Region:North America

Author(s):Geetanshi

Product Code:KRAC0038

Pages:95

Published On:August 2025

By Type:

The flash memory market is segmented into several types, including NAND Flash, NOR Flash, Embedded Flash, DRAM, and Others (e.g., 3D XPoint, MRAM). Among these, NAND Flash is the dominant sub-segment, primarily due to its widespread use in consumer electronics such as smartphones, tablets, and solid-state drives (SSDs). The increasing demand for high-capacity storage solutions, the shift toward 3D NAND technology, and the trend towards mobile and edge computing have further solidified NAND Flash's leading position. NOR Flash remains important for specific applications like automotive and industrial devices, where fast read speeds and reliability are critical. Embedded Flash is also gaining traction, particularly in IoT and connected devices, but NAND Flash remains the preferred choice for most high-volume applications.

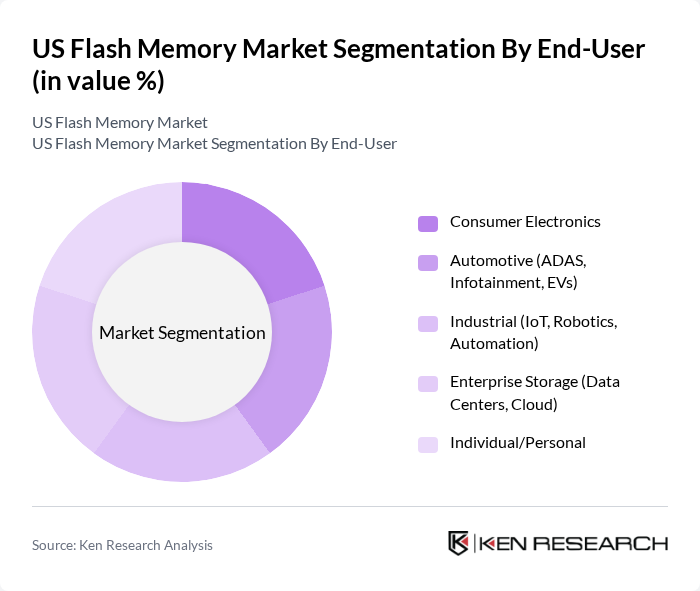

By End-User:

The end-user segmentation of the flash memory market includes Consumer Electronics, Automotive (ADAS, Infotainment, EVs), Industrial (IoT, Robotics, Automation), Enterprise Storage (Data Centers, Cloud), and Individual/Personal. The Consumer Electronics segment leads the market, driven by the increasing adoption of smartphones, tablets, and laptops, as well as the demand for high-performance storage solutions in these devices. The Automotive sector is experiencing significant growth, particularly with the rise of electric vehicles and advanced driver-assistance systems (ADAS), which require reliable and fast storage solutions. Industrial applications are expanding as IoT and automation technologies proliferate, but Consumer Electronics remains the dominant end-user segment.

The US Flash Memory Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics Co., Ltd., Western Digital Corporation, Micron Technology, Inc., Kingston Technology Company, Inc., SanDisk Corporation, Kioxia Corporation, Intel Corporation, SK Hynix Inc., ADATA Technology Co., Ltd., Transcend Information, Inc., PNY Technologies, Inc., Corsair Components, Inc., Crucial (Micron Technology, Inc.), Seagate Technology Holdings PLC, Lexar Media, Inc., Infineon Technologies AG, Microchip Technology Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The US flash memory market is poised for significant evolution, driven by technological advancements and increasing data demands. As industries adopt more sophisticated data management solutions, the shift towards 3D NAND technology will likely dominate. Additionally, the integration of flash memory in emerging technologies, such as AI and IoT, will create new avenues for growth. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to thrive in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | NAND Flash NOR Flash Embedded Flash DRAM Others (e.g., 3D XPoint, MRAM) |

| By End-User | Consumer Electronics Automotive (ADAS, Infotainment, EVs) Industrial (IoT, Robotics, Automation) Enterprise Storage (Data Centers, Cloud) Individual/Personal |

| By Application | Mobile Devices (Smartphones, Tablets) Laptops and PCs Data Centers & Servers Gaming Consoles USB Flash Drives & Memory Cards Solid-State Drives (SSDs) |

| By Sales Channel | Online Retail Offline Retail Direct Sales (B2B) |

| By Distribution Mode | Wholesale Retail E-commerce |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Samsung SanDisk Kingston Micron Western Digital Intel SK Hynix Kioxia Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Development Managers, Supply Chain Analysts |

| Data Center Operators | 60 | IT Infrastructure Managers, Data Storage Specialists |

| Automotive Industry Suppliers | 50 | Procurement Managers, Engineering Leads |

| Mobile Device Manufacturers | 70 | R&D Engineers, Product Managers |

| Cloud Service Providers | 55 | Operations Managers, Technical Architects |

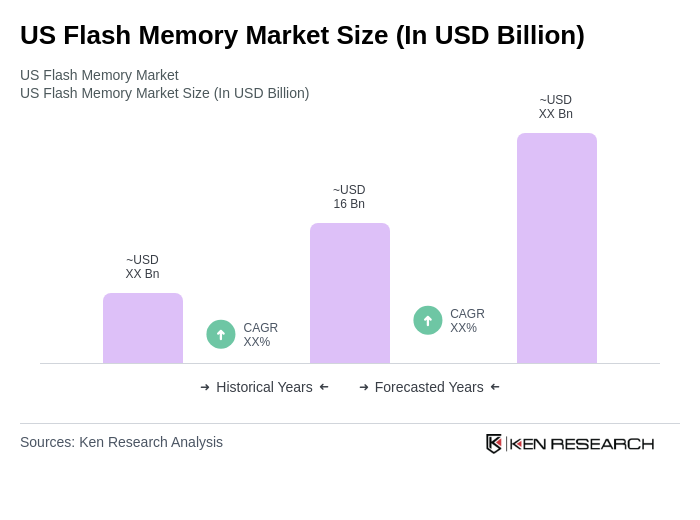

The US Flash Memory Market is valued at approximately USD 16 billion, reflecting a robust growth trajectory driven by increasing demand for data storage solutions across various sectors, including consumer electronics, automotive, and enterprise storage.