Region:North America

Author(s):Shubham

Product Code:KRAC4270

Pages:99

Published On:October 2025

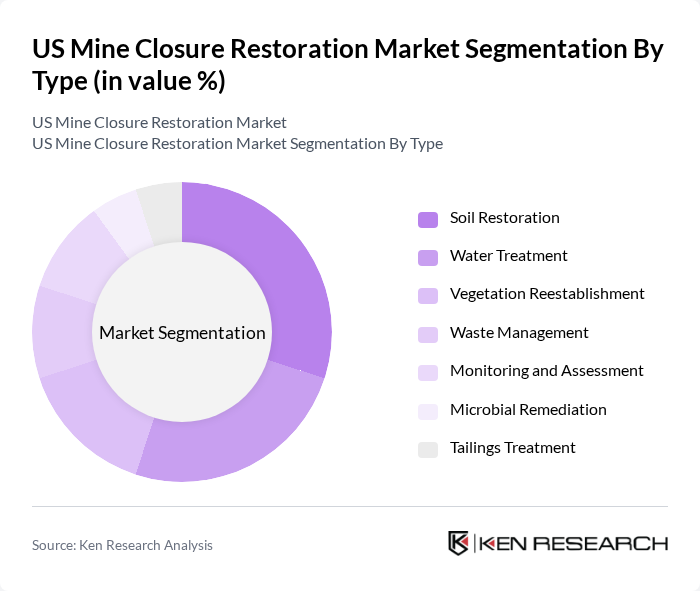

By Type:The market can be segmented into various types of restoration services, including soil restoration, water treatment, vegetation reestablishment, waste management, monitoring and assessment, microbial remediation, and tailings treatment. Among these, soil restoration and water treatment are the most significant subsegments, driven by the need to rehabilitate contaminated land and ensure safe water quality post-mining activities. The increasing focus on sustainable practices and regulatory compliance further boosts the demand for these services.

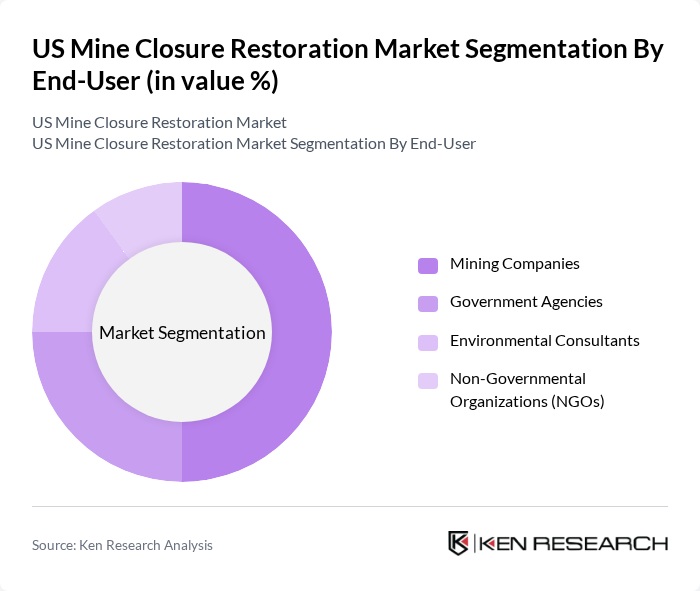

By End-User:The end-user segmentation includes mining companies, government agencies, environmental consultants, and non-governmental organizations (NGOs). Mining companies are the leading end-users, as they are directly responsible for mine closure and restoration activities. Government agencies also play a crucial role in enforcing regulations and providing funding for restoration projects, while environmental consultants and NGOs contribute to the planning and execution of restoration efforts.

The US Mine Closure Restoration Market is characterized by a dynamic mix of regional and international players. Leading participants such as AECOM, Barr Engineering Company, Golder Associates, Jacobs Engineering Group, Kiewit Corporation, Tetra Tech, Inc., ERM Group, Inc., Stantec Inc., Ramboll Group, Wood PLC, Newmont Corporation, Teck Resources Limited, Freeport-McMoRan Inc., BHP Group, Anglo American plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US mine closure restoration market is poised for growth, driven by increasing environmental awareness and technological advancements. As regulations tighten, companies will likely invest more in innovative restoration techniques, enhancing efficiency and effectiveness. Additionally, the integration of artificial intelligence in restoration processes is expected to streamline operations, reduce costs, and improve outcomes. The focus on community engagement and biodiversity will further shape restoration strategies, aligning them with broader sustainability goals and public expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Soil Restoration Water Treatment Vegetation Reestablishment Waste Management Monitoring and Assessment Microbial Remediation Tailings Treatment |

| By End-User | Mining Companies Government Agencies Environmental Consultants Non-Governmental Organizations (NGOs) |

| By Application | Abandoned Mine Lands Active Mining Sites Industrial Sites Urban Development Projects |

| By Service Type | Consulting Services Remediation Services Monitoring Services |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By Funding Source | Government Grants Private Investments Public-Private Partnerships (PPP) |

| By Policy Support | Federal Incentives State-Level Programs Tax Credits |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coal Mine Closure Projects | 50 | Environmental Managers, Mine Closure Planners |

| Metal Mining Restoration Efforts | 60 | Operations Directors, Sustainability Officers |

| Regulatory Compliance in Mine Closure | 45 | Compliance Officers, Legal Advisors |

| Community Engagement in Restoration | 40 | Community Relations Managers, Local Government Officials |

| Innovative Restoration Technologies | 55 | Research Scientists, Technology Developers |

The US Mine Closure Restoration Market is valued at approximately USD 600 million, reflecting a significant growth driven by regulatory pressures for environmental sustainability and advancements in restoration technologies.