Region:North America

Author(s):Dev

Product Code:KRAB0400

Pages:90

Published On:August 2025

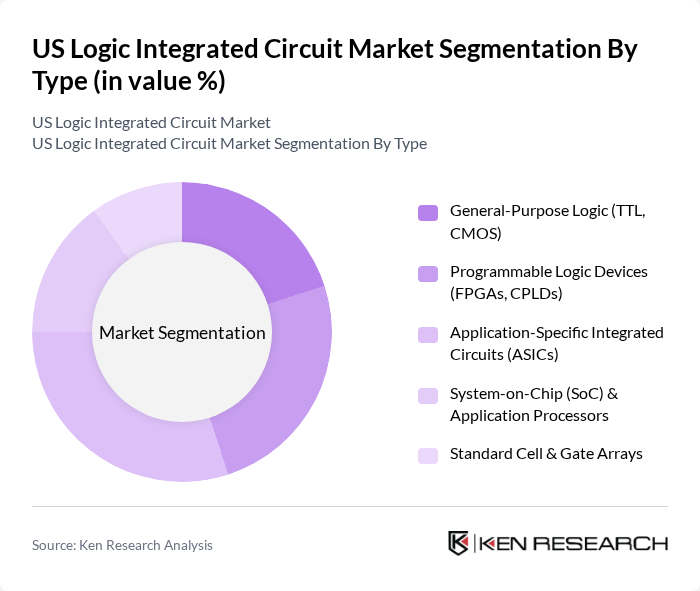

By Type:The market is segmented into various types of logic integrated circuits, including General-Purpose Logic (TTL, CMOS), Programmable Logic Devices (FPGAs, CPLDs), Application-Specific Integrated Circuits (ASICs), System-on-Chip (SoC) & Application Processors, and Standard Cell & Gate Arrays. Among these, Application-Specific Integrated Circuits (ASICs) are leading the market due to their tailored functionality for specific applications, which enhances performance and efficiency. The growing demand for customized solutions in sectors like automotive and consumer electronics, plus AI accelerators for data centers and edge inference, is driving the adoption of ASICs.

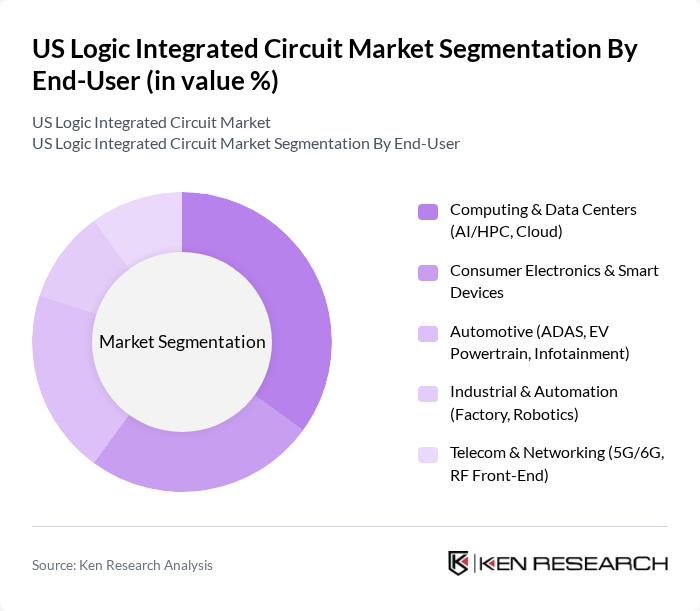

By End-User:The end-user segmentation includes Computing & Data Centers (AI/HPC, Cloud), Consumer Electronics & Smart Devices, Automotive (ADAS, EV Powertrain, Infotainment), Industrial & Automation (Factory, Robotics), and Telecom & Networking (5G/6G, RF Front-End). The Computing & Data Centers segment is currently the dominant end-user, driven by the exponential growth in data generation and the need for high-performance computing solutions. The increasing reliance on cloud services and AI applications, including deployment of advanced-node GPUs/ASICs in hyperscale facilities, further propels this segment's growth.

