Region:North America

Author(s):Rebecca

Product Code:KRAD1376

Pages:99

Published On:November 2025

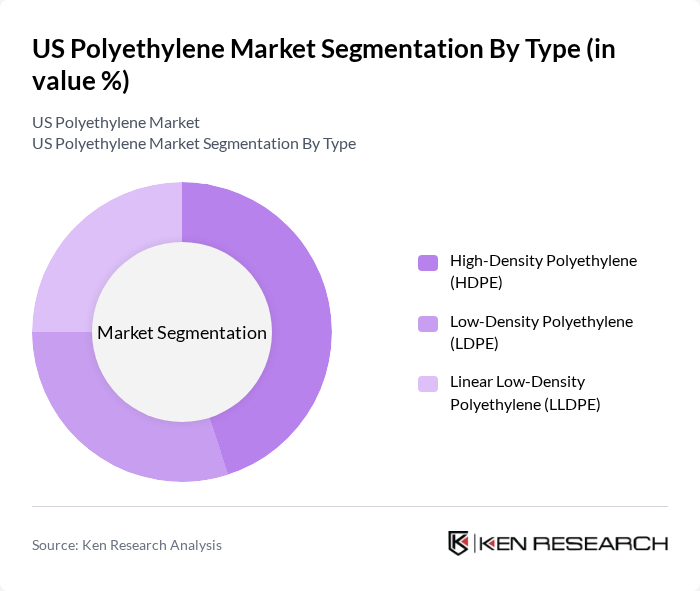

By Type:The polyethylene market can be segmented into three main types: High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), and Linear Low-Density Polyethylene (LLDPE). Among these, HDPE is the leading subsegment due to its strength, durability, and resistance to impact and chemicals, making it ideal for a wide range of applications, including containers, pipes, and industrial products. LDPE is favored for its flexibility and low-density characteristics, primarily used in packaging films and squeeze bottles. LLDPE is gaining traction due to its enhanced tensile strength and elasticity, making it suitable for stretch films, bags, and agricultural films. The adoption of LLDPE is further supported by its cost-effectiveness and suitability for blending with other polyethylene grades to optimize performance in specific applications .

By End-Use Industry:The end-use industries for polyethylene include packaging, automotive, construction, healthcare, electronics, and consumer goods. The packaging industry is the largest consumer of polyethylene, driven by the growing demand for flexible packaging solutions in food and beverage sectors, e-commerce, and retail. The automotive industry utilizes polyethylene for lightweight and durable components, while the construction sector increasingly adopts polyethylene for pipes, geomembranes, and insulation materials. Healthcare applications are expanding, with polyethylene used in medical devices, pharmaceutical packaging, and protective equipment. Electronics and consumer goods sectors also contribute to demand, leveraging polyethylene for cable insulation, housings, and everyday products .

The US Polyethylene Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Dow Inc., LyondellBasell Industries N.V., Chevron Phillips Chemical Company LLC, INEOS Group, Westlake Chemical Corporation, Formosa Plastics Corporation, SABIC, Braskem S.A., TotalEnergies SE, Nova Chemicals Corporation, Reliance Industries Limited, Alpek S.A.B. de C.V., Eastman Chemical Company, and Huntsman Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The US polyethylene market is poised for continued growth, driven by increasing demand from the packaging and construction sectors. As sustainability becomes a priority, innovations in biodegradable polyethylene and recycling technologies are expected to gain traction. Additionally, the expansion of e-commerce will further enhance the need for efficient packaging solutions. Companies that invest in sustainable practices and technological advancements will likely lead the market, adapting to evolving consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | High-Density Polyethylene (HDPE) Low-Density Polyethylene (LDPE) Linear Low-Density Polyethylene (LLDPE) |

| By End-Use Industry | Packaging Automotive Construction Healthcare Electronics Consumer Goods |

| By Application | Films and Sheets Containers and Bottles Pipes and Fittings Wire and Cable Insulation |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Geography | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Insights | 100 | Packaging Managers, Product Development Specialists |

| Automotive Applications | 80 | Procurement Managers, Design Engineers |

| Construction Sector Usage | 60 | Project Managers, Material Suppliers |

| Consumer Goods Sector | 50 | Brand Managers, Supply Chain Analysts |

| Recycling and Sustainability Initiatives | 40 | Sustainability Officers, Environmental Compliance Managers |

The US Polyethylene Market is valued at approximately USD 25 billion, driven by increasing demand in packaging, automotive, and construction sectors. This growth reflects a five-year historical analysis highlighting the market's expansion and versatility in various applications.