Region:North America

Author(s):Dev

Product Code:KRAD0372

Pages:91

Published On:August 2025

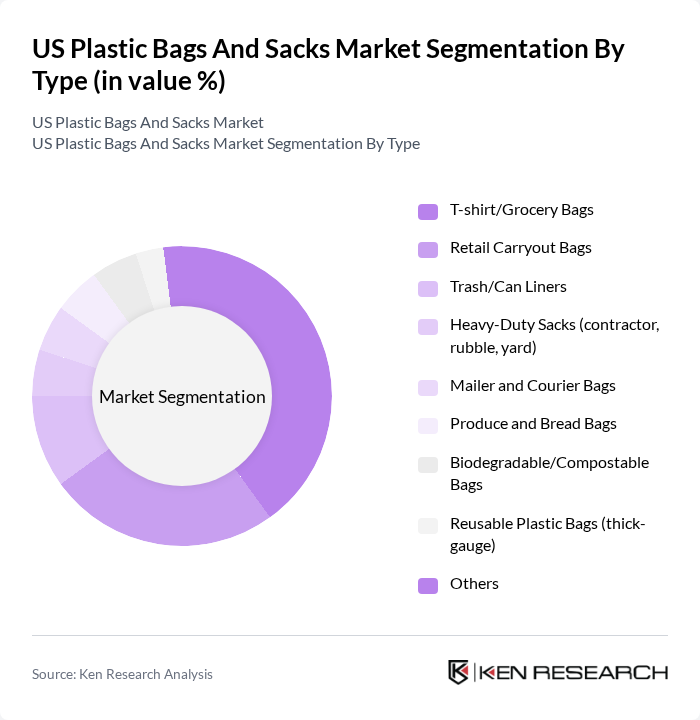

By Type:The market is segmented into various types of plastic bags and sacks, including T-shirt/Grocery Bags, Retail Carryout Bags, Trash/Can Liners, Heavy-Duty Sacks, Mailer and Courier Bags, Produce and Bread Bags, Biodegradable/Compostable Bags, Reusable Plastic Bags, and Others. Among these, T-shirt/Grocery Bags dominate the market in jurisdictions without bans due to their widespread use in retail environments; in regulated states, thicker-gauge reusable plastic and paper substitutes have partially displaced traditional thin HDPE bags, while trash/can liners and specialty retail/e?commerce mailers remain resilient. The convenience they offer for consumers and retailers alike has solidified their position as a staple in shopping practices, though policy-driven substitution is ongoing. Retail Carryout Bags also hold a significant share, driven by the foodservice industry's demand for takeout packaging and continued growth in food delivery. The growing trend towards sustainability has led to an increase in the adoption of Biodegradable/Compostable and recycled-content bags, although they currently represent a smaller segment of the overall market relative to conventional PE formats.

