Region:Middle East

Author(s):Geetanshi

Product Code:KRAA8980

Pages:83

Published On:November 2025

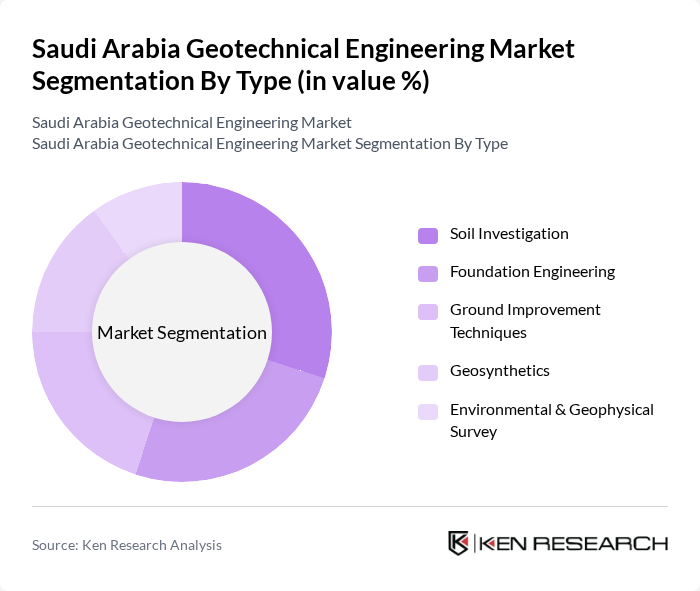

By Type:The geotechnical engineering market can be segmented into various types, including soil investigation, foundation engineering, ground improvement techniques, geosynthetics, and environmental & geophysical survey. Each of these subsegments plays a crucial role in ensuring the safety and stability of construction projects.

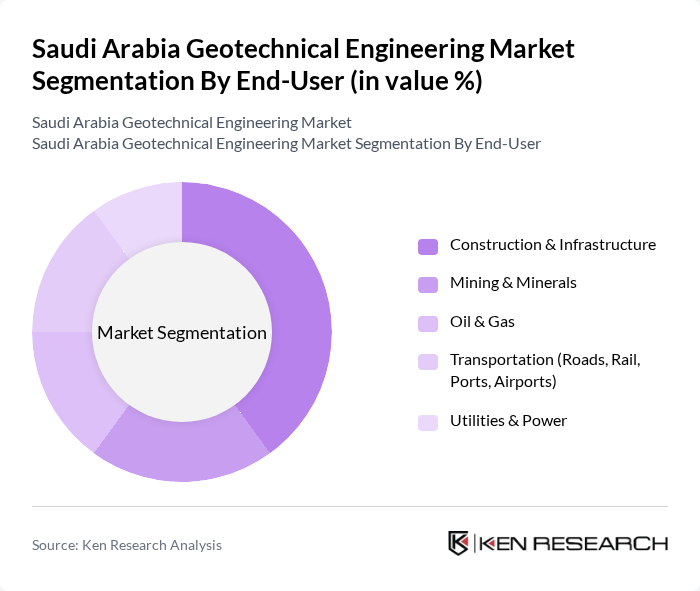

By End-User:The end-user segmentation includes construction & infrastructure, mining & minerals, oil & gas, transportation (roads, rail, ports, airports), and utilities & power. Each sector has unique requirements for geotechnical services, contributing to the overall market dynamics.

The Saudi Arabia Geotechnical Engineering Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Consolidated Engineering Company (Khatib & Alami), Saudi Arabian Parsons Limited, Riyadh Geotechnique & Foundations Co. (RGF), Geotechnical & Environmental Company Ltd. (GECO), Arab Center for Engineering Studies (ACES), Saudi BAUER Foundation Contractors Ltd., Huta Foundation Works Co. Ltd. (HUTA Group), Fugro-Suhaimi Ltd. (FSL), Geotech Arabia Ltd., Soil & Foundation Company Limited (SAFCO), Engineering and Research International (ERI), Aljoaib Engineering Consulting (GTC), Geo-Patterns Laboratory (GPL), SoilTec Engineering Geotechnical & Environmental Services, Osaimi Engineering Consulting contribute to innovation, geographic expansion, and service delivery in this space.

The future of the geotechnical engineering market in Saudi Arabia appears promising, driven by ongoing infrastructure investments and urbanization trends. As the government continues to prioritize mega projects and sustainable development, the demand for innovative geotechnical solutions will likely increase. Additionally, the integration of advanced technologies, such as AI and data analytics, will enhance project efficiency and safety, positioning the industry for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Soil Investigation Foundation Engineering Ground Improvement Techniques Geosynthetics Environmental & Geophysical Survey |

| By End-User | Construction & Infrastructure Mining & Minerals Oil & Gas Transportation (Roads, Rail, Ports, Airports) Utilities & Power |

| By Region | Central Region (Riyadh, Qassim, etc.) Eastern Region (Dammam, Khobar, Jubail, etc.) Western Region (Jeddah, Makkah, Madinah, etc.) Southern Region (Abha, Jizan, Najran, etc.) |

| By Application | Residential Projects Commercial Projects Industrial Projects Infrastructure Projects (Bridges, Tunnels, Dams) Environmental Remediation |

| By Investment Source | Government Funding Private Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies Tax Incentives Grants Regulatory Support |

| By Technology | Conventional Drilling & Testing Advanced Laboratory Analysis Digital Monitoring & Data Analytics Remote Sensing & GIS |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Infrastructure Developments | 80 | Construction Supervisors, Architects |

| Industrial Facility Foundations | 60 | Geotechnical Engineers, Operations Managers |

| Public Works and Road Projects | 90 | Municipal Engineers, Urban Planners |

| Environmental Geotechnics | 50 | Sustainability Consultants, Environmental Engineers |

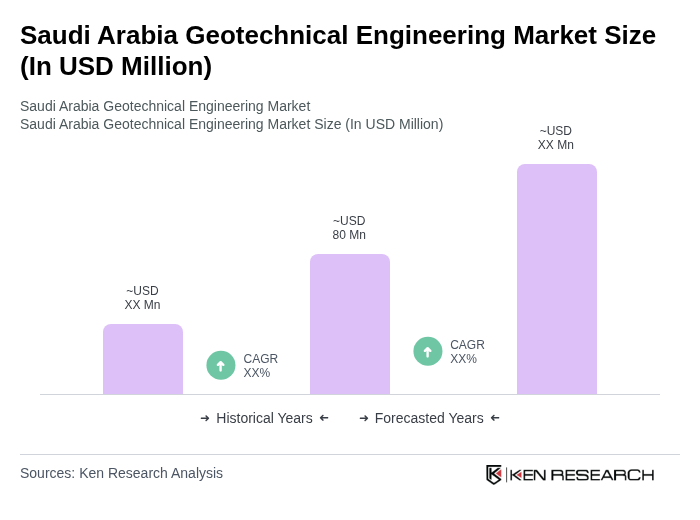

The Saudi Arabia Geotechnical Engineering Market is valued at approximately USD 80 million, driven by rapid urbanization, significant infrastructure investments, and the demand for sustainable construction practices.