Region:North America

Author(s):Rebecca

Product Code:KRAC8573

Pages:93

Published On:November 2025

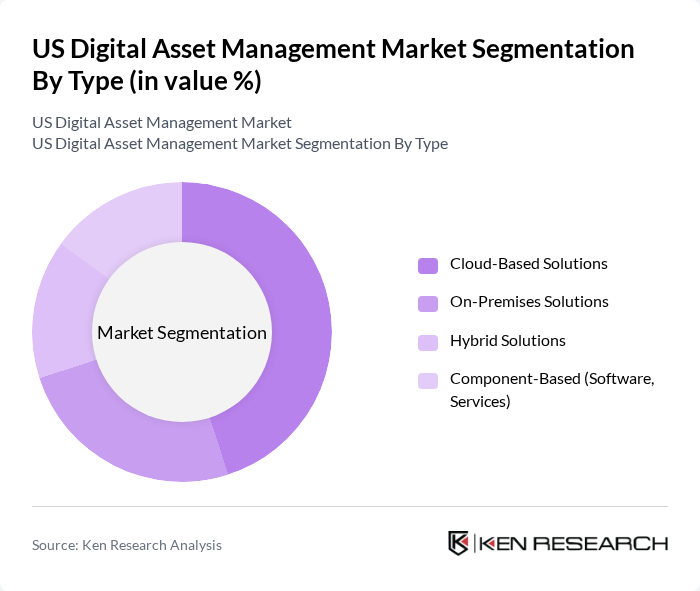

By Type:The Digital Asset Management market is segmented into Cloud-Based Solutions, On-Premises Solutions, Hybrid Solutions, and Component-Based (Software, Services). Cloud-Based Solutions are experiencing the highest adoption due to their scalability, cost-effectiveness, and ability to integrate with existing enterprise systems. The shift to cloud-native platforms is further accelerated by the need for distributed teams to access assets remotely, AI-driven automation for asset tagging, and faster campaign execution. Hybrid models are also gaining traction in sectors with sensitive data, such as healthcare and government, where a mix of on-premises and cloud deployment is preferred .

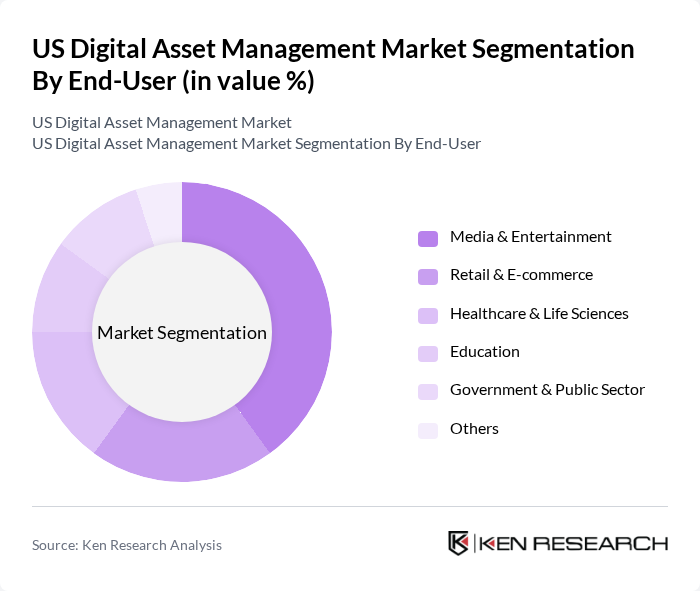

By End-User:The end-user segmentation includes Media & Entertainment, Retail & E-commerce, Healthcare & Life Sciences, Education, Government & Public Sector, and Others. The Media & Entertainment sector leads due to the increasing demand for high-quality digital content, large-scale media libraries, and the need for efficient asset management solutions. Retail & E-commerce is rapidly expanding its adoption, driven by the surge in online retail and the necessity for cohesive brand representation across digital channels. Healthcare & Life Sciences, Education, and Government sectors are also investing in DAM to ensure compliance, streamline operations, and enhance digital engagement .

The US Digital Asset Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adobe Inc., Widen (an Acquia company), Bynder, Canto, Inc., MediaBeacon, Inc., Brandfolder (a Smartsheet company), Cloudinary Ltd., Nuxeo (a Hyland company), Frontify AG, Picturepark (Vision Information Transaction AG), Aprimo LLC, Asset Bank (Bright Interactive Ltd.), MerlinOne, Inc., FotoWare AS, Canto Cumulus (Canto, Inc.) contribute to innovation, geographic expansion, and service delivery in this space.

The US digital asset management market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As organizations increasingly adopt AI and machine learning, the efficiency of asset management processes will improve, enabling better decision-making. Additionally, the growing emphasis on user experience will lead to more intuitive interfaces, enhancing user engagement. Companies that prioritize sustainability will also find new avenues for growth, aligning their practices with consumer values and regulatory expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Component-Based (Software, Services) |

| By End-User | Media & Entertainment Retail & E-commerce Healthcare & Life Sciences Education Government & Public Sector Others |

| By Industry Vertical | Financial Services Manufacturing Telecommunications Consumer Goods Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises |

| By Functionality | Asset Management Workflow Management Reporting & Analytics Integration & API Management Others |

| By Region | Northeast Midwest South West |

| By Pricing Model | Subscription-Based One-Time License Fee Freemium Usage-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Media & Entertainment Sector | 100 | Content Managers, Digital Asset Coordinators |

| Retail & E-commerce | 70 | Marketing Directors, Brand Managers |

| Healthcare & Pharmaceuticals | 60 | Compliance Officers, Digital Strategy Leads |

| Education & E-learning | 50 | Instructional Designers, IT Administrators |

| Corporate Sector | 80 | Corporate Communications Managers, IT Managers |

The US Digital Asset Management Market is valued at approximately USD 1.6 billion, reflecting a significant growth trend driven by the increasing need for efficient digital content management and the adoption of cloud-native AI-enhanced platforms.