US Contract Management Software Market Overview

- The US Contract Management Software Market is valued at USD 2.1 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing need for organizations to streamline their contract processes, enhance compliance, and reduce risks associated with contract management. The rise in digital transformation initiatives, integration with enterprise systems (CRM/ERP), and the proliferation of remote work have further accelerated the adoption of contract management solutions. Advanced technologies such as artificial intelligence and machine learning are increasingly being integrated to automate clause extraction, risk detection, and predictive analytics, enhancing contract review accuracy and efficiency .

- Key players in this market are concentrated in major cities such as New York, San Francisco, and Chicago, which dominate due to their robust business ecosystems and concentration of technology firms. The presence of numerous corporate headquarters in these areas fosters a competitive environment that drives innovation and adoption of contract management software .

- In 2023, the US government implemented the Federal Acquisition Regulation (FAR) amendments, issued by the General Services Administration, requiring federal agencies to adopt electronic contract management systems. This regulation enhances transparency, improves efficiency, and ensures compliance in federal contracting processes, thereby boosting the demand for contract management software solutions. The FAR amendments specifically mandate electronic recordkeeping, standardized contract workflows, and compliance monitoring for all federal procurement activities .

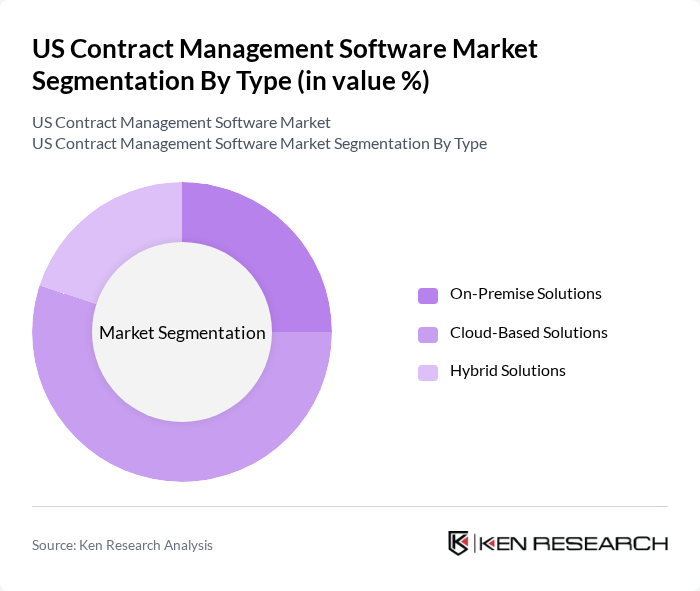

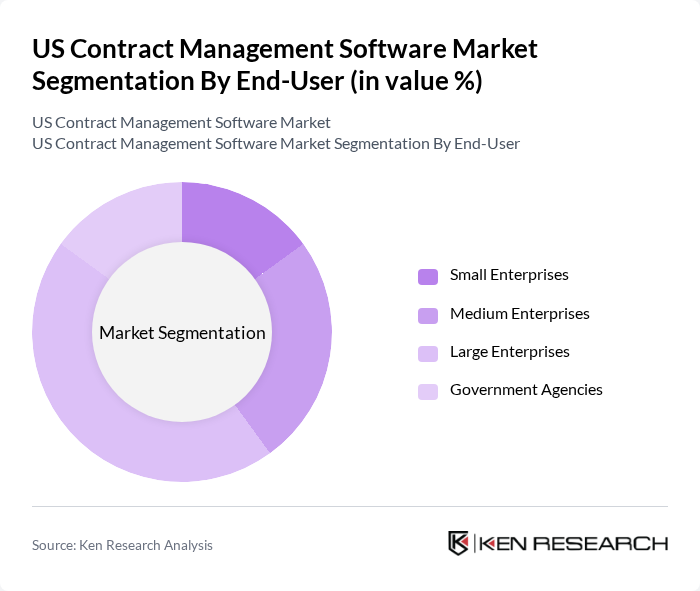

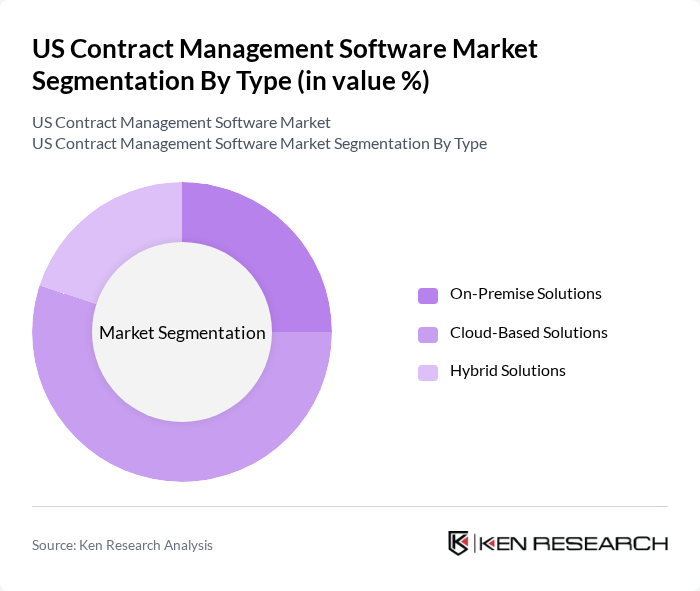

US Contract Management Software Market Segmentation

By Type:The market is segmented into On-Premise Solutions, Cloud-Based Solutions, and Hybrid Solutions. Among these, Cloud-Based Solutions are leading due to their flexibility, scalability, and lower upfront costs, making them attractive for businesses of all sizes. The trend towards remote work, demand for secure collaboration, and the need for real-time access to contracts have further propelled the adoption of cloud-based contract management systems. Cloud solutions also offer enhanced integration capabilities with other enterprise platforms, supporting seamless workflows and centralized data management .

By End-User:The end-user segmentation includes Small Enterprises, Medium Enterprises, Large Enterprises, and Government Agencies. Large Enterprises dominate this segment as they require comprehensive contract management solutions to handle complex contracts and compliance requirements. The increasing focus on risk management, regulatory compliance, and operational efficiency among large organizations drives their demand for sophisticated contract management software. The pharmaceutical, legal, and financial sectors are particularly prominent due to their high contract volumes and stringent compliance needs .

US Contract Management Software Market Competitive Landscape

The US Contract Management Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as DocuSign, Inc., Icertis, Inc., Coupa Software, Inc., SAP SE, Oracle Corporation, Agiloft, Inc., ContractWorks, Concord, JAGGAER, PandaDoc, Inc., Zycus, Inc., Contract Logix, LLC, Ironclad, Inc., SirionLabs, Evisort, Inc., EZ Contracts, Conga (now part of Apttus), Wolters Kluwer ELM Solutions, ContractPodAi, Malbek contribute to innovation, geographic expansion, and service delivery in this space.

US Contract Management Software Market Industry Analysis

Growth Drivers

