Region:North America

Author(s):Dev

Product Code:KRAA9568

Pages:97

Published On:November 2025

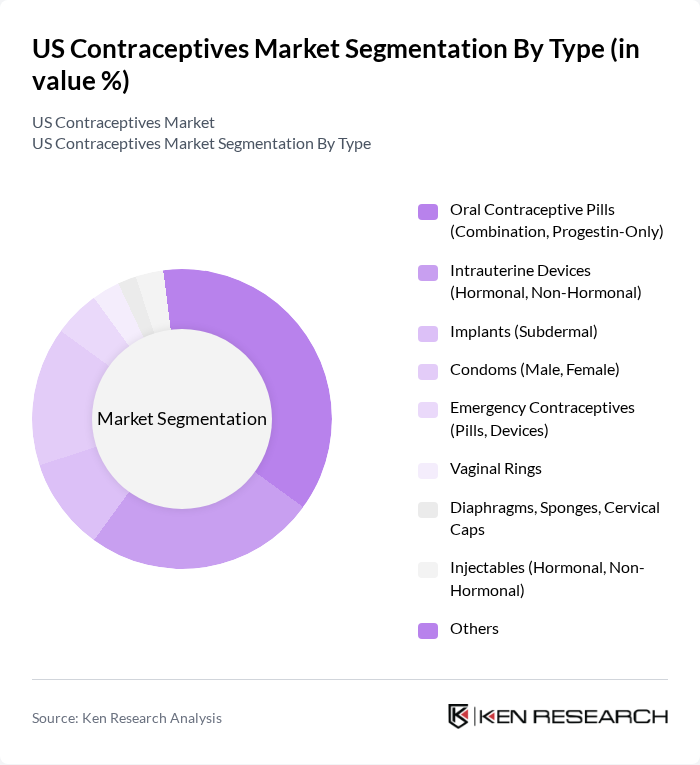

By Type:The contraceptives market is segmented into various types, including oral contraceptive pills, intrauterine devices, implants, condoms, emergency contraceptives, vaginal rings, diaphragms, injectables, and others. Among these, oral contraceptive pills remain the most widely used due to their convenience and effectiveness. The increasing acceptance of hormonal contraceptives, the growing trend of self-medication, and the rising adoption of long-acting reversible contraceptives (LARCs) such as IUDs and implants have further propelled demand. There is also a growing preference for hormone-free and natural contraceptive options, reflecting evolving consumer preferences .

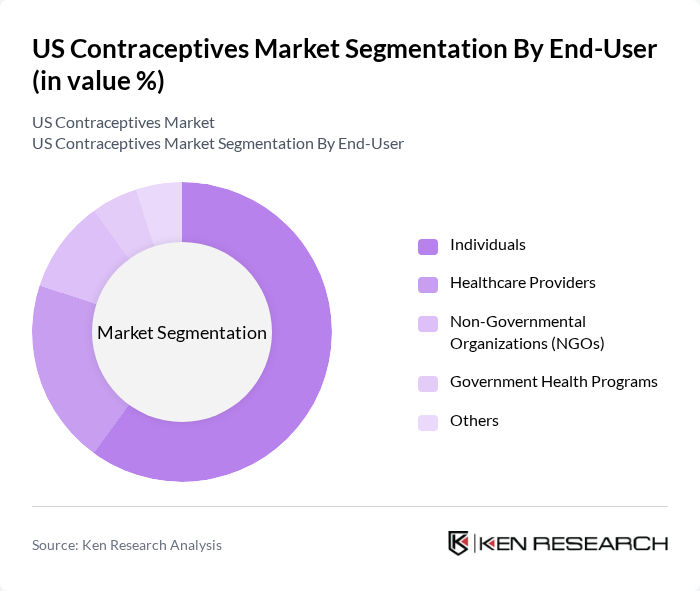

By End-User:The end-user segmentation includes individuals, healthcare providers, NGOs, government health programs, and others. Individuals represent the largest segment, driven by increasing awareness of reproductive health, the need for family planning, and the convenience of over-the-counter and prescription options. Healthcare providers play a crucial role in educating patients about contraceptive options and facilitating access, while NGOs and government health programs support underserved populations through targeted outreach and subsidized services .

The US Contraceptives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Bayer AG, Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Johnson & Johnson (Janssen Pharmaceuticals), Organon & Co., CooperSurgical, Inc., Church & Dwight Co., Inc., HRA Pharma (a Perrigo Company), Mylan N.V. (a Viatris company), Allergan plc (an AbbVie company), Ferring Pharmaceuticals, Gedeon Richter Plc, Sandoz (a Novartis division), Lupin Pharmaceuticals, Inc., Afaxys, Inc., Agile Therapeutics, Inc., Evofem Biosciences, Inc. contribute to innovation, geographic expansion, and service delivery in this space. These companies collectively hold a significant share of the market, leveraging extensive product portfolios, strong distribution networks, and ongoing investment in research and development to introduce advanced contraceptive solutions .

The US contraceptives market is poised for significant evolution, driven by increasing consumer demand for personalized and accessible reproductive health solutions. As telehealth services expand, more individuals will gain access to contraceptive options, particularly in underserved areas. Additionally, the focus on long-acting reversible contraceptives (LARCs) is expected to grow, reflecting a shift in consumer preferences towards convenience and efficacy. These trends indicate a dynamic market landscape that will continue to adapt to the needs of consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Oral Contraceptive Pills (Combination, Progestin-Only) Intrauterine Devices (Hormonal, Non-Hormonal) Implants (Subdermal) Condoms (Male, Female) Emergency Contraceptives (Pills, Devices) Vaginal Rings Diaphragms, Sponges, Cervical Caps Injectables (Hormonal, Non-Hormonal) Others |

| By End-User | Individuals Healthcare Providers Non-Governmental Organizations (NGOs) Government Health Programs Others |

| By Distribution Channel | Retail Pharmacies Hospital Pharmacies Online Channels Clinics Others |

| By Age Group | 44 Years Above 44 Years |

| By Income Level | Low Income Middle Income High Income Others |

| By Geographic Region | Northeast Midwest South West Others |

| By Product Formulation | Hormonal Non-Hormonal Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Contraceptive Users Survey | 120 | Women aged 18-45, diverse socio-economic backgrounds |

| Healthcare Provider Insights | 70 | Gynecologists, Family Planning Specialists |

| Pharmacy Distribution Analysis | 60 | Pharmacists, Pharmacy Managers |

| NGO and Advocacy Group Perspectives | 40 | Reproductive Health Advocates, Policy Makers |

| Insurance Provider Feedback | 50 | Health Insurance Analysts, Policy Underwriters |

The US contraceptives market is valued at approximately USD 7.3 billion, reflecting a significant growth trend driven by increased awareness of reproductive health and the demand for effective family planning solutions.