Region:North America

Author(s):Dev

Product Code:KRAD1664

Pages:91

Published On:November 2025

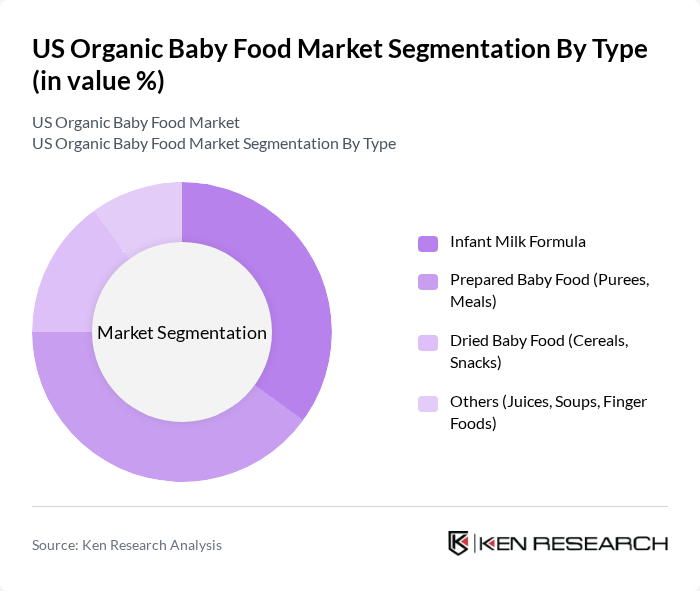

By Type:The market is segmented into various types of organic baby food products, including Infant Milk Formula, Prepared Baby Food (Purees, Meals), Dried Baby Food (Cereals, Snacks), and Others (Juices, Soups, Finger Foods). Each sub-segment caters to different consumer preferences and nutritional needs. There is a notable trend towards convenience, clean-label ingredients, and functional nutrition, with parents increasingly seeking products that offer both health benefits and ease of use .

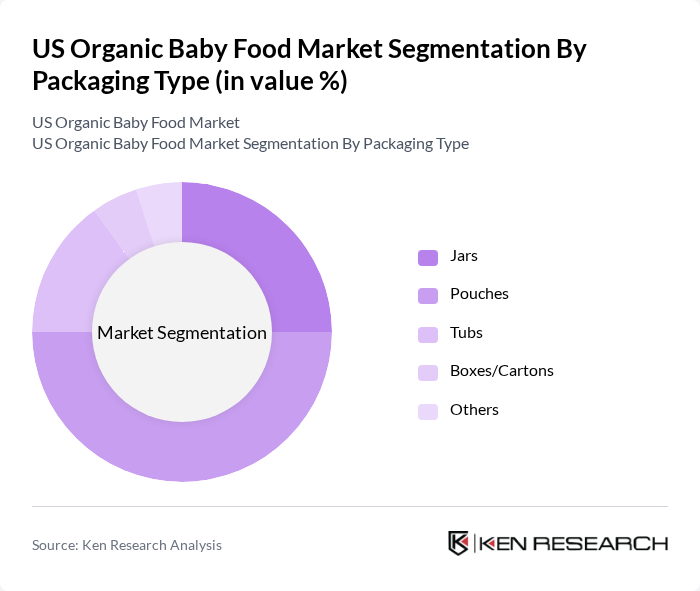

By Packaging Type:The packaging segment includes Jars, Pouches, Tubs, Boxes/Cartons, and Others. Packaging choice significantly influences consumer purchasing decisions, with convenience, portability, and sustainability becoming increasingly important. Pouches have gained substantial popularity due to their lightweight, resealable design and ease of use for parents on the go. There is also a growing demand for eco-friendly and recyclable packaging solutions in response to consumer environmental concerns .

The US Organic Baby Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gerber Products Company (Nestlé USA), Happy Family Organics (Danone S.A.), Earth's Best Organic (Hain Celestial Group), Plum Organics (Sun-Maid Growers of California), Beech-Nut Nutrition Company, Sprout Organic Foods, Inc., Little Spoon, Inc., Once Upon a Farm PBC, Baby Gourmet Foods Inc., Yumi, Nara Organics, Nurture Life, Inc., Happy Tot (Danone S.A.), Pure Spoon, and Tiny Organics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the US organic baby food market appears promising, driven by increasing consumer awareness and a shift towards healthier eating habits. As more parents prioritize nutrition, the demand for organic products is expected to rise. Additionally, advancements in technology and distribution methods will likely enhance product availability. Companies that innovate with plant-based ingredients and sustainable practices will be well-positioned to capture market share, particularly as e-commerce continues to grow as a primary sales channel.

| Segment | Sub-Segments |

|---|---|

| By Type | Infant Milk Formula Prepared Baby Food (Purees, Meals) Dried Baby Food (Cereals, Snacks) Others (Juices, Soups, Finger Foods) |

| By Packaging Type | Jars Pouches Tubs Boxes/Cartons Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retailers Convenience Stores Specialty Stores Others |

| By Ingredient Type | Fruits Vegetables Grains Dairy Others |

| By Age Group | Infants (0-6 months) Babies (6-12 months) Toddlers (1-3 years) Others |

| By Region | Northeast Midwest South West |

| By Price Range | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Organic Baby Food Retailers | 100 | Store Managers, Category Buyers |

| Parents of Infants and Toddlers | 150 | Caregivers, Health-Conscious Consumers |

| Pediatric Nutrition Experts | 50 | Registered Dietitians, Pediatricians |

| Organic Food Manufacturers | 75 | Product Development Leads, Quality Assurance Managers |

| Market Analysts and Researchers | 40 | Industry Analysts, Market Research Professionals |

The US Organic Baby Food Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by increasing consumer awareness of health benefits associated with organic products and a preference for natural, chemical-free food options for infants and toddlers.