Region:North America

Author(s):Geetanshi

Product Code:KRAC0122

Pages:88

Published On:August 2025

By Type:The market is segmented into various types of consulting services, including Strategy Consulting, Operations Consulting, Financial Advisory, Human Resources Consulting, Technology Consulting, Risk & Compliance Consulting, Sustainability Consulting, Marketing Consulting, and Others. Each of these segments addresses specific client needs and evolving industry demands. Operations Consulting currently holds the largest share, driven by demand for process optimization, supply chain resilience, and digital transformation initiatives .

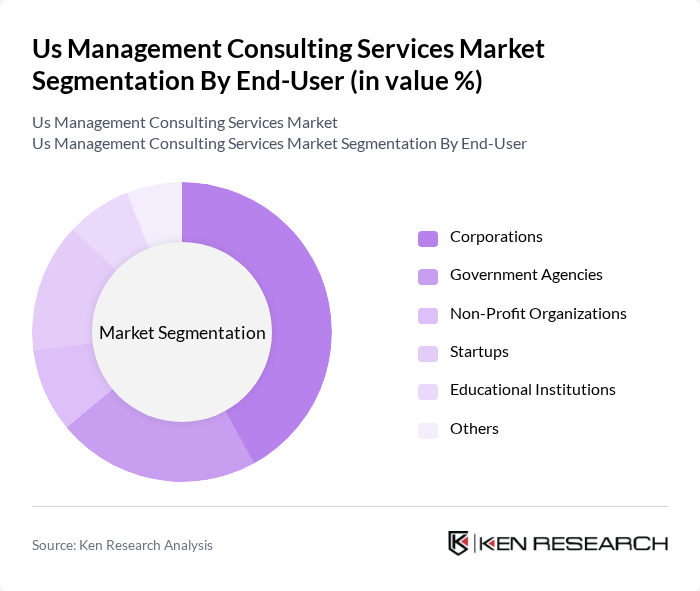

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Startups, Educational Institutions, and Others. Each segment has unique requirements and expectations from consulting services, influencing the overall market dynamics. Corporations remain the largest end-user segment, driven by ongoing needs for digital transformation, regulatory compliance, and operational efficiency .

The Us Management Consulting Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Deloitte Consulting LLP, Accenture plc, PwC Advisory Services (PricewaterhouseCoopers LLP), EY Advisory (Ernst & Young LLP), KPMG Advisory (KPMG LLP), Oliver Wyman, Roland Berger, Kearney, Capgemini Invent, Guidehouse (formerly Navigant Consulting), FTI Consulting, and Protiviti contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. management consulting services market appears promising, driven by ongoing digital transformation and the increasing complexity of business operations. As firms continue to prioritize cost efficiency and operational excellence, consulting services will play a pivotal role in guiding organizations through these changes. Additionally, the rise of remote consulting and the integration of advanced technologies will reshape service delivery, enhancing client engagement and satisfaction in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategy Consulting Operations Consulting Financial Advisory Human Resources Consulting Technology Consulting Risk & Compliance Consulting Sustainability Consulting Marketing Consulting Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Startups Educational Institutions Others |

| By Service Delivery Model | On-Site Consulting Remote Consulting Hybrid Consulting |

| By Industry Vertical | Healthcare Financial Services (BFSI) Manufacturing Retail Technology Energy & Utilities Public Sector Others |

| By Project Size | Small Projects Medium Projects Large Projects |

| By Client Type | Private Sector Public Sector International Organizations |

| By Pricing Model | Fixed Fee Hourly Rate Retainer Fee Performance-Based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Strategy Consulting Engagements | 90 | Senior Consultants, Strategy Directors |

| Operations Improvement Projects | 60 | Operations Managers, Process Improvement Leads |

| IT Consulting Services | 50 | IT Directors, Technology Consultants |

| Human Resource Consulting | 40 | HR Managers, Talent Acquisition Specialists |

| Market Entry Strategy Consultations | 45 | Business Development Managers, Market Analysts |

The US Management Consulting Services Market is valued at approximately USD 126 billion, reflecting a significant growth driven by the increasing complexity of business operations and the demand for digital transformation and strategic guidance.