Region:North America

Author(s):Geetanshi

Product Code:KRAE1009

Pages:97

Published On:December 2025

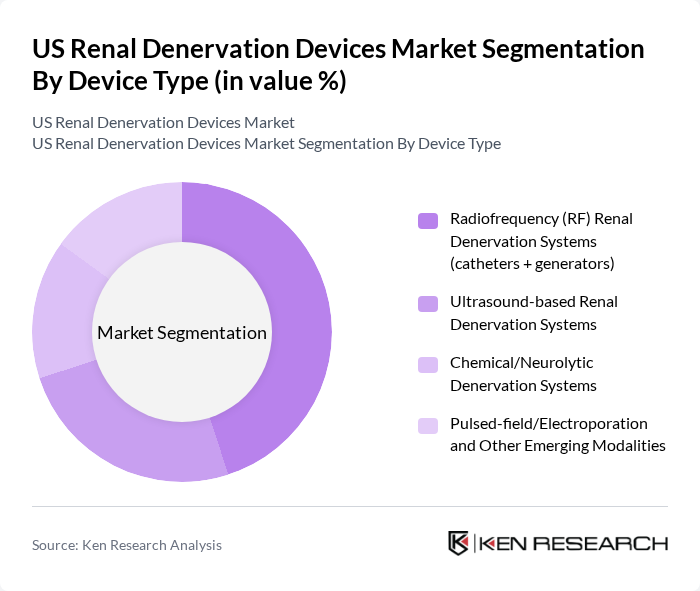

By Device Type:The renal denervation devices market is segmented into various device types, including Radiofrequency (RF) Renal Denervation Systems, Ultrasound-based Renal Denervation Systems, Chemical/Neurolytic Denervation Systems, and Pulsed-field/Electroporation and Other Emerging Modalities. This structure is consistent with how leading market studies classify technologies by energy source. Among these, Radiofrequency (RF) systems are currently leading the market due to their established efficacy, extensive clinical trial data, and widespread acceptance in clinical practice. The RF systems are favored for their ability to deliver precise energy to the renal nerves via multi?electrode catheters, supporting durable reductions in blood pressure in patients with uncontrolled hypertension.

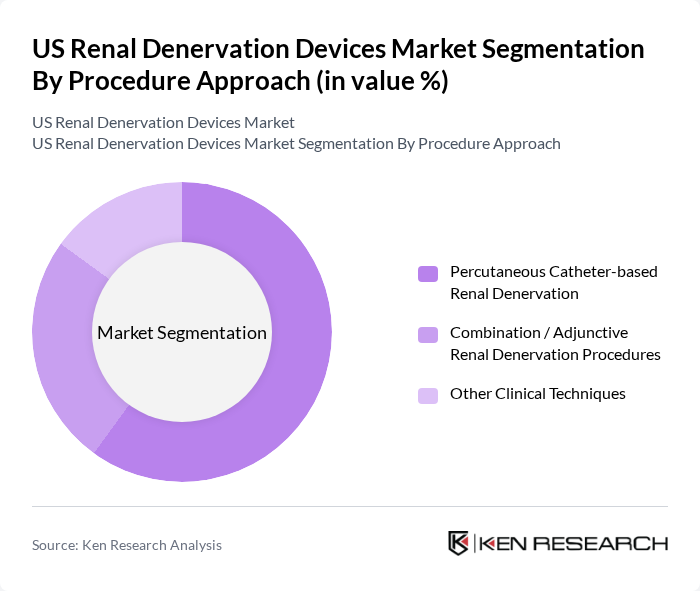

By Procedure Approach:The market is also segmented by procedure approach, which includes Percutaneous Catheter-based Renal Denervation, Combination/Adjunctive Renal Denervation Procedures, and Other Clinical Techniques. The Percutaneous Catheter-based approach is the most prevalent due to its minimally invasive nature, catheter-based access via the femoral or radial artery, and the ability to perform the procedure in a catheterization lab setting with short recovery times, which appeals to both patients and healthcare providers. This method has shown promising results in clinical studies of patients with resistant or uncontrolled hypertension, with sustained reductions in office and ambulatory blood pressure, further solidifying its position as the preferred choice.

