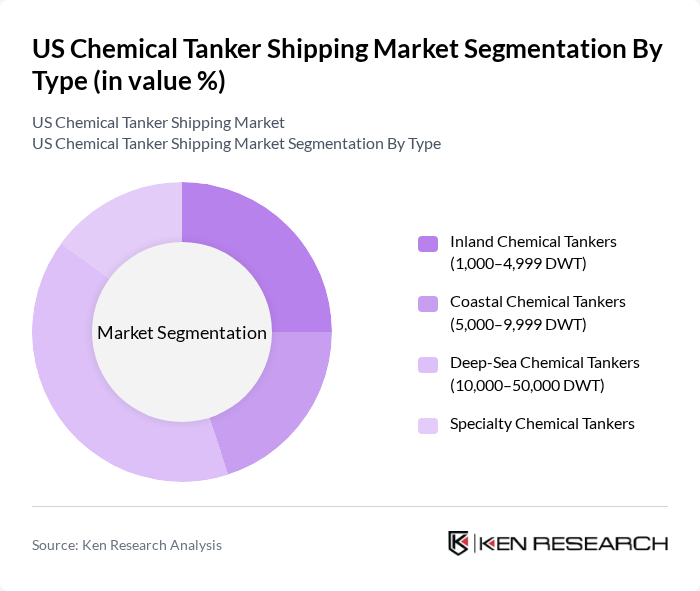

By Type:The market is segmented into various types of chemical tankers, including Inland Chemical Tankers, Coastal Chemical Tankers, Deep-Sea Chemical Tankers, and Specialty Chemical Tankers. Each type serves distinct operational needs based on cargo capacity and shipping routes. MR (Medium Range) chemical tankers, which typically fall within the coastal and deep-sea categories, account for the largest share due to their versatility and suitability for both domestic and international shipping .

The Deep-Sea Chemical Tankers segment is currently dominating the market due to their ability to transport large volumes of chemicals over long distances, catering to international trade demands. The increasing globalization of supply chains and the need for efficient transportation of bulk chemicals have led to a higher preference for deep-sea tankers. Additionally, advancements in ship design, fuel efficiency, and digitalization have made these vessels more attractive to shipping companies, further solidifying their market leadership .

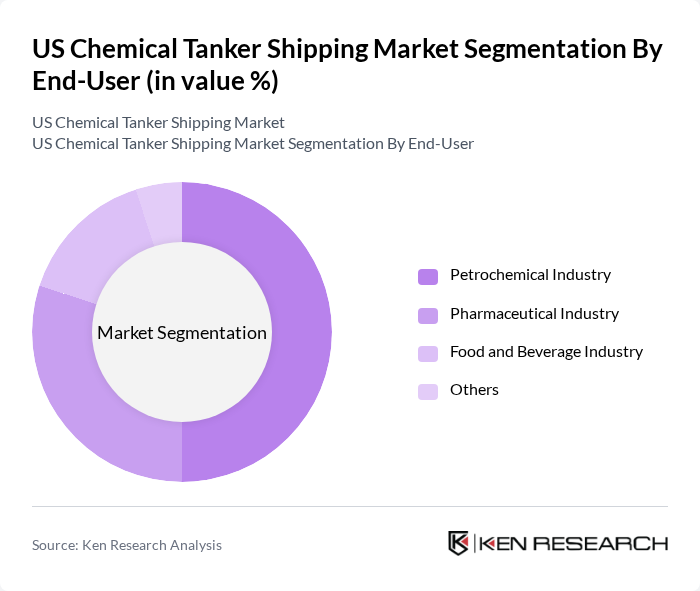

By End-User:The market is segmented based on end-users, including the Petrochemical Industry, Pharmaceutical Industry, Food and Beverage Industry, and Others. Each segment reflects the specific needs and demands of different sectors relying on chemical transportation. The petrochemical industry, in particular, remains the largest consumer due to the volume and diversity of chemical products shipped .

The Petrochemical Industry is the leading end-user segment, accounting for a significant portion of the market. This dominance is driven by the high demand for petrochemicals in various applications, including plastics, fertilizers, and synthetic fibers. The continuous growth of the automotive and construction sectors, which heavily rely on petrochemical products, further fuels the need for efficient chemical transportation. Additionally, the industry's focus on sustainability and innovation is pushing for more advanced shipping solutions, reinforcing its market position .

The US Chemical Tanker Shipping Market is characterized by a dynamic mix of regional and international players. Leading participants such as Odfjell SE, Stolt-Nielsen Limited, Teekay Corporation, Navig8 Group, Hapag-Lloyd AG, MOL Chemical Tankers, Samco Shipholding, AET Tankers, DHT Holdings, Inc., American Shipping Company ASA, SeaTrade Maritime, BSM Tanker Management, V.Group Limited, K Line, NYK Line, Kirby Corporation, American Petroleum Tankers, Crowley Maritime Corporation, TOTE Maritime, Seabulk International contribute to innovation, geographic expansion, and service delivery in this space.

The US chemical tanker shipping market is poised for significant transformation as it adapts to evolving industry demands and regulatory landscapes. With a strong focus on sustainability and digitalization, companies are likely to invest in eco-friendly technologies and advanced fleet management systems. Additionally, the increasing demand for specialized chemical tankers will drive innovation and efficiency. As the market navigates challenges, strategic partnerships and investments in emerging markets will be crucial for long-term growth and competitiveness in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Inland Chemical Tankers (1,000–4,999 DWT) Coastal Chemical Tankers (5,000–9,999 DWT) Deep-Sea Chemical Tankers (10,000–50,000 DWT) Specialty Chemical Tankers |

| By End-User | Petrochemical Industry Pharmaceutical Industry Food and Beverage Industry Others |

| By Cargo Type | Hazardous Chemicals (IMO I, II, III) Non-Hazardous Chemicals Specialty Chemicals Others |

| By Fleet Size | Large Fleets (10+ vessels) Medium Fleets (5–9 vessels) Small Fleets (1–4 vessels) Others |

| By Shipping Route | Domestic Routes International Routes Coastal Routes Inland Waterways |

| By Regulatory Compliance Level | Fully Compliant (IMO, USCG, EPA) Partially Compliant Non-Compliant Others |

| By Service Type | Full-Service Shipping Niche Shipping Services Charter Services Logistics & Terminal Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chemical Tanker Fleet Operations | 100 | Fleet Managers, Operations Directors |

| Chemical Manufacturing Logistics | 80 | Logistics Coordinators, Supply Chain Managers |

| Port Operations and Management | 60 | Port Authority Officials, Terminal Managers |

| Regulatory Compliance in Shipping | 50 | Compliance Officers, Environmental Managers |

| Market Trends and Forecasting | 70 | Market Analysts, Industry Consultants |

The US Chemical Tanker Shipping Market is valued at approximately USD 6.3 billion, driven by the increasing demand for chemical transportation, particularly from the petrochemical and pharmaceutical industries, as well as advancements in shipping technology and regulatory compliance.