The US Logic Integrated Circuit Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intel Corporation, Texas Instruments Incorporated, Advanced Micro Devices, Inc., NVIDIA Corporation, Qualcomm Incorporated, Broadcom Inc., Marvell Technology, Inc., Microchip Technology Incorporated, Analog Devices, Inc., ON Semiconductor Corporation (onsemi), NXP Semiconductors N.V., STMicroelectronics N.V., Infineon Technologies AG, Renesas Electronics Corporation, Lattice Semiconductor Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The US logic integrated circuit market is poised for significant evolution, driven by technological advancements and increasing consumer demand. As industries embrace automation and connectivity, the integration of AI in circuit design will enhance efficiency and performance. Additionally, the expansion of 5G technology will create new applications for logic ICs, further stimulating market growth. Companies that adapt to these trends will likely capture substantial market share in the coming years, positioning themselves for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | General-Purpose Logic (TTL, CMOS) Programmable Logic Devices (FPGAs, CPLDs) Application-Specific Integrated Circuits (ASICs) System-on-Chip (SoC) & Application Processors Standard Cell & Gate Arrays |

| By End-User | Computing & Data Centers (AI/HPC, Cloud) Consumer Electronics & Smart Devices Automotive (ADAS, EV Powertrain, Infotainment) Industrial & Automation (Factory, Robotics) Telecom & Networking (5G/6G, RF Front-End) |

| By Application | CPUs, GPUs, and AI Accelerators Embedded Controllers & MCUs Edge/IoT Logic and Gate Arrays Networking & Switch/Router Logic Security & Defense Logic (Trusted/Assured ICs) |

| By Distribution Channel | Direct OEM/ODM Sales Authorized Distributors E-commerce/Online B2B Platforms Design Services & IP Licensing Partners |

| By Technology Node | Advanced Nodes (?7nm, 5nm, 3nm roadmap) Mature Nodes (28–90nm) Specialty/More-than-Moore (FD-SOI, SiGe, GaN/SiC logic) Legacy Nodes (?130nm) |

| By Packaging | D/3D Advanced Packaging (CoWoS, Foveros, InFO) Fan-out/WLCSP Flip-Chip BGA/LGA Leaded & Other (QFN, QFP, DIP) |

| By Customer Type | Hyperscalers & Cloud Service Providers Tier-1 OEMs (PC, Smartphone, Auto) Industrial/Defense Primes SMEs/Startups & Design Houses |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Logic ICs | 120 | Product Managers, Design Engineers |

| Automotive Logic IC Applications | 100 | Automotive Engineers, Procurement Managers |

| Telecommunications Infrastructure | 80 | Network Engineers, Operations Managers |

| Industrial Automation Logic ICs | 70 | Manufacturing Engineers, Supply Chain Analysts |

| Emerging Technologies (AI, IoT) | 90 | Research Scientists, Technology Strategists |

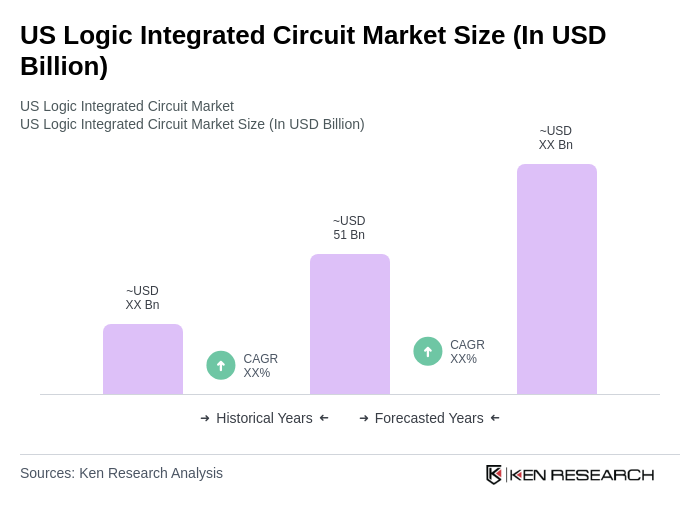

The US Logic Integrated Circuit Market is valued at approximately USD 51 billion, reflecting a robust growth trajectory driven by advancements in computing solutions, smart devices, and data center expansions, particularly in AI and machine learning applications.