- Increasing Demand for Automation:The US contract management software market is experiencing a surge in demand for automation, driven by the need for efficiency. In future, businesses are projected to spend approximately $4.0 billion on automation technologies, reflecting a 15% increase from the previous year. This trend is fueled by the desire to reduce manual errors and streamline workflows, as companies recognize that automated contract processes can save up to 30% in time and costs associated with contract management.

- Rising Need for Compliance and Risk Management:With regulatory scrutiny intensifying, organizations are increasingly prioritizing compliance and risk management in contract management. In future, the compliance software market is expected to reach $2.4 billion, growing at a rate of 12% annually. This growth is driven by the need to adhere to regulations such as the Sarbanes-Oxley Act and GDPR, which mandate stringent contract oversight, thereby propelling the adoption of contract management solutions that ensure compliance and mitigate risks.

- Expansion of Small and Medium Enterprises:The adoption of contract management solutions is rapidly increasing among small and medium enterprises (SMEs), which represent 99.9% of US businesses. In future, SMEs are projected to invest around $2.2 billion in contract management software, reflecting a 20% increase from the previous year. This trend is driven by the need for efficient contract handling and the availability of affordable, scalable solutions tailored to the unique needs of SMEs, enhancing their operational capabilities.

Market Challenges

- High Initial Implementation Costs:One of the significant barriers to adopting contract management software is the high initial implementation costs, which can range from $50,000 to $200,000 for mid-sized companies. In future, it is estimated that 40% of organizations cite these costs as a primary deterrent to adoption. This financial burden can hinder smaller firms from investing in necessary technologies, limiting their ability to compete effectively in the market.

- Complexity in Integration:Integrating new contract management software with existing systems poses a considerable challenge for many organizations. In future, approximately 35% of companies report facing significant integration issues, which can lead to project delays and increased costs. This complexity often results in resistance from IT departments and can deter organizations from fully leveraging the benefits of contract management solutions, ultimately impacting their operational efficiency.

US Contract Management Software Market Future Outlook

The future of the US contract management software market appears promising, driven by technological advancements and evolving business needs. As organizations increasingly embrace digital transformation, the integration of AI and machine learning is expected to enhance contract analysis and management efficiency. Furthermore, the shift towards cloud-based solutions will facilitate greater accessibility and collaboration, allowing businesses to streamline their contract processes and improve compliance. These trends indicate a robust growth trajectory for the market in the coming years.

Market Opportunities

- Emergence of AI and Machine Learning:The integration of AI and machine learning technologies presents a significant opportunity for enhancing contract management. In future, AI-driven solutions are expected to reduce contract review times by up to 50%, enabling organizations to make faster, data-driven decisions. This technological advancement can lead to improved accuracy and efficiency in contract management processes, positioning companies for competitive advantage.

- Growth in Cloud-Based Solutions:The increasing adoption of cloud-based contract management solutions offers substantial market opportunities. In future, the cloud services market is projected to reach $600 billion, with contract management solutions capturing a significant share. This growth is driven by the need for scalable, flexible solutions that enhance collaboration and accessibility, allowing organizations to manage contracts more effectively across distributed teams.