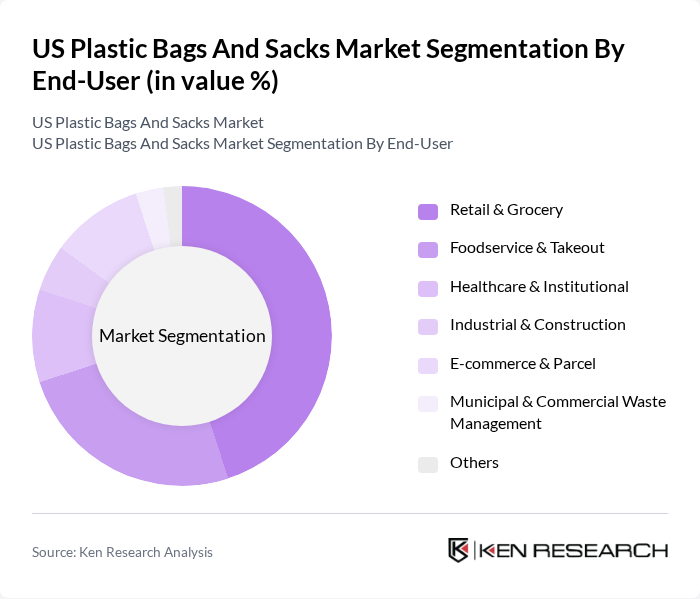

By End-User:The end-user segmentation includes Retail & Grocery, Foodservice & Takeout, Healthcare & Institutional, Industrial & Construction, E-commerce & Parcel, Municipal & Commercial Waste Management, and Others. The Retail & Grocery segment is the largest, supported by high-frequency consumer purchases; policy changes have shifted some volume to thicker-gauge reusable and paper alternatives in certain states, but plastic solutions remain prevalent in many markets. The Foodservice & Takeout segment is also significant as demand for takeout and delivery persists, sustaining carryout and liner needs. E-commerce & Parcel is a rapidly growing segment, reflecting online shopping’s continued expansion and the use of poly mailers and security bags. Sustainability commitments are influencing specifications across Healthcare & Institutional and Industrial & Construction, with increasing interest in recycled content and certified compostable options for defined use cases.

The US Plastic Bags And Sacks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novolex Holdings, LLC, Inteplast Group, Berry Global, Inc., Pactiv Evergreen Inc., Poly-America, L.P., AEP Industries Inc. (a Berry Global company), Reynolds Consumer Products (Hefty), Revolution Company (Revolution Plastics), Four Star Plastics, International Plastics, Inc., Crown Poly, Inc., Advance Polybag, Inc., Hilex Poly (a Novolex brand), Intertape Polymer Group Inc. (IPG), Roplast Industries, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The US plastic bags and sacks market is poised for transformation as sustainability becomes a central focus. Innovations in biodegradable materials and the development of reusable bags are expected to reshape consumer preferences. Additionally, the growth of e-commerce will continue to drive demand for efficient packaging solutions. As regulations tighten, companies that adapt to these changes and invest in sustainable practices will likely thrive, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | T-shirt/Grocery Bags Retail Carryout Bags Trash/Can Liners Heavy-Duty Sacks (contractor, rubble, yard) Mailer and Courier Bags Produce and Bread Bags Biodegradable/Compostable Bags Reusable Plastic Bags (thick-gauge) Others |

| By End-User | Retail & Grocery Foodservice & Takeout Healthcare & Institutional Industrial & Construction E-commerce & Parcel Municipal & Commercial Waste Management Others |

| By Material Type | High-Density Polyethylene (HDPE) Low-Density Polyethylene (LDPE) Linear Low-Density Polyethylene (LLDPE) Polypropylene (PP) and Woven Sacks Bioplastics (PLA, PBAT blends) Recycled Content (PCR) Polyethylene Others |

| By Thickness | Lightweight (<0.7 mil grocery/produce) Standard-Duty (0.7–1.5 mil carryout) Heavy-Duty (?1.5 mil contractor/liners) Others |

| By Distribution Channel | Online (direct-to-business and marketplaces) Supermarkets/Hypermarkets Convenience & Dollar Stores Jan/San and Foodservice Distributors Industrial/Wholesale Distributors Others |

| By Application | Retail & Consumer Packaging Waste & Recycling Liners Shipping & Fulfillment Agricultural & Landscaping Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Plastic Bag Usage | 120 | Store Managers, Procurement Officers |

| Consumer Attitudes Towards Plastic Bags | 150 | General Consumers, Eco-conscious Shoppers |

| Manufacturers of Plastic Bags | 100 | Production Managers, Sales Directors |

| Environmental Impact Assessments | 80 | Environmental Consultants, Policy Makers |

| Retailer Sustainability Initiatives | 110 | Sustainability Officers, Corporate Social Responsibility Managers |

The US Plastic Bags and Sacks Market is valued at approximately USD 4.7 billion, reflecting steady demand across various sectors such as retail carryout, trash liners, e-commerce mailers, and industrial sacks.