The US Renal Denervation Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Boston Scientific Corporation, ReCor Medical, Inc. (Otsuka Medical Devices), Abbott Laboratories (including legacy St. Jude Medical technology), Terumo Corporation, Ablative Solutions, Inc., Cardiosonic Ltd., MicroPort Scientific Corporation, Nuvectra Corporation, Biotronik SE & Co. KG, AngioDynamics, Inc., Cook Medical LLC, SentreHEART, Inc., Cardiovascular Systems, Inc., and other emerging US renal denervation technology developers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the US renal denervation devices market appears promising, driven by ongoing technological advancements and increasing awareness of hypertension management. As healthcare providers continue to embrace minimally invasive procedures, the demand for renal denervation devices is expected to rise. Additionally, the integration of digital health technologies will enhance patient monitoring and treatment adherence, further supporting market growth. The focus on personalized medicine will also play a crucial role in tailoring treatments to individual patient needs, fostering innovation in this sector.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Radiofrequency (RF) Renal Denervation Systems (catheters + generators) Ultrasound-based Renal Denervation Systems Chemical/Neurolytic Denervation Systems Pulsed-field/Electroporation and Other Emerging Modalities |

| By Procedure Approach | Percutaneous Catheter-based Renal Denervation Combination / Adjunctive Renal Denervation Procedures Other Clinical Techniques |

| By End-User | Interventional Cardiology Departments Electrophysiology & Catheterization Labs Hypertension & Nephrology Specialty Clinics Academic & Research Hospitals |

| By Region | Northeast Midwest South West |

| By Patient Profile | Resistant / Uncontrolled Hypertension High Cardiovascular Risk Patients (multi-morbidity) Patients Intolerant or Non?adherent to Drug Therapy |

| By Distribution Channel | Direct Contracts with Hospitals & IDNs Group Purchasing Organizations (GPOs) Specialized Medical Device Distributors E?procurement & Tender-based Channels |

| By Product Component | Disposable Renal Denervation Catheters Generators / Energy Consoles Accessories & Ancillary Components |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Interventional Cardiology Practices | 90 | Cardiologists, Interventional Specialists |

| Nephrology Clinics | 70 | Nephrologists, Clinic Administrators |

| Hospital Procurement Departments | 60 | Procurement Managers, Supply Chain Directors |

| Patient Advocacy Groups | 40 | Patient Representatives, Health Advocates |

| Healthcare Policy Makers | 50 | Health Economists, Policy Analysts |

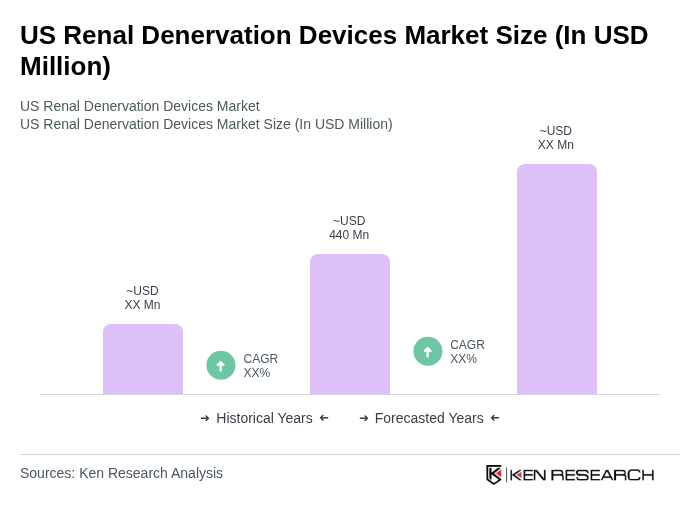

The US Renal Denervation Devices Market is valued at approximately USD 440 million, reflecting a significant growth driven by the increasing prevalence of hypertension and the demand for minimally invasive procedures.