Region:North America

Author(s):Dev

Product Code:KRAD3328

Pages:88

Published On:November 2025

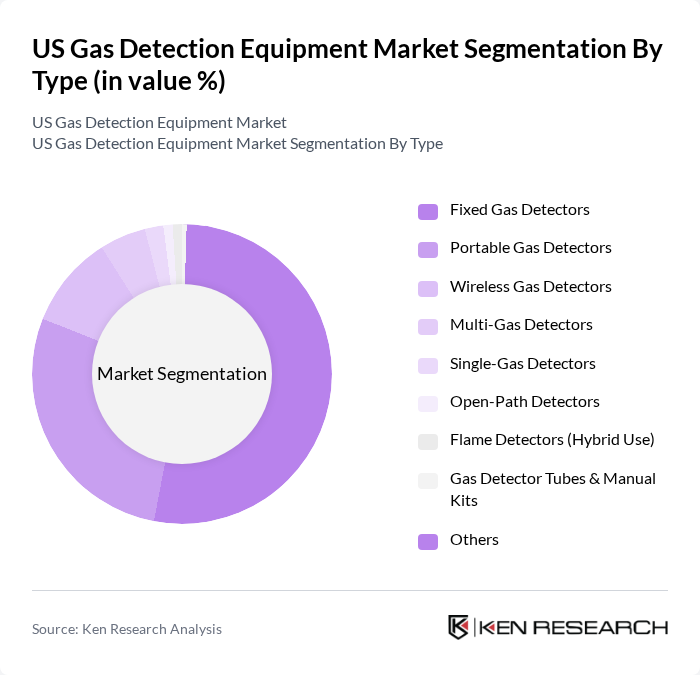

By Type:The market is segmented into various types of gas detection equipment, including Fixed Gas Detectors, Portable Gas Detectors, Wireless Gas Detectors, Multi-Gas Detectors, Single-Gas Detectors, Open-Path Detectors, Flame Detectors (Hybrid Use), Gas Detector Tubes & Manual Kits, and Others. Fixed Gas Detectors are leading the market due to their reliability and effectiveness in continuous monitoring of gas levels in industrial settings, commanding approximately 53% of the market share. The increasing focus on workplace safety and regulatory compliance is driving the demand for these devices. Portable gas detectors represent the second-largest segment and are expected to experience the highest growth rates, driven by their flexibility in various environments and their ability to provide localized detection in immediate surroundings.

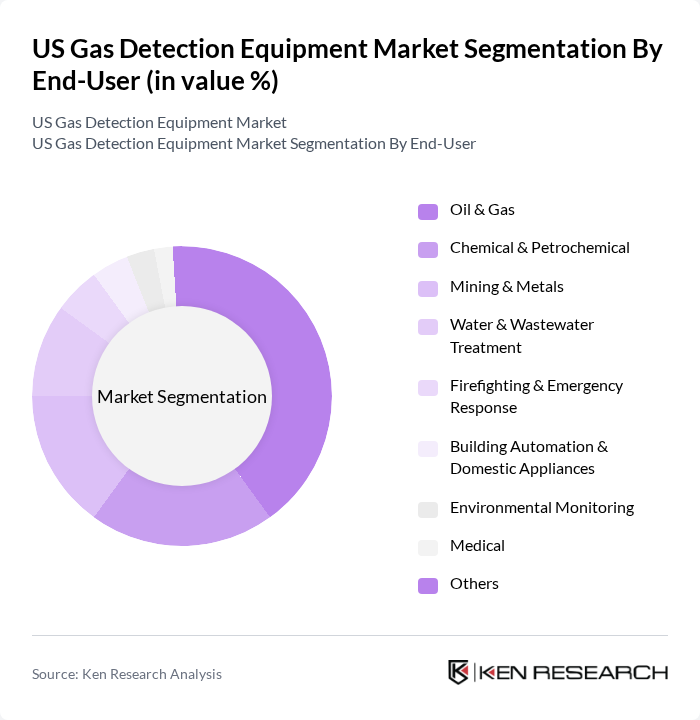

By End-User:The end-user segmentation includes Oil & Gas, Chemical & Petrochemical, Mining & Metals, Water & Wastewater Treatment, Firefighting & Emergency Response, Building Automation & Domestic Appliances, Environmental Monitoring, Medical, and Others. The Oil & Gas sector is the dominant end-user, driven by the need for stringent safety measures and compliance with regulations in hazardous environments. The increasing exploration and production activities in this sector, particularly shale gas exploration, further fuel the demand for gas detection equipment.

The US Gas Detection Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Drägerwerk AG & Co. KGaA, MSA Safety Incorporated, Siemens AG, RKI Instruments, Inc., Industrial Scientific Corporation, Teledyne Technologies Incorporated, 3M Company, Crowcon Detection Instruments Ltd., Gas Clip Technologies, Sensit Technologies, GfG Instrumentation, Inc., ABB Ltd., AMETEK, Inc., RAE Systems by Honeywell, Thermo Fisher Scientific Inc., General Electric Company (GE), Fluke Corporation, Sensata Technologies, Lynred, Airtest Technologies Inc., Opgal Optronics Industries Ltd., New Cosmos Electric Co., Ltd., RIKEN KEIKI Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US gas detection equipment market appears promising, driven by ongoing technological innovations and increasing regulatory pressures. As industries prioritize safety and environmental compliance, the adoption of advanced gas detection systems is expected to rise. Furthermore, the integration of artificial intelligence and machine learning into detection technologies will enhance predictive maintenance capabilities, ensuring timely responses to potential hazards. This evolution will likely lead to a more robust market landscape, fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed Gas Detectors Portable Gas Detectors Wireless Gas Detectors Multi-Gas Detectors Single-Gas Detectors Open-Path Detectors Flame Detectors (Hybrid Use) Gas Detector Tubes & Manual Kits Others |

| By End-User | Oil & Gas Chemical & Petrochemical Mining & Metals Water & Wastewater Treatment Firefighting & Emergency Response Building Automation & Domestic Appliances Environmental Monitoring Medical Others |

| By Application | Industrial Safety Environmental Monitoring Leak Detection Emergency Response Process Control Others |

| By Technology | Infrared (IR) Technology Ultrasonic Technology Photoionization Detector (PID) Technology Semiconductor Technology Catalytic Technology Metal Oxide Semiconductor Technology Thermal Conductivity Sensors Laser-Based Detection Photoacoustic Sensors Others |

| By Distribution Channel | Direct Sales (OEM to End-User) Distributors/Resellers Online Retail/E-Commerce System Integration Providers Retail Sales Others |

| By Region | Northeast Midwest South West |

| By Policy Support | Federal Grants State Incentives Tax Credits Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Gas Detection Systems | 100 | Safety Managers, Operations Directors |

| Commercial Building Safety Equipment | 80 | Facility Managers, Compliance Officers |

| Residential Gas Leak Detectors | 60 | Homeowners, Property Managers |

| Oil & Gas Sector Detection Solutions | 90 | Field Engineers, Safety Compliance Managers |

| Emergency Response Equipment | 50 | Fire Safety Officers, Emergency Response Coordinators |

The US Gas Detection Equipment Market is valued at approximately USD 3.8 billion, reflecting a significant growth driven by increasing safety regulations, technological advancements, and heightened demand across various industries such as oil and gas, chemicals, and manufacturing.