Region:North America

Author(s):Dev

Product Code:KRAD6390

Pages:81

Published On:December 2025

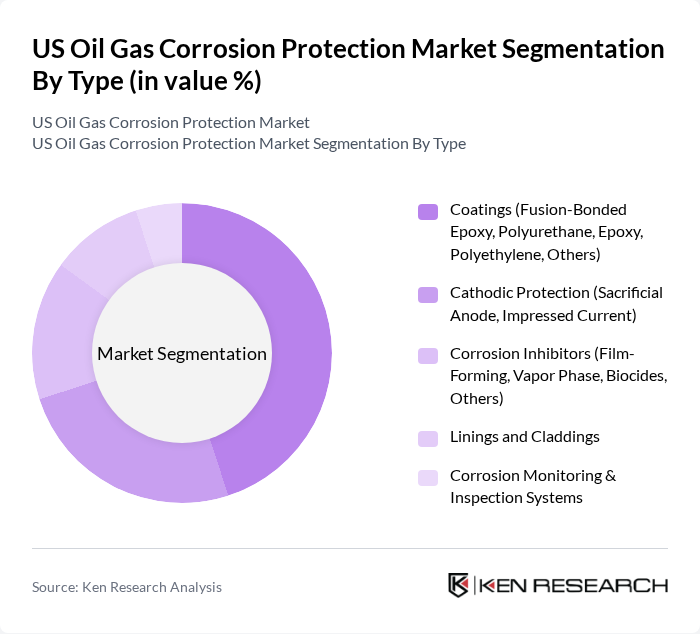

By Type:The segmentation by type includes various methods and materials used for corrosion protection in the oil and gas industry. The subsegments are Coatings (Fusion-Bonded Epoxy, Polyurethane, Epoxy, Polyethylene, Others), Cathodic Protection (Sacrificial Anode, Impressed Current), Corrosion Inhibitors (Film-Forming, Vapor Phase, Biocides, Others), Linings and Claddings, and Corrosion Monitoring & Inspection Systems. Among these, coatings are the most widely used due to their effectiveness in providing a protective barrier against corrosive environments.

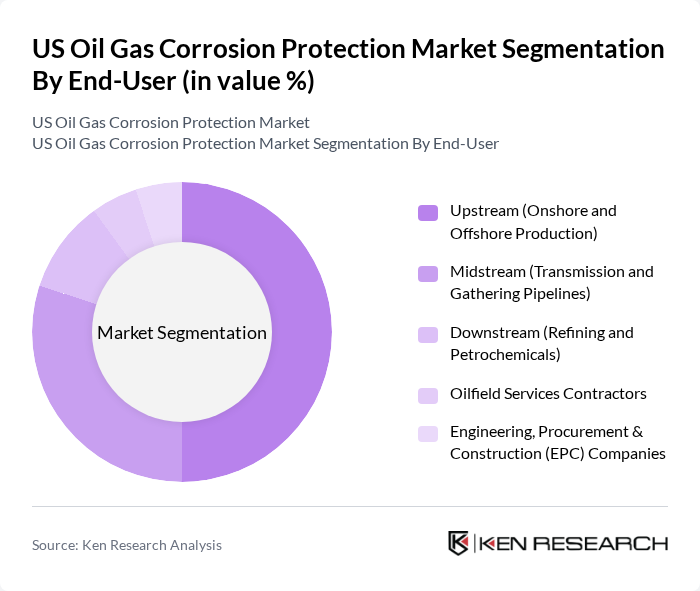

By End-User:The segmentation by end-user includes various sectors utilizing corrosion protection solutions. The subsegments are Upstream (Onshore and Offshore Production), Midstream (Transmission and Gathering Pipelines), Downstream (Refining and Petrochemicals), Oilfield Services Contractors, and Engineering, Procurement & Construction (EPC) Companies. The upstream sector is the largest consumer of corrosion protection solutions due to the harsh environments encountered in oil and gas extraction.

The US Oil Gas Corrosion Protection Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Sherwin-Williams Company, PPG Industries, Inc., Akzo Nobel N.V. (International Paint LLC), Hempel A/S, 3M Company, Axalta Coating Systems, LLC, Carboline Company, Tnemec Company, Inc., Jotun A/S, Cortec Corporation, EonCoat, LLC, KTA-Tator, Inc., MESA Products, Inc. (MESA, Inc.), Aegion Corporation (including Corrpro Companies, Inc.), and ROSEN Group (U.S. Operations) contribute to innovation, geographic expansion, and service delivery in this space.

The US oil and gas corrosion protection market is poised for significant growth as technological innovations and regulatory pressures converge. Companies are increasingly adopting smart coatings and predictive maintenance technologies to enhance asset management and reduce operational risks. Furthermore, the integration of IoT in corrosion monitoring is expected to streamline maintenance processes, allowing for real-time data analysis. As sustainability becomes a priority, the demand for eco-friendly solutions will likely drive further advancements in the market, fostering a more resilient industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Coatings (Fusion-Bonded Epoxy, Polyurethane, Epoxy, Polyethylene, Others) Cathodic Protection (Sacrificial Anode, Impressed Current) Corrosion Inhibitors (Film?Forming, Vapor Phase, Biocides, Others) Linings and Claddings Corrosion Monitoring & Inspection Systems |

| By End-User | Upstream (Onshore and Offshore Production) Midstream (Transmission and Gathering Pipelines) Downstream (Refining and Petrochemicals) Oilfield Services Contractors Engineering, Procurement & Construction (EPC) Companies |

| By Application | Pipeline Protection (Transmission, Gathering, Flowlines) Storage Tanks and Terminals Offshore Platforms, Subsea Structures and Risers Refineries, Petrochemical Plants and Process Equipment Wellheads, Valves and Ancillary Infrastructure |

| By Material Protected | Carbon Steel and Low?Alloy Steel Stainless Steel and High?Alloy Materials Concrete Structures Non?Metallics (Composites, Plastics, Liners) Others |

| By Region | Northeast Midwest South (Including Gulf Coast) West |

| By Technology | Electrochemical Protection (Cathodic and Anodic) Organic Coatings (Liquid and Powder) Inorganic Coatings (Metallic, Zinc?Rich, Ceramic) Surface Engineering and Thermal Spray Systems Digital Corrosion Monitoring and Predictive Analytics |

| By Service Type | Inspection and Integrity Assessment Services Maintenance and Rehabilitation Services Engineering Design and Consulting Services Cathodic Protection Design, Installation and Commissioning Training and Certification Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Production | 100 | Corrosion Engineers, Field Operations Managers |

| Midstream Pipeline Operations | 80 | Pipeline Integrity Managers, Safety Officers |

| Downstream Refining Processes | 90 | Refinery Managers, Maintenance Supervisors |

| Corrosion Protection Product Suppliers | 70 | Sales Managers, Product Development Engineers |

| Regulatory Compliance and Standards | 60 | Compliance Officers, Environmental Managers |

The US Oil Gas Corrosion Protection Market is valued at approximately USD 2.1 billion, driven by the need for infrastructure maintenance, rising investments in oil and gas exploration, and growing awareness of corrosion management to extend asset life and reduce operational costs.