Region:North America

Author(s):Shubham

Product Code:KRAC0735

Pages:98

Published On:August 2025

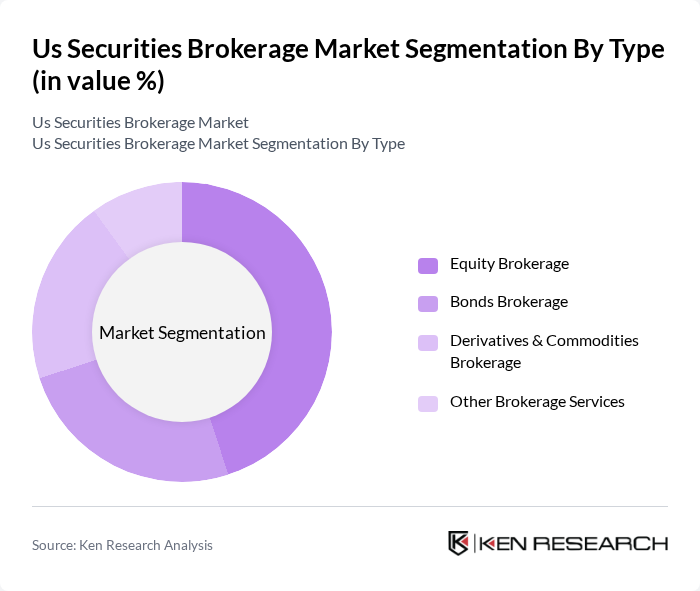

By Type:The market is segmented into brokerage services including equity (equities) brokerage, bonds brokerage, derivatives & commodities brokerage, and other brokerage services, aligning with industry coverage used by leading market researchers. Equity brokerage is widely recognized as a prominent segment given continued retail focus on stocks and ETFs, while options and futures activity has expanded derivatives brokerage, and fixed income brokerage supports demand for treasuries and corporate bonds.

By Mode:The brokerage market is also segmented by mode, which includes online and offline services. Online brokerage has gained significant traction due to zero-commission pricing, mobile-first trading, fractional shares, and broader product access, appealing especially to younger and first-time investors; offline models remain relevant for full-service advice and complex wealth needs.

The US Securities Brokerage Market is characterized by a dynamic mix of regional and international players. Leading participants such as Charles Schwab Corporation, Fidelity Investments, E*TRADE from Morgan Stanley, TD Ameritrade (a Charles Schwab company), Robinhood Markets, Inc., Interactive Brokers Group, Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley, J.P. Morgan Securities LLC, Wells Fargo Advisors, Raymond James Financial, Inc., Ameriprise Financial, Inc., The Vanguard Group, Inc., Tastytrade, Inc., Webull Financial LLC contribute to innovation, geographic expansion, and service delivery in this space.

The U.S. securities brokerage market is poised for transformative growth driven by technological advancements and evolving investor preferences. As retail participation continues to rise, firms will increasingly leverage artificial intelligence and machine learning to enhance trading strategies and customer engagement. Additionally, the integration of blockchain technology is expected to streamline operations and improve transparency. These trends will likely reshape the competitive landscape, fostering innovation and creating new opportunities for market players to thrive in an increasingly digital environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Brokerage Bonds Brokerage Derivatives & Commodities Brokerage Other Brokerage Services |

| By Mode | Online Offline |

| By Type of Establishment | Exclusive Brokers Banks Investment Firms Other Types of Establishments |

| By Product/Instrument Coverage | Equities (Stocks, ETFs) Fixed Income (Treasuries, Munis, Corporate Bonds) Options and Futures Mutual Funds and Money Market Funds Alternative Investments (Structured Notes, IPOs, Alternatives Access) |

| By Client Segment | Retail (Self-Directed) Advisory/Wealth (Managed Accounts) Institutional (Asset Managers, Pensions) Hedge Funds and Prop Trading Firms Corporates and SMEs (Treasury, Stock Plans) |

| By Revenue Model | Commissions Net Interest Income (Cash Sweep, Margin) Payment for Order Flow (PFOF) Advisory Fees and Managed Account Fees Other (Securities Lending, Market Data, Subscriptions) |

| By Geographic Focus (U.S. Regions) | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Brokerage Services | 140 | Retail Investors, Financial Advisors |

| Institutional Brokerage Insights | 100 | Institutional Traders, Portfolio Managers |

| Online Trading Platforms | 110 | Product Managers, UX Researchers |

| Regulatory Compliance in Brokerage | 80 | Compliance Officers, Legal Advisors |

| Market Trends and Investor Behavior | 90 | Market Analysts, Economic Researchers |

The US Securities Brokerage Market is valued at approximately USD 200 billion, reflecting significant growth driven by increased retail investor participation and advancements in trading technology, including mobile and zero-commission trading platforms.