Region:North America

Author(s):Geetanshi

Product Code:KRAD0061

Pages:88

Published On:August 2025

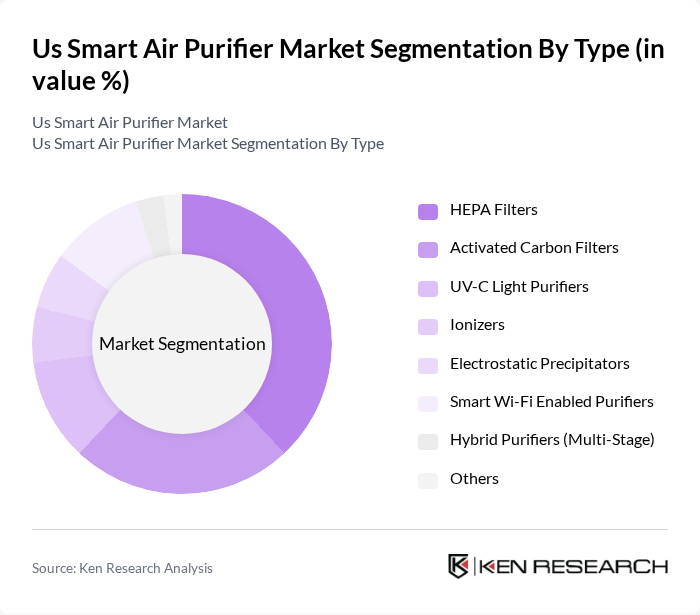

By Type:The market is segmented into HEPA filters, activated carbon filters, UV-C light purifiers, ionizers, electrostatic precipitators, smart Wi-Fi enabled purifiers, hybrid purifiers (multi-stage), and others. HEPA filters remain the most popular due to their high efficiency in capturing airborne particles, including allergens, dust, and pathogens, making them the preferred choice for consumers prioritizing health and air quality .

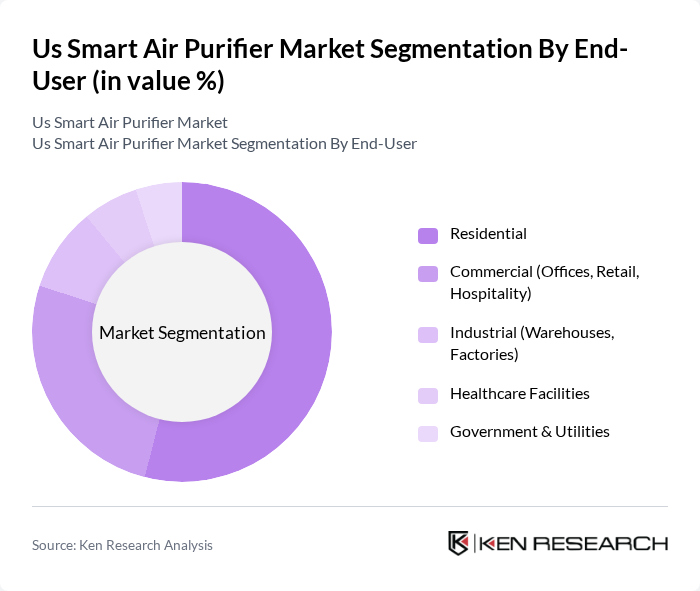

By End-User:The end-user segmentation includes residential, commercial (offices, retail, hospitality), industrial (warehouses, factories), healthcare facilities, and government & utilities. The residential segment leads the market, driven by heightened consumer awareness of indoor air quality, increased incidence of allergies and asthma, and the growing adoption of smart home automation systems that encourage the use of connected air purification devices .

The Us Smart Air Purifier Market is characterized by a dynamic mix of regional and international players. Leading participants such as Dyson Ltd., Honeywell International Inc., Philips Electronics N.V., Xiaomi Corporation, Coway Co., Ltd., Blueair AB, Levoit (Vesync Co., Ltd.), Sharp Corporation, LG Electronics Inc., Samsung Electronics Co., Ltd., Guardian Technologies (GermGuardian), Winix Inc., Medify Air, Airmega (Coway Brand), TOSOT, Whirlpool Corporation, Hamilton Beach Brands (Clorox), IQAir AG, Daikin Industries, Ltd., AtomikAir contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. smart air purifier market appears promising, driven by increasing consumer demand for healthier indoor environments and technological innovations. As urbanization continues to rise, the need for effective air purification solutions will become more critical. Additionally, the integration of smart home technologies is expected to enhance product appeal, making air purifiers more attractive to tech-savvy consumers. Companies that adapt to these trends will likely capture significant market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | HEPA Filters Activated Carbon Filters UV-C Light Purifiers Ionizers Electrostatic Precipitators Smart Wi-Fi Enabled Purifiers Hybrid Purifiers (Multi-Stage) Others |

| By End-User | Residential Commercial (Offices, Retail, Hospitality) Industrial (Warehouses, Factories) Healthcare Facilities Government & Utilities |

| By Sales Channel | Online Retail (Amazon, Walmart.com, Brand Stores) Offline Retail (Big Box, Specialty Stores) Direct Sales (B2B, Institutional) Distributors |

| By Distribution Mode | Direct Distribution Indirect Distribution E-commerce Platforms |

| By Price Range | Budget Mid-Range Premium |

| By Brand Positioning | Luxury Brands Value Brands Eco-Friendly Brands |

| By Product Features | Smart Connectivity (Wi-Fi, App, Voice Control) Filter Replacement Alerts Air Quality Monitoring (Sensors, Real-Time Data) Mobile App Integration Energy Efficiency Noise Reduction Features |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Air Purifier Users | 120 | Homeowners, Renters |

| Commercial Air Purifier Users | 90 | Facility Managers, Office Administrators |

| Health and Wellness Sector | 60 | Health Practitioners, Wellness Coaches |

| Retail and E-commerce Buyers | 100 | Retail Buyers, E-commerce Managers |

| Environmental Health Advocates | 50 | NGO Representatives, Policy Makers |

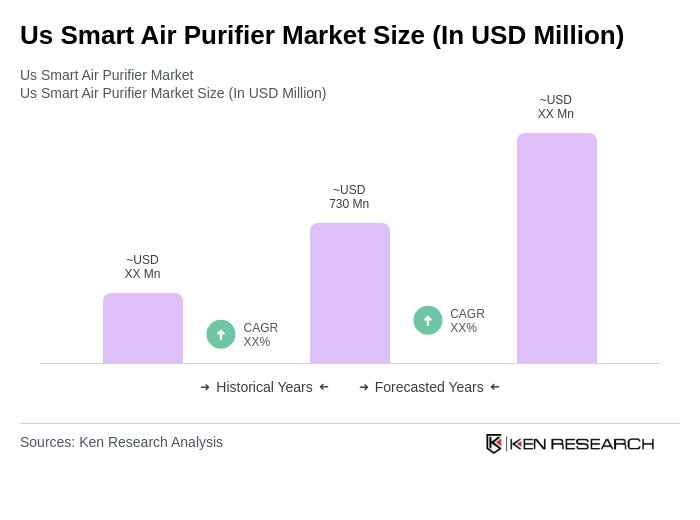

The US Smart Air Purifier Market is valued at approximately USD 730 million, reflecting a significant growth trend driven by increased consumer awareness of indoor air quality and the prevalence of respiratory diseases.