Region:North America

Author(s):Geetanshi

Product Code:KRAC2377

Pages:99

Published On:October 2025

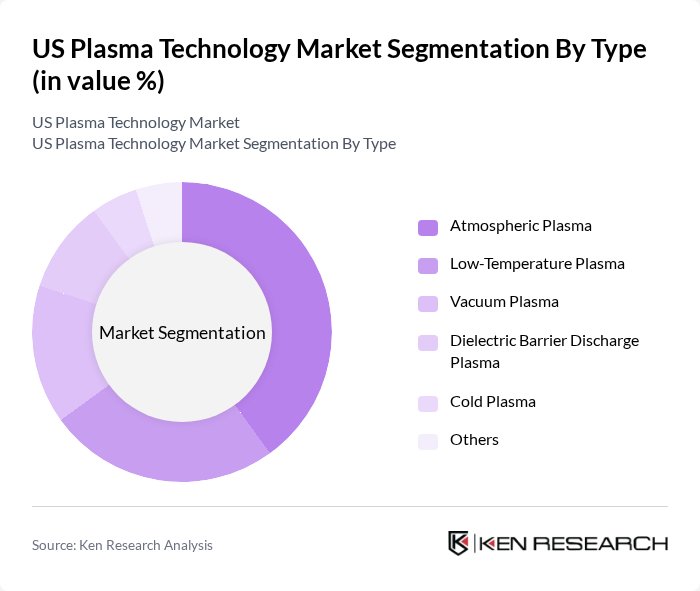

By Type:The plasma technology market is segmented into Atmospheric Plasma, Low-Temperature Plasma, Vacuum Plasma, Dielectric Barrier Discharge Plasma, Cold Plasma, and Others. Atmospheric Plasma leads the segment due to its versatility and broad applications in surface cleaning, activation, and coating processes for electronics, automotive, and medical devices. Low-Temperature Plasma is experiencing rapid growth, particularly in healthcare for sterilization, wound healing, and decontamination, driven by its non-thermal, eco-friendly properties. Vacuum Plasma and Dielectric Barrier Discharge Plasma are increasingly adopted for specialized industrial and research applications, while Cold Plasma is gaining traction for medical and food safety uses. The expanding adoption of these technologies across diverse industries is a key driver of market growth.

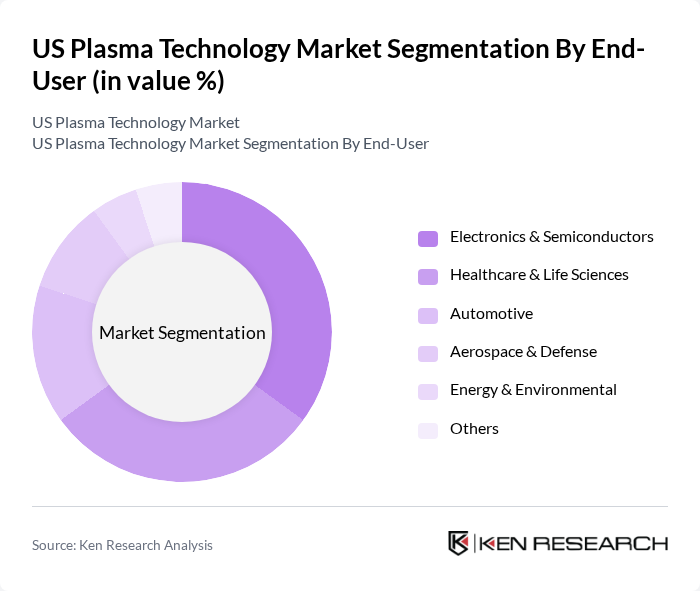

By End-User:The end-user segmentation includes Electronics & Semiconductors, Healthcare & Life Sciences, Automotive, Aerospace & Defense, Energy & Environmental, and Others. Electronics & Semiconductors represent the largest share, driven by the need for precision surface treatment and advanced manufacturing. Healthcare & Life Sciences are rapidly expanding, fueled by the adoption of plasma for sterilization, wound healing, and medical device production. Automotive and Aerospace & Defense sectors utilize plasma for coating, cleaning, and material processing, while Energy & Environmental applications focus on pollution control and sustainable manufacturing. The broadening scope of plasma technologies across these sectors continues to propel market growth.

The US Plasma Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Plasma-Therm LLC, Nordson Corporation, Veeco Instruments Inc., Advanced Plasma Solutions, Trion Technology, Inc., SPTS Technologies Ltd., Oxford Instruments PLC, Applied Materials Inc., Linde PLC, 3M Company, Henniker Plasma, Plasmatreat North America Inc., Plasma Etch, Inc., OC Oerlikon Management AG, Diener electronic GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The US plasma technology market is poised for significant growth, driven by increasing integration of advanced manufacturing techniques and healthcare applications. As industries prioritize sustainability and efficiency, the demand for innovative plasma solutions will rise. Additionally, the convergence of AI and IoT technologies with plasma systems is expected to enhance operational capabilities. This evolution will likely create new avenues for investment and development, positioning plasma technology as a cornerstone of future manufacturing and healthcare advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Atmospheric Plasma Low-Temperature Plasma Vacuum Plasma Dielectric Barrier Discharge Plasma Cold Plasma Others |

| By End-User | Electronics & Semiconductors Healthcare & Life Sciences Automotive Aerospace & Defense Energy & Environmental Others |

| By Application | Surface Treatment & Cleaning Material Processing (Etching, Patterning) Coating & Deposition Sterilization & Decontamination Waste Treatment Plasma Medicine Others |

| By Component | Plasma Generators Power Delivery Systems Control Systems Vacuum Systems Gas Handling Equipment Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Distribution Mode | Offline Distribution Online Distribution Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Semiconductor Manufacturing | 100 | Process Engineers, Production Managers |

| Medical Device Applications | 80 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Surface Treatment Services | 70 | Operations Managers, Technical Directors |

| Research & Development in Plasma Technology | 50 | R&D Scientists, Innovation Managers |

| Industrial Plasma Equipment Suppliers | 60 | Sales Directors, Product Managers |

The US Plasma Technology Market is valued at approximately USD 2.5 billion, reflecting the combined value of atmospheric, cold, and remote plasma technologies. Atmospheric plasma alone accounts for a significant portion of this market size.