Region:Middle East

Author(s):Shubham

Product Code:KRAA8921

Pages:80

Published On:November 2025

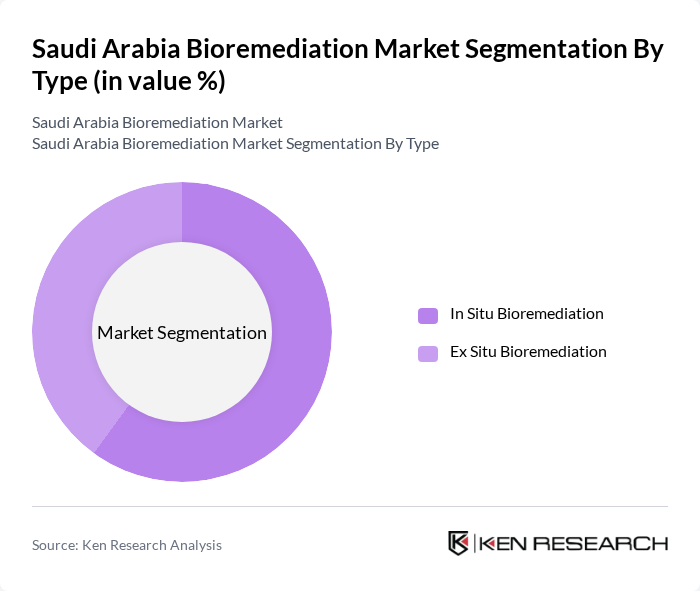

By Type:The bioremediation market can be segmented into two primary types: In Situ Bioremediation and Ex Situ Bioremediation. In Situ Bioremediation involves treating contaminated material at the site, while Ex Situ Bioremediation involves removing contaminated material for treatment elsewhere. The choice between these methods often depends on the specific contamination scenario and regulatory requirements.

In Situ Bioremediation is currently the dominant sub-segment in the market, accounting for a significant portion of the overall bioremediation efforts. This method is favored due to its cost-effectiveness and minimal disruption to the environment. As industries seek to comply with stringent environmental regulations, the preference for in situ methods is expected to continue, driven by advancements in technology and increased awareness of environmental sustainability.

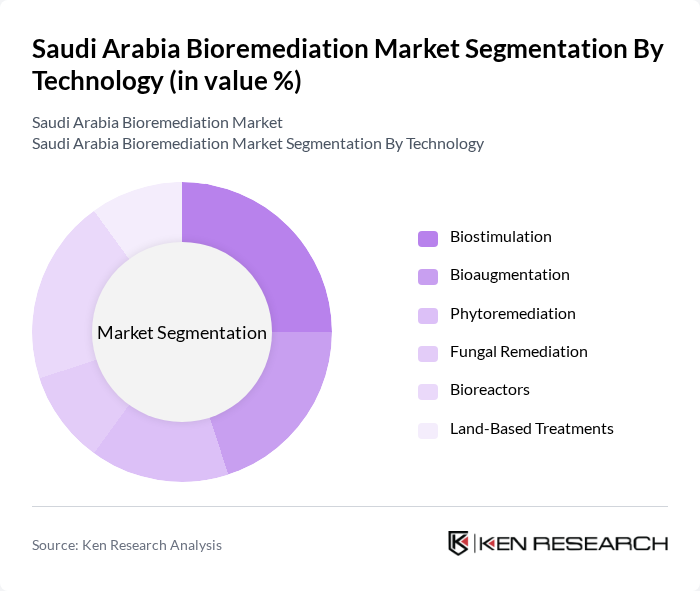

By Technology:The bioremediation market can also be categorized based on technology into several sub-segments: Biostimulation, Bioaugmentation, Phytoremediation, Fungal Remediation, Bioreactors, and Land-Based Treatments. Each technology offers unique advantages and is suited for different types of contaminants and environmental conditions.

Biostimulation is the leading technology in the bioremediation market, as it enhances the natural degradation processes of contaminants by adding nutrients or other substances. This method is particularly effective for hydrocarbon pollutants, which are prevalent in Saudi Arabia due to its oil industry. The growing emphasis on sustainable practices and regulatory compliance is driving the adoption of biostimulation technologies across various sectors.

The Saudi Arabia Bioremediation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco (Environmental Protection Department), Bee’ah (Tadweer Environmental Services), Veolia Middle East, Clean Arabia Environmental Services, Suez Middle East Recycling LLC, Al Kafaah Environmental Solutions, AquaTreat Environmental Solutions, EnviroServe Saudi Arabia, Green Kingdom Environmental Services, Ecolog International, NESMA Environmental Solutions, Al-Qaryan Group (Environmental Division), Al-Jazira Environmental Services, Gulf Environment & Waste FZE, Taqa Environmental Services Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bioremediation market in Saudi Arabia appears promising, driven by increasing environmental regulations and a growing commitment to sustainability. As the government continues to enforce stricter compliance measures, industries will likely invest more in bioremediation technologies. Additionally, advancements in technology, such as AI integration, will enhance the efficiency of bioremediation processes, making them more attractive to stakeholders. The market is poised for growth as awareness and investment in environmental initiatives rise.

| Segment | Sub-Segments |

|---|---|

| By Type | In Situ Bioremediation Ex Situ Bioremediation |

| By Technology | Biostimulation Bioaugmentation Phytoremediation Fungal Remediation Bioreactors Land-Based Treatments |

| By Application | Soil Remediation Wastewater Remediation Oilfield Remediation Others |

| By End-User | Oil & Gas Industry Manufacturing Industry Agriculture Industry Power Generation Industry Municipalities Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Investment Source | Private Investments Government Funding International Aid Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Spill Remediation Projects | 100 | Environmental Managers, Project Coordinators |

| Wastewater Treatment Facilities | 80 | Facility Managers, Operations Supervisors |

| Soil Decontamination Initiatives | 70 | Site Engineers, Environmental Consultants |

| Government Regulatory Bodies | 50 | Policy Makers, Environmental Officers |

| Research Institutions Focused on Bioremediation | 60 | Research Scientists, Academic Professors |

The Saudi Arabia Bioremediation Market is valued at approximately USD 230 million, driven by increasing environmental regulations, awareness of sustainable practices, and the need for effective waste management